How to Invest with a Silver ETF

Post on: 1 Июнь, 2015 No Comment

How to Invest with a Silver ETF

For most commodities investors, gold is the precious metal of choice. Gold prices have enjoyed a relatively steady rise in value over the last few years. Even after the sudden drop in prices which occurred on April 14th, the price of gold still exceeds $1,300 per ounce. If youre not convinced that gold prices are going to continue rising at a rate that makes them worth investing in, why not try the other major precious metal silver.

Silver is in high demand in the industrial sector and it has always been a traditional store of value, albeit one not as glamorous as gold. Some people invest in silver by purchasing bullions, but there are ways to invest without the hassle of trading a physical item. The silver ETF (Exchange Traded Fund) is one of the easiest ways to do this. As of April 2013, the price of Silver has still not recovered to its two year high, which means that there are some good investment opportunities out there for people who have money to commit to this commodity.

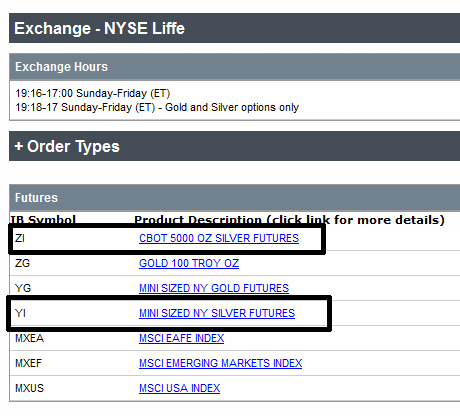

There are two main kinds of ETF. Physical ETFs allow you to invest in funds which directly hold silver bullion. In contrast, futures funds involve investing in derivatives which track the price of silver.

Most of the popular silver ETF options are short or leveraged options which provide daily leveraged returns. If you choose to hold one of these products for more than one day, then your returns will be compounded. This means that returns you see may differ from what you expect. If you have the funds and plan to hold an ETF for a long time, its a good idea to look for a long ETF, rather than buying a short term, leveraged product.

A Warning about Leverage

Leverage allows you to purchase more silver (or other commodities and investment products) than the money you are investing with would allow you to purchase outright. A leverage of 40:1 means that you are holding 40 times the value of your investment. If your investment increases in value, you will see 40 times the return; however, any losses you make will also be amplified.

Investing on leverage increases the risk you face and it is something that is not recommended for novice traders. If you choose to use leverage you should take care to always hold enough in reserve to cover any losses you may face.

Silver is a particularly volatile commodity and prices are constantly fluctuating. This means that a skilled and active investor could stand to make a lot of money, however the risk involved in this kind of investment is high. If you choose to invest in silver ETFs, be sure to seek professional advice before committing a large quantity of money.

Jared Leveson is a frequent commodities trader and finance blogger. His favourite investment is the silver ETF. which he believes offers good long term value. Tracking the global markets is both a source of income and a passionate hobby for Jared.