Forex Forecast

Post on: 3 Май, 2015 No Comment

Online Forex trading

June 6, 2010

Forex trading refers to buying and selling of currencies in the economic market of foreign exchange. Forex market, unlike any other exchange market, has no centralized area or office and all the trading is done either on phone or on internet.

Online Forex trading is the place you need to be if you wish to make a career in the currency trading business.

To benefit from an online trading company or online institution you are trading with, there are things to be kept in mind. Such as, chose an online trading site that offers you a good broker service, suitable leverage option and all the important tools like currency rates. Never pick the first online trading site you com across i.e. search well for online trading sites that offer you best of services for your Forex currency trading.

There is a lot you can benefit from online Forex trading by sitting home and keeping an eye on your every Forex deal, if chosen the right online trading site or company. It is advisable that you refer to friends or customers of the site for reference regarding the reliability and background of the site in the field of Forex trading.Also, when opening an account with an online Forex site you need to be aware of the tools being provided to you for making your trading an easy one.

Prefer to chose an online trading site that believes in educating its’ customer or trader with Forex knowledge, such as offering free of cost of information or articles on Forex terms, currency trading, Forex broker and benefits of Forex trading.

Online Forex trading is full of benefits for it begins with low investment when beginning trade and pays a huge sum when traded right.

Forex is a trading market that deals with more than trillion of dollar regularly, thus being discipline and well planned is the key when entering online Forex trading. Online currency trading is a platform that could earn you fortune if planned every move with knowledge and winning strategies.

Leave a Comment | forex trading | Tagged: forex trading | Permalink

Posted by ivanyurukov

Forex Trading History

June 6, 2010

Trading, as we use the term today, has been in practice since the era of Babylonians. Yes, it’s true! Although at that time, it was referred to with a different name altogether…

That’s right. During earlier times, goods were exchanged in return for goods. And slowly, people started to exchange goods in return for foreign currencies of that time to make their trade a lot easier.

History of Currency or Forex trading can be traced back to the Middle Age times. It is believed that an international investment banker developed the method of using checks and bills to trade. However, starting from the middle ages, a lot has changed and evolved, creating the biggest currency trading market in the world today.

By the late1930s, London was being considered as the worlds foremost foreign exchange center. One of the main reasons behind this was that during that time, the British pound was regarded as the worlds standard trading exchange.

But the scenario took a dramatic turn after the Second World War, when the British economy was almost smashed resulting in the rise of the United States dollar. The USD then started to climb the path to success as it rose to become the worlds major trading as well as reserve currency.

In July 1944, the Bretton Woods agreement was attained on the application of USA.

As a result to the Bretton Woods contract, a system of fixed exchange rates was decided, which resulted in partially re-establishing the Gold Standard and fixing the USD price at $35.00 per 1 ounce of Gold.

While the USD was priced against Gold, the other major currencies were set up against the USD itself.

The Second World War and the series of events which followed are mainly believed to have played an instrumental role in shaping todays Forex market situation.

Early 1980’s saw London becoming the key center of the Euro-dollar market, and till today, London efficiently remains the major offshore market.

From back in the year 1978, when Forex trading displayed revenue of about 5 billion US dollars on per day basis, till date, the per day Forex trading turnover has now crossed the figure of a whooping 1.5 trillion US dollars.

Leave a Comment | forex trading | Tagged: forex trading | Permalink

Posted by ivanyurukov

New to Forex

June 6, 2010

For those of you that are new to the foreign exchange (forex) market, it is important to familiarize yourselves with this market’s characteristics and unique attributes. The forex market allows traders to buy and sell distinct currency pairs. Below are a few guidelines to start trading with Advanced Currency Markets – your gateway to the largest and most liquid market on earth.

What is Forex (Foreign Exchange, FX) ?

