Should You Expose Your Clients to Managed Futures

Post on: 31 Март, 2015 No Comment

Its easy to forget that 2008 was a breakout year for many managed futures strategies. That was the case not because returns for the space were not only positive but also were altogether non-correlated in a historically volatile market. Its easy to forget because the same strategies that were so loved after 2008s performance are now being questioned after their dismal performance across the past two years. That so many investorsmany of whom were drawn to the asset class not that long agoare disappointed today brings to light the misconceptions that continue to surround the managed futures strategy.

Its true that since the beginning of 2011, managed futures have not only lagged global equities and fixed income in a material way, but the category has underperformed hedge funds as well (see chart below).

So why shouldnt investors be upset? They shouldnt because managed futuresunlike equities that tend to follow earnings growth and valuation expansion or fixed income that tracks interest ratestypically employ trend-following strategies that attempt to benefit from either long- or short-term momentum movements across or within global asset classes.

Some strategies have exposure to only one asset class or trend type (which warrants significant due diligence before investing) but in many cases, managed futures managers are trying to buy and sell futures based on a directional trend in multiple asset classes.

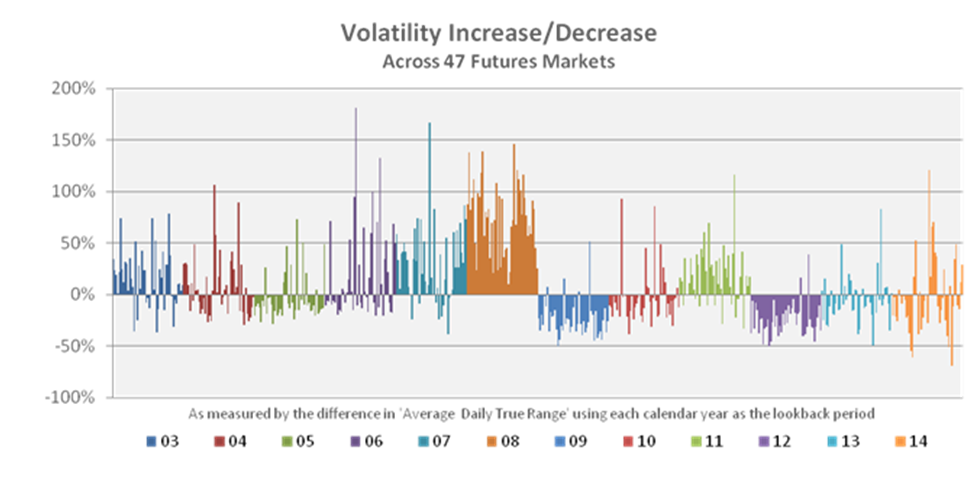

Since there have been no major trends across asset classes over the last two years (see chart 2 at left), it should come as no surprise that trend-following strategies, i.e. managed futures, have not performed well.

The fact is that weve had choppy and trendless markets since the beginning of 2011.

A Short-Term Trend Is Not a Friend, but a Long-Term Trend.

The question that really matters, then, is whether exposure to managed futures is warranted in the current market environment.

We know that relying on previous performance is often dangerous when trying to compound capital; just ask anyone who invested in managed futures two years ago. But the categorys relative short-term underperformance should not be surprising given its historical results.

Over the last 15 years, managed futures have underperformed global equities on a two-year rolling basis seven times, and by a noticeable amount: 10.6% on average (see chart 3). Yet the category has outperformed global equities by 2.0% over all the rolling time periods for the same 15 years.

In other words, the main tenets for investing in managed futures strategies have not changed. Its true that managed futures strategies need consistent trends before they can produce strong performance, and we know that in the short run markets will not always be trending. But the long-term profitability potential of managed futures not only opens the possibility of creating excess returns in an investors overall portfolio, it may reduce the volatility of those returns as well.

A Great Diversifier

It could be said that in this era of fiscal cliffs, debt ceilings, quantitative easings, and potential sovereign debt defaults, diversification for retail and institutional investors alike is more important than ever.

Managed futures are by no means a complete solution to these issues, but they should warrant heavy consideration in the ongoing task of moving an investment portfolio up and to the left on the efficient frontier.

In addition to the excess returns indicated by chart 3 above, managed futures allow investors to diversify their portfolios, both by virtue of the different markets futures fund managers have at their disposal, as well as the historical independence of managed futures relative to other asset classes. In the U.S. alone, managers can trade everything from stock indexes, currencies, and Treasuries to precious metals, energy, and grains.

More than that, managed futures strategies have the opportunity to branch into global markets, increasing their diversity even more. All of this flexibility means the category may be able to generate positive returns at times when the stock and bond markets are not. Chart 4 shows a snapshot of the low managed futures correlations to four asset classes over multiple time periods.

Worth the Effort

When dealing with managed futures, its probably fair to say that investor education is crucial, even more so perhaps than most asset classes.

Before making the asset allocation decision, investors need to decide what type of trend-following strategy fits within their portfolio and then begin the important job of performing due diligence on the manager.

Whether the strategy is offered in a limited partnership, mutual fund or ETF structure, the drivers of return for managed futures are common beta exposures that are ever changing, so the task can be a bit onerous.

While there is some debate about whether managed futures warrant investor capital due to their recent performance, there isnt much doubt that trends exist in global markets.

We suggest investors should focus on longer-term results and the potential diversification benefits that the asset class can provide. The bottom line: managed futures offer several potential advantages for investors looking to expand and improve their overall portfolios.