Foreign Direct Investment Trends In The US

Post on: 16 Март, 2015 No Comment

Did you hear the news a couple of weeks back? Probably not, but it should have made major headlines. In 2013, Honda exported more cars from the US than it imported into this country. That means the Japanese carmaker is now a net exporter from the US. Its a first for the Japanese car giants. In order for this to happen, Honda has had to invest a significant amount of money in its US operations. Indeed, their American subsidiary employs 25,000 people which includes work not just in manufacturing, but marketing, and research and development. Its clear they want to do business in the US, which creates jobs.

They arent alone either. While Honda has invested billions to make and export things in the US, others are doing the same on a smaller scale. In Ohio, an old GM truck plant that closed in 2008 has found new life. Is it Ford and Chrysler moving in? No. One of the Japanese carmakers? No. A Chinese firm called Fuyao Auto Glass is moving in to build windshields and other glass pieces for cars and trucks. It is one of the leading producers of auto glass in the world, and is eyeing international expansion. They chose Ohio because theres a lot of idle expertise there, and labor costs in China are continuing to rise. The plan is to create about 800 jobs and it stands as the largest Chinese investment in Ohio, ever.

What do Honda and Fuyao have in common? Theyre both participating in something called Foreign Direct Investment (FDI). FDI is most often thought about in terms of wealthy countries investing in developing ones. A food exporter might set up an operation near banana or coffee farms, or energy companies will set up shop in Iraq to help explore for oil. Thats FDI. But, the US is actually the worlds largest recipient of FDI. The White House has a great report on FDI trends in the US and how it helps the economy.

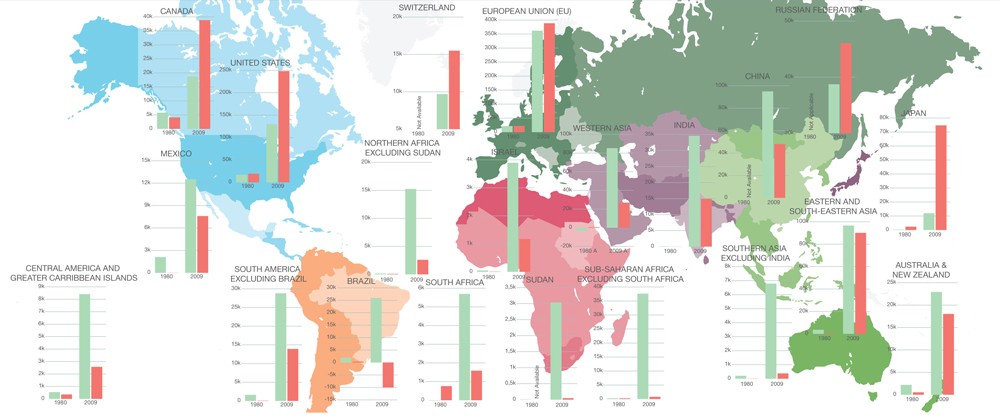

- Investment flows into the United States come mostly from a small number of industrial countries. Since 2010, Japan, Canada, Australia, Korea, and seven European countries collectively have accounted for more than 80 percent of new FDI. Although still small, flows from emerging economies like China and Brazil are growing rapidly.

- These firms employed 5.6 million people in the United States, or 4.1 percent of private-sector employment. About one-third of jobs at U.S. affiliates are in the manufacturing sector.

- In the 2008-09 recession and subsequent recovery, employment at U.S. affiliates was more stable than overall private-sector employment. As a result, U.S. affiliates’ share of total U.S. manufacturing employment rose from 14.8 percent in 2007 to 17.8 percent in 2011.

- Compensation at U.S. affiliates has been consistently higher than the U.S. average over time, and the differential holds for both manufacturing and non-manufacturing jobs.

As you can see, theyre so far largely interested in manufacturing. This makes sense. For one thing, we have a lot of idle capacity and skills for manufacturing, as the American companies have sent so many of those jobs overseas. Now theyre coming back. But there are other advantages too. In some cases, producing something in China and importing it the US is very expensive. Shipping and tariffs add quite a bit to the cost. Making it in the US solves those issues. But making something in the US also reduces the companys exposure to currency shifts. A wild swing in the dollar or their home currency can really throw off profits. But if you make something using the same currency as the people who will buy it, some of that risk is mitigated.

FDI is showing no sign of slowing down. Its still a smaller piece of the US economic landscape, but its becoming one of the most significant of the future.