Leave a Comment | forex | Tagged: forex | Permalink

Posted by ivanyurukov

Forex Forecast

June 6, 2010

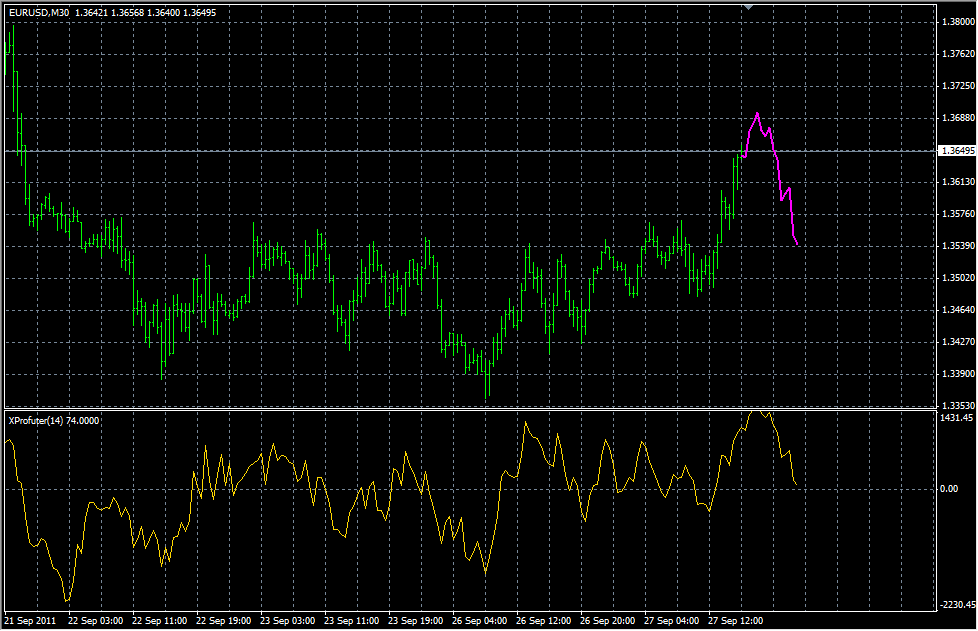

Basic Forex forecast methods: Technical analysis and fundamental analysis.

This article provides insight into the two major methods of analysis used to forecast the behavior of the Forex market. Technical analysis and fundamental analysis differ greatly, but both can be useful forecast tools for the Forex trader. They have the same goal to predict a price or movement. The technician studies the effect while the fundamentalist studies the cause of market movement.

Technical analysis

Technical analysis is a method of predicting price movements and future market trends by studying charts of past market action. One major advantage of technical analysis is that experienced analysts can follow many markets and market instruments simultaneously.

Technical analysis is built on three essential principles:

1. Market action discounts everything! However, the pure technical analyst is only concerned with price movements, not with the reasons for any changes.

2. Prices move in trends Technical analysis is used to identify patterns of market behavior that have long been recognized as significant. Also, there are recognized patterns that repeat themselves on a consistent basis.

3. History repeats itself Forex chart patterns have been recognized and categorized for over 100 years and the manner in which many patterns are repeated leads to the conclusion that human psychology changes little over time.

Forex charts are based on market action involving price. There are five categories in Forex technical analysis theory:

* Indicators (oscillators, e.g. Relative Strength Index (RSI)

* Number theory (Fibonacci numbers, Gann numbers)

* Waves (Elliott wave theory)

* Gaps (high-low, open-closing)

* Trends (following moving average).

Some major technical analysis tools are described below:

Relative Strength Index (RSI):

The RSI measures the ratio of up-moves to down-moves and normalizes the calculation so that the index is expressed in a range of 0-100. If the RSI is 70 or greater, then the instrument is assumed to be overbought (a situation in which prices have risen more than market expectations). An RSI of 30 or less is taken as a signal that the instrument may be oversold (a situation in which prices have fallen more than the market expectations).

Stochastic oscillator:

This is used to indicate overbought/oversold conditions on a scale of 0-100%. Conversely, as prices fall in a strong down trend, closing prices tend to be near to the extreme low of the period range. Stochastic calculations produce two lines, %K and %D that are used to indicate overbought/oversold areas of a chart. Divergence between the stochastic lines and the price action of the underlying instrument gives a powerful trading signal.

