Technical Analysis Is it voodoo Or does it work Traders Laboratory

Post on: 30 Июнь, 2015 No Comment

Technical Analysis: Is it voodoo? Or does it work?

One particular topic I have been thinking about recently is technical analysis. The markets never change because human behavior will never change. Anyone involved in the markets will know that we are not really trading the markets. We are trading other people . Thus human behavior reflects market behavior and we are able to exploit recurring price patterns to profit from. That is the core belief in technical analysis.

However, technical anaylsis and price patterns have mainly been studied and researched for daily charts. In intraday trading, do this patterns still remain valid? Classic price patterns such as the head-n-shoulder and triangles have become widely popular among the trading public. What was once an edge is no longer present. That is why false breakouts, pattern failures have become a popular trading strategy among professionals.

My biggest question is this: do technical analysis work when day trading the futures markets? From my personal experience specializing in the dow mini futures, the answer is no. Let me explain:

Classic head-n-shoulders patterns can stilll be traded successfully with a different set of guidelines. The only reason why they work is simply because price is unable to make a higher high than its previous peak. This indicates weakness and traders will usually short this pattern. Amatuers will usually short the break of the neckline. This is usually too late into the move. I have learned that trading soley on technical patterns is a sure way of losing. Many professionals are fully aware that amateurs love trading price patterns. Therefore, they have made tweaks in the rules and guidelines for trading these patterns. Pattern failure is fairly common in the dow futures.

Another favorite by the trading public is double bottoms and double tops. Amatuers love shorting new lows. In the dow futures market, the markets will usually trade 5-8 points below the previous low just to reverse and rally. The markets need to test new lows and highs to see if there is significant buying or selling pressure in these levels. When professionals realize that the only participants involved are small traders, they will usually reverse it in the oppposite direction.

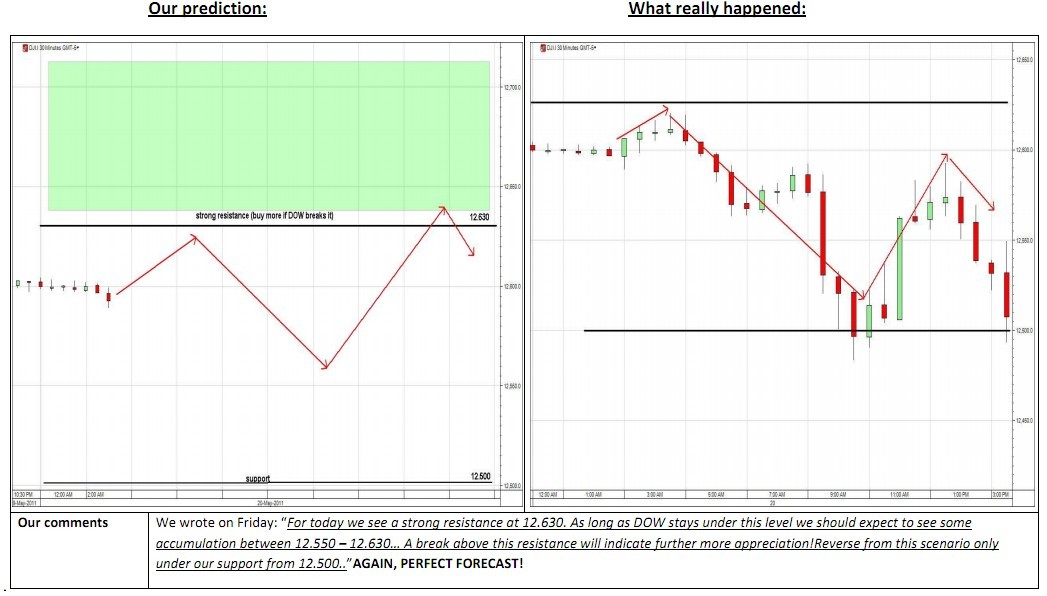

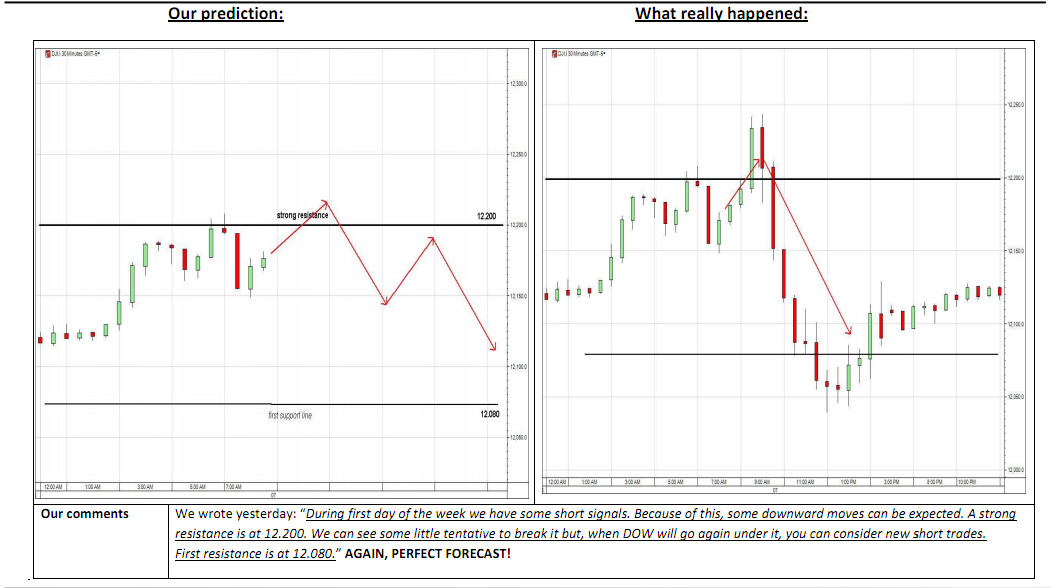

Regardless of any pattern or technical indicator, price is king. Tape reading and volume analyis are pure information that can help you trade with an edge. In the futures markets, you need to be able to define key support and resistance levels. These are the high probability trade zones. There are different ways in finding these zones using, fibonacci cluster levels, pivot points, moving averages, etc. You must find something that you feel comfortable trading with. I specialize in using pivot points, pivot point clusters, and market profile. Others prefer moving average cluster zones. I strongly believe trading off these key levels give you a higher probability trade than relying on technical price patterns.

I have had the opportunity to day trade with many professionals. I have yet to meet a trader who relies soley on technical price patterns. Of course we are all aware of the pattern. The only time I will trade a pattern is when it lines up with a key price level in my market analysis.

Do your homework and know your market. Hard work and preseverance is the key to trading success.

- Share

- Share this post on Digg Del.icio.us Technorati Twitter