Manager Liquidity Risk Measurement

Post on: 13 Октябрь, 2015 No Comment

Apply for Job

Date: Mar 11, 2015

Location: Toronto, ON, CA

Company: RBC

PURPOSE

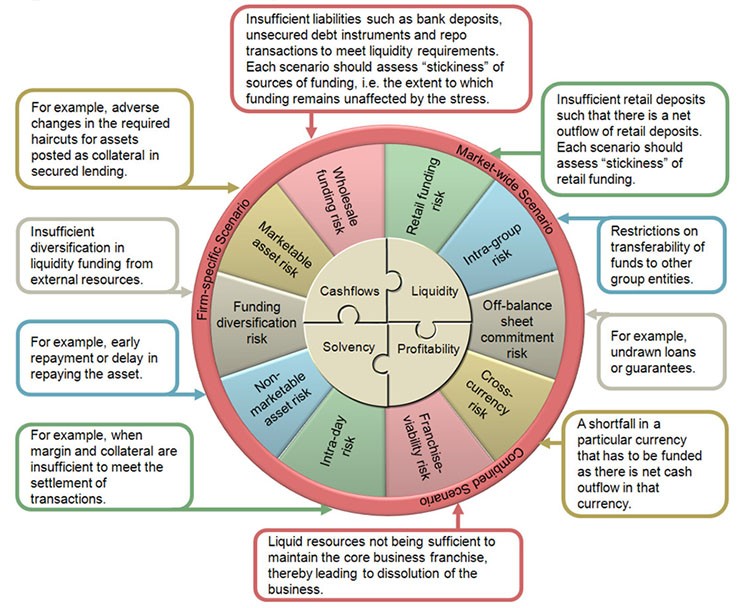

The position is responsible for analyzing liquidity positions of business and platforms in RBC. The position is also responsible for coordinating with the CT’s FTP group to ensure that liquidity risk considerations are appropriately reflected in the FTP methodology, as well as in the various liquidity cost allocation mechanisms. The incumbent will be in charge of forecasting and monitoring the enterprise’s funding requirements. In addition, the incumbent is also accountable for preparing liquidity stress test scenarios in order to improve RBC’s risk measurement processes and to increase quality of information provided to executive management and regulators.

In delivering the above mandate, the position is required to maintain close partnership with GRM, CT risk infrastructure, CT FTP group, CT Capital and Term and Term Funding teams and various finance groups across the organization.

PRIMARY RESPONSIBILITIES

• Lead the planning and forecasting of funding requirements, as well as reflection of term funding costs (secured and unsecured) to platforms.

• Analyze actual term funding allocations relative to liquidity value/cost attributed through the FTP mechanisms.

• Lead in determining High Quality Liquid Asset amount and charges for various retail platforms so that the platform will reach its liquidity targets.

• Participate in the development and maintenance of the bank’s liquidity risk assumptions.

• Define and manage stress testing scenarios for retail balance sheets for both regulatory and internal requirements.

• Provide support in completing the enterprise Recovery and Resolution plan.

• Stay abreast of various changes in the regulatory requirements and provide impact analyses to senior management.

• Provide input in various projects

AUTHORITIES, IMPACT, RISK

• The position has authority to

o Recommend changes to existing liquidity risk measurement and modeling processes

o Recommend changes to Liquidity cost allocations and FTP methodologies

o Recommend changes to internal and external liquidity stress testing methodology and presentation

o Recommend changes to the liquidity profiling of platform B/S

• Specific impact or potential consequences of approvals/ recommendations:

o This position is involved in designing and responsible for recommending changes to the term funding analysis in a balance sheet of over $1000 billion (RBC non-capital markets business platforms).

o The mandate has potentially significant impact on the structure of the bank’s balance sheet investments and positions.

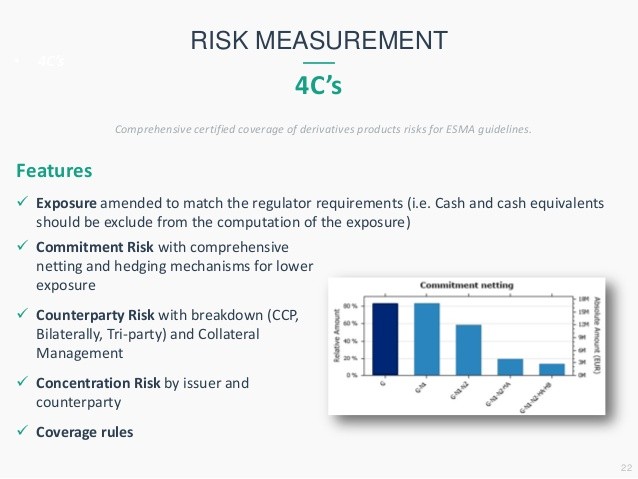

• Position’s scope: Provides modelling, measures and centre of excellence for liquidity risk for the bank. Ensure the best risk measurement technique and processes have been employed to serve the department’s objectives and the bank leverages its investment in its liquidity risk measurement and reporting systems.

Job Requirements (Knowledge / Experience)

• Solid understanding of liquidity risk concepts.

• Working knowledge of cost and benefit allocations (Funds transfer pricing)

• Well organized, able to work on multiple tasks and deadline oriented.

• Ability to react to changing stakeholder demands.

• Strong business analysis and problem solving skills. Ability to identify, analyze and rectify project issues as they arise.

• Strong conceptual thinker

• Solid knowledge in the areas of data warehousing, relational databases and information flow.

• Highly skilled in Financial Institution’s balance sheet

Education:

• Undergraduate degree in a technical field, such as, engineering, or science background. A graduate degree in finance, business, economics, or MBA is preferable.

Skills / Competencies / Attributes

• Analytical / systematic thinker

• Problem solver

• Highly polished communication skills