Moving Average Convergence Divergence (MACD):

This indicator involves plotting two momentum lines. If the MACD and trigger lines cross, then this is taken as a signal that a change in the trend is likely.

Number theory:

Fibonacci numbers: The Fibonacci number sequence (1,1,2,3,5,8,13,21,34) is constructed by adding the first two numbers to arrive at the third. The inverse of 62%, which is 38%, is also used as a Fibonacci retracement number.

Gann numbers:

W.D. Gann was a stock and a commodity trader working in the 50s who reputedly made over $50 million in the markets. He made his fortune using methods that he developed for trading instruments based on relationships between price movement and time, known as time/price equivalents.

Waves

Elliott wave theory: The Elliott wave theory is an approach to market analysis that is based on repetitive wave patterns and the Fibonacci number sequence. An ideal Elliott wave patterns shows a five-wave advance followed by a three-wave decline.

Gaps

Gaps are spaces left on the bar chart where no trading has taken place. An up gap is formed when the lowest price on a trading day is higher than the highest high of the previous day. A down gap is formed when the highest price of the day is lower than the lowest price of the prior day. An up gap is usually a sign of market strength, while a down gap is a sign of market weakness. It usually signals the beginning of an important price move. A runaway gap is a price gap that usually occurs around the mid-point of an important market trend. For that reason, it is also called a measuring gap.

Trends

A trend refers to the direction of prices. Rising peaks and troughs constitute an up trend; falling peaks and troughs constitute a downtrend that determines the steepness of the current trend. The breaking of a trend line usually signals a trend reversal.

Moving averages are used to smooth price information in order to confirm trends and support and resistance levels. They are also useful in deciding on a trading strategy, particularly in futures trading or a market with a strong up or down trend.

The most common technical tools:

DMI (Directional Movement Indicator) is a popular technical indicator used to determine whether or not a currency pair is trending.

Unlike the fundamental analyst, the technical analyst is not much concerned with any of the bigger picture factors affecting the market, but concentrates on the activity of that instruments market.

Fundamental analysis

Fundamental analysis is a method of forecast ing the future price movements of a financial instrument based on economic, political, environmental and other relevant factors and statistics that will affect the basic supply and demand of whatever underlies the financial instrument. One major advantage of technical analysis is that experienced analysts can follow many markets and market instruments, whereas the fundamental analyst needs to know a particular market intimately. Fundamental analysis focuses on what ought to happen in a market.

The fundamentalist studies the cause of market movement, while the technician studies the effect. Fundamental analysis is a macro or strategic assessment of where a currency should be trading based on any criteria but the movement of the currencys price itself.

Leave a Comment | forex forecast | Tagged: forex. forex forecast | Permalink

Posted by ivanyurukov

Currency Trading Approaches That Fit You Personal Character

June 5, 2010

Not all trading approaches fit all people in order to begin trading at currency trading market. Like, some investors are positive and some are providing patience this dissimilarity of nature provide variety in trading attitudes and reaction for the currency trading market. The investors all are acquainted with the thing that trading is a moving business activity and if it does not exist without revenue getting chances, moreover it does not limit its activities from risk taking deals. This way, deal with great attention and discipline to get maximum at the primarily stage and then step by step get maximum revenues out of it. There are several kinds of trading approaches, containing intraday-trading, scalping, swinging and positions trading. The investors should opt the trading approach that is relevant your personality kind.

Scalping is very various trading approach as collated to other methods. There are several characteristics that are customarily connected with all trading kinds. These characteristics assist to figure out your type of currency trading style. Your scalping currency features. Scalping is essential for those who are self-acting and implement solutions rapidly and firmly, as it is a quick trading method. It has very short-trading time span for just several seconds or several minutes. Strong sides for scalping are targeted attitude, concentrations and firm edge increases the opportunities of fortune in scalping. Weak sides for scalping are being not attentive and making slow decision will be bad for scalpers.

