Strong hedge gains help end 09 on high note

Post on: 16 Март, 2015 No Comment

Related News

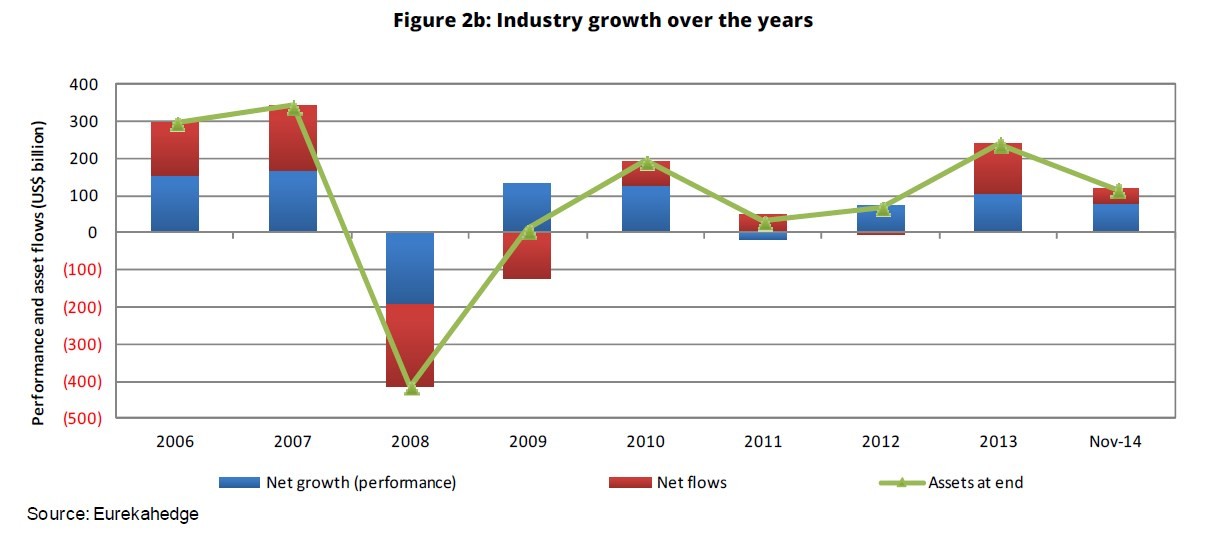

BOSTON (Reuters) — For hedge funds, 2009 will be remembered as one of the industry’s best ever — a year when managers delivered strong gains after 2008’s drubbing and investors returned to the fray with new money.

But the hangover from 2008, when clients reacted to the industry’s worst-ever losses by pulling out a record $155 billion, has not fully disappeared, managers and investors said.

The $2 trillion hedge fund industry is just beginning to tally this year’s winnings, but preliminary numbers offer plenty to cheer about.

Performance trackers, including Hennessee Group and Hedge Fund Research, are expected to report 2009 data in early January.

Buoyed by a strong rally across many asset classes, global hedge funds, on average, gained 13.2 percent through Tuesday, according to the HFRX index compiled by Chicago-based research group Hedge Fund Research.

In the first 11 months of the year, funds returned 19 percent on average, HFR said earlier this month. That compared with a loss of 19 percent last year.

It has been a very good year for many managers, said Sol Waksman, chief executive of research firm BarclayHedge Ltd. From April on we saw the exact opposite of the things that made the second half of 2008 terrible. Wherever you looked around the world, stock prices went up and bond prices went up.

Indeed, some of the industry’s biggest stars delivered stunningly strong returns this year, investors told Reuters.

David Tepper’s Appaloosa Management gained about 120 percent after fees as the manager bet that certain bank shares would recover, said a person who is familiar with the fund’s performance but not permitted to speak about it publicly.

Kenneth Griffin, long considered one of the industry’s best managers, delivered gains of 62 percent to investors in his Citadel Investment Group’s flagship Kensington and Wellington funds after large losses in 2008, an investor said.

And Philip Falcone, who became known for his successful bet against the subprime market and for an activist stake in the New York Times Company, delivered a 45.15 percent gain in his flagship Harbinger Capital fund through the end of November, an investor said.

Investors said that the headline numbers — where funds, on average, gained less than 20 percent to trail the 24 percent gain in the S&P 500 stock index — do not paint the full picture.

In particular, managers specializing in convertible arbitrage strategies fared much better.

Through November, funds that exploit price discrepancies between corporate convertible debt and equity surged by an average 55 percent, HFR reported.

As expected, last year’s winners — the funds that bet exclusively on falling stock prices — suffered double digit losses. HFR reported they were down 20 percent through November.

Strong gains prompted investors to put $150 billion into hedge funds during the first nine months of the year, Barclays Capital said.

Still, last year’s problems continue to weigh on many managers, who cannot begin collecting their normally lucrative performance fees of 20 percent or more until after they recoup last year’s losses and pass their so-called high water marks.

We are not at new highs yet, BarclayHedge’s Waksman said, adding keep in mind how bad things really were last year.

(Editing by Steve Orlofsky)