Interest Calculator Simple vs Compound Interest Calculator

Post on: 23 Февраль, 2016 No Comment

This simple interest calculator figures both monthly interest income payments and compound growth so you can compare the results side-by-side.

Note: The results of this interest calculator are based on monthly compounding.

Want to save your results?

How Interest Grows Your Investments

You want to earn interest when you deposit money – but have you ever wondered how it works?

Interest is a fee that is paid by a borrower to an investor, compensating the investor for the use of their funds. Interest rates are one way financial institutions encourage deposits – and they are also a way for them to make money from borrowers.

Interest is usually calculated based on the principal and it can be easily calculated using the Interest Calculator.

Variable Vs. Fixed Interest Rates

Variable interest rates – also known as floating interest rates – are not fixed, but are dependent on market performance. If the market is volatile, interest rates also change dramatically during the entire course of the term. If you do not expect to keep a loan for a long time, then a variable interest rate may be more desirable over a fixed interest rate. The downside to variable rates is that if the interest rate rises, you may not be able to meet your payment obligations.

Fixed interest rates. on the other hand, do not change over the course of the term. The advantage of a fixed interest rate is that it allows you to plan your spending easily – the rate is set in stone. The disadvantage is that if interest rates drop significantly, as a borrower youll still pay the higher, original rate.

The Interest Calculator calculates fixed interest rates. New calculations would have to be done for variable interest rates when rates change.

Simple Vs. Compounded Interest

Simple interest rate is calculated by multiplying the principal by the interest rate by the number of payment periods over the life of the loan. Heres the formula:

Simple Interest = P x I x N

P = The loan amount.

I = The interest rate.

N = The duration of the loan using the number of periods.

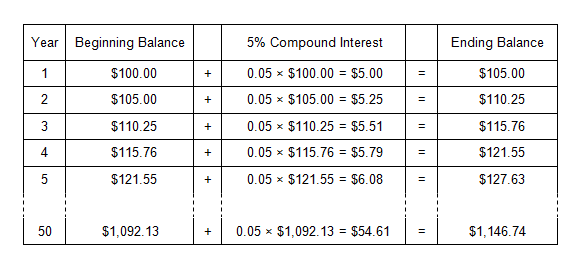

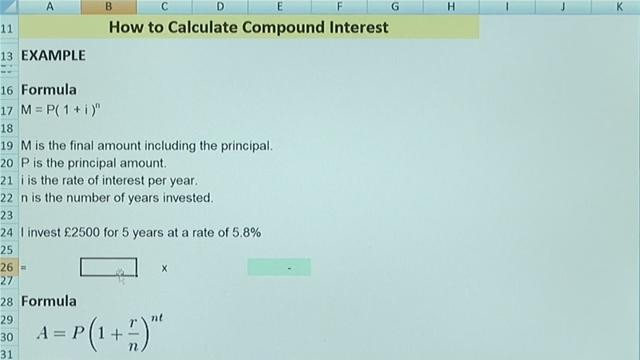

Compound interest refers to charges that the borrower must pay not just on the principal amount borrowed, but also on any interest accumulated at that point in time.

This online interest calculator compounds on a monthly basis, helping you determine the affects of compounding on interest-earning investments.

Compare Interest Rates

Before you invest money, first compare and calculate the affects of various interest rates. Interest rates should play an important role in your decision-making process.

This interest calculator not only shows you the affects of simple monthly interest, but it also shows you the future value if interest is compounded every month. Choose an investment (such as a savings account or other financial product) with a high interest rate that compounds – youll be glad you did.

Interest Calculator Terms & Definitions

- Amount Invested – The amount you plan on investing over a certain term (number of years).

- Annual Interest Rate – The annual percentage interest rate your money earns if deposited.

- Number of Years for Compounding – The number of years your investment will compound (also called the term).

- Simple Monthly Interest Income Payment – The amount of interest earned every month.

- Total of Interest Payments – The sum of all the interest payments earned over the term.

- Future Value (with Compound Interest) – The value of the investment at the end of the term accounting for interest and compounding.

- Compound Interest – Interest that is added to the principal of a deposit, resulting in interest earning interest.