Your intraday trading features: This feature presents the investors who have keep interests to end the trading deal on the identical day. The majority of the investors do not like to work utilizing swinging styles as they do not have the time to be at the trading in night and that is why they feel to finish the deal on the identical day for the cause the active trading during night will surely change the price costs. The Swinging Trading approach. Strong side of swinging investors are patience, calmness, disciplined attitude and readiness to wait for long time. Generally swing investors can be active during night deals. Be attentive as stop losses are bigger in swinging trading so it’s better to be calm and trade when the market is against your trading approach.

Before you make a decision to buy any forex trading signals, please make sure to visit this blog and read info about how to choose forex trading signals, what data to check, how to testdrive the signals – in other words, what to do to be sure that forex buy sell signals really work and can assist to improve your Forex trading.

1 Comment | trading | Tagged: trading | Permalink

Posted by ivanyurukov

Why Start Taking Forex Trading Lessons

June 5, 2010

Perhaps, Forex can be called a marketplace with the greatest turnover in the world. It is also the only market where trades are done around the clock. Many different people now have changed their routine office life for the confortable home place with a lap-top or desk-top which aids in Forex trading. There are others, though, who prefer to have a stable job and do Forex trading as hobby or additional income.

Reading different article on the Net, you may get the idea that Forex trading is a piece of cake. As any other businesses, Forex trading requires knowledge and practical skills without which you will never be successful. Any of these will help you to minimize the risks while making money.

If you are among those who wish to start trading at Forex, you may need some training, which may be received both online and offline. You will also be taught how to read Forex charts and other data, what trading platforms exist there, what time to sell or buy currencies. You will also get the knowledge of professional slang and terminology.

On the Net, there are many lessons offered for those eager to start practicing. All you need is to do some research and choose one that suits you and your needs. The best courses will model real-life situations where you will be able to try your hand in trading currencies. Your results will be thoroughly analyzed and right conclusions will be drawn which will help you to avoid as much loss as possible in the future.

Some practical skills that you will achieve will allow you to cope with stress that follows the trading process.You will learn to trade in the due moment but never earlier or later, which means that you will be able to maximize your profit.

As soon as you are ready, you may start. Most people begin Forex trading because they prefer flexible hours that 24-hour open market offers, because they are lured by the leverage, because they enjoy the high level of market predictability, because commissions are insignificant or absent, and because the money-making process is immediate.

Leave a Comment | forex trading | Tagged: forex lessons | Permalink

Posted by ivanyurukov

Forex trading course how to pick the right one?

June 5, 2010

Forex market is one big financial world where every other day around 3 trillion dollars are traded among traders and brokers across the world. This market is widely known with names like FX, foreign exchange, Forex and so on.

Brokers and traders involved in the Forex deals know how hard Forex can be if taken casually, as in this trade market even a small mistake can cause a big loss. Thing is if you are someone new and wish to enter Forex trade, it is advisable you know it all.

Forex trading course is more or less an education on Forex that teaches everything one need to know about Forex.

Many people make mistake of trading in Forex by depending on advices of friends and family member already in Forex. This is a mistake for Forex requires a complete attention and can not work on simple assumptions and little know-how advices or tips.

Forex trading courses are designed to assist a beginner in adjusting to ups and downs of currency without panicking or getting to excited, as people in general tend to make irrational decision when face unexpected success or loss.

A good Forex trading course does not avoids the importance of various tools like Forex strategies, Forex charts, demo account and stop loss for managing risk.

There are various ways to get an education or understanding of Forex or foreign exchange, such as books on Forex, forums and blogs as well as chat rooms on Forex. Hiring a good broker also provides you with the right Forex information and tips you would need.

It is important that you pick on the right Forex trading course for yourself, as getting the right knowledge is the first step towards the success in Forex.

Make sure that you have a complete history and analyses of the company and its’ credibility. Compare 2 or 3 courses to make sure you get to pick the one offering the maximum benefits. Prefer the course that believes in covering all the aspects of Forex including tools, risk management, discipline lessons, research-analyses and lessons on decision making i.e. when to start a trade and when to stop.

1 Comment | forex trading | Tagged: forex | Permalink

Posted by ivanyurukov