IPath S&P 500 VIX Short Term Futures TM ETN(NYSEARCA VXX) Why Volatility ETFs Are A Bad Idea

Post on: 11 Сентябрь, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

Yet, despite these positives, volatility ETFs and ETNs are actually pretty terrible investments for almost everyone out there. There are a number of issues that make these types of funds and ETNs quite poor over medium and long time frames, suggesting that these should be avoided by all except extremely short-term traders.

Inside Volatility ETFs and ETNs

First, it may be useful to point out how these products are constructed in order to get a better idea of the asset class and how they work. Let’s focus on the most popular volatility ETN on the market, the iPath S&P 500 VIX Short-Term Futures ETN (NYSEARCA:VXX).

This note has over $1 billion in assets under management, and sees a truly impressive volume level of over 40 million shares a day. Still, the product is a bit pricey compared to some low cost index funds in the market, charging investors 89 basis points a year in fees.

This ETN, like many other popular volatility products on the market, focuses on the S&P 500 VIX Short-Term Futures Index, better known simply as the VIX, for its exposure. However, this index isn’t exactly easy to understand, as it measures the 30-Day expected volatility of the S&P 500 Index.

The easiest way of looking at the benchmark is that it focuses on near and next-term put and call options on the S&P 500. One could write a whole series of articles on the subject, but the most important item to remember is that the VIX represents the expected movement of the S&P 500 over the next month .

Contango: The enemy of volatility

Based on the above explanation, you might think that a bet on a product like VXX is just simply a prediction that the S&P 500 will be more volatile in the near future, or that at least put/call demand will reflect a broad market assumption of volatility in the coming days and weeks. While this is generally correct, for the volatility ETF and ETN world, there is an important factor that needs to be added on top of this; contango.

Most of the time, the VIX futures market trades in a condition known as ‘contango’, a situation where contracts further along the futures curve are more expensive than front month contracts. This trend can have an enormous impact on volatility ETFs and ETNs, as it can eat away at returns over longer time periods.

That is because volatility ETFs and ETNs like VXX must roll from month to month in order to get new contracts and avoid ‘delivery’. But since the next month contracts are more expensive than current ones, VXX investors face a loss every roll period that the product is in contango.

In fact, current contango levels show that the next month contract is more than 5% pricier than the current month, a pretty big hurdle to overcome on a monthly basis!

This can lead to truly devastating returns over long time periods, and make it all but impossible to make money in volatility investing over the long haul. After all, thanks to this roll feature,VXX is down over 80% while the spot VIX has lost just over 15% of its value in the trailing two year time frame.

Caveat to Volatility ETF investing

This isn’t to say that volatility products can’t be used effectively and for huge gains. Right before the fiscal cliff deal was announced, VIX-based products were surging higher generating massive profits for those who got in at the right time.

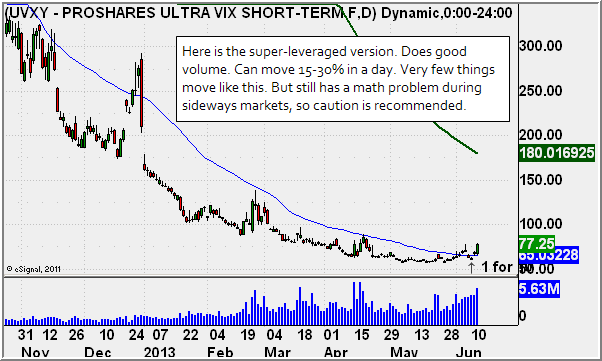

In VXX from December 17 th 2012 to December 28 th 2012, gains came in at about 21% for the time period, while 2x leveraged versions of the product like (UVXY) or (TVIX) added more than 40% in the same time frame. These performances obviously crushed broad markets in a similar period, and helped to give some investors a nice end-of-year boost.

However, as quickly as these gains materialized, they disappeared for many investors.From December 31 st 2012 to January 4 th 2013, VXX slumped by about 20% and the leveraged ones lost about 40%, erasing any gains that investors had seen in the runup.

Clearly, near perfect timing is needed in these types of products as gains can apparently evaporate overnight (see Use VIX ETPs to Profit from Market Volatility ).

A Better Way to Play Volatility?

Fortunately, there are a couple ways that investors can take advantage of the curve in the volatility market, and harness it for positive purposes. There are actually a number of volatility products out there that target the inverse volatility market for exposure.

These products, such as the ProShares Short VIX Short-Term Futures ETF (SVXY) , theVelocityShares Daily Inverse VIX Short Term ETN (XIV) , and the VelocityShares Daily Inverse VIX Medium Term ETN (ZIV) , all seek to take advantage of the contangoed curve and add each month the VIX is facing this situation.

While some might discount this as a poor play, the proof is in the performance of these products over the past few months as XIV and SVXY are both up about 80% over the past year, while ZIV has moved higher by over 90% in the time frame. Meanwhile, during the calendar year of 2012, the inverse volatility ETFs were the best performers in the ETF world—bar none—for the year (read Inside the Two ETFs Up More Than 140% in 2012 ).

Not a sure thing

Once again though, it is important to point out that these are by no means sure things over the short-term. Products in this space are capable of incredible losses in short-time frames when volatility is moving higher or in the rare instances that the VIX is backwardated as opposed to being in contango.

When this situation strikes and there isn’t any contango, inverse volatility products can lose—such as in the difficult summer of 2011—upwards of 70% in just a few months. Still, even with this enormous loss, the trailing two year return for XIV still beats the markets, while the one year figures are even more pronounced (albeit with much higher levels of volatility).

Over long time periods, volatility ETFs and ETNs are almost always a terrible investment. The deck is stacked against them thanks to the traditional slope of the futures curve, and this can be very difficult to overcome.

If you are still feeling bold though and desire volatility exposure in your portfolio, at least make sure you have an ultra-short time horizon. Contango problems tend to be less pronounced in short time periods, so a correct call in a limited time frame could pay off big (see the 4 Best ETF Strategies for 2013 ).

Inverse volatility ETFs can be an interesting option instead for those who want to play the other side of the volatility trade. Just remember that they can experience extreme swings in short time periods when the fear trade is on in the market.

Still despite this downside, I think they are the best way to play volatility and to use that traditionally unfavorable curve in your favor. By doing this with these overlooked investment tools, you can play off the contangoed curve and—hopefully— see big gains.

While it is true they can lose in short time periods, such as when fear levels are elevated, their performance during flat markets or positive environments is unmatched. So next time you are considering a play on volatility ETFs and ETNs, look to the inverse side, and leave the hedging to other ETFs which are not as susceptible to futures curve risks as products like VXX are.

Author is long XIV.

This article is brought to you courtesy of Eric Dutram From Zacks .