Energy Outlook

Post on: 13 Сентябрь, 2015 No Comment

Thursday, March 05, 2015

IEA Sees Fundamental Shifts in the Current Oil Price Drop

- The IEA’s latest medium-term oil forecast is a useful update to the thinking behind its current long-term outlook, which predated much of the current price drop.

- They expect shale output to be relatively resilient and rely on Iraq’s capacity to expand output in spite of significant security risks.

When the International Energy Agency issued its most recent long-term energy forecast last November 12th, Brent crude oil traded just above $80 per barrel. At that point it had fallen only half as far as it would by January 2015, compared to its June 2014 high of $115. As a result, the IEA’s assessment of the price drop in its 2015 World Energy Outlook was incomplete, to say the least. The agency’s Medium-Term Oil Market Report. issued in February, provides a necessary update and some interesting insights about how—and how far—they envision the oil market recovering.

Anyone expecting the IEA to provide a detailed oil-price forecast for the next five years will be disappointed. The current report reproduces recent oil futures price curves and generally endorses the consensus that prices won’t rise as high as the level from which they have just fallen, at least by the end of the decade. At the same time, in the Executive Summary they remind their audience, The futures market’s record as price forecaster is of course notoriously mixed. Six months ago West Texas Intermediate Crude for delivery in April 2015 was selling for around $90/bbl ; yesterday it closed under $52. So much for the predictive power of futures markets, as most participants are aware.

The report’s analysis of the factors influencing the oil supply and demand balance over the next five years is more useful. First and foremost, it recognizes that the factors contributing to this price correction bear little resemblance to the price drops of 1998 and 2008, and share only a few common threads with the big correction of 1986, chiefly involving OPEC’s behavior. The biggest differences relate to the nature of the North American shale sector, which drove strong non-OPEC supply growth for the last several years, and the economic and policy factors—slowing growth in China, subsidy phaseouts, and currency depreciation— likely to dampen the global demand response to cheaper oil.

With regard to shale, the IEA suggests that the current pressures on the US oil industry will prove temporary. They apparently expect the growth of unconventional production from both shale and oil sands to slow but remain the largest source of non-OPEC supply increases through 2020, outstripping increases in OPEC’s capacity and offsetting declines elsewhere. Those declines include a 500,000 bbl/day drop in Russian production, mainly due to the effect of sanctions over Russia’s involvement in Ukraine.

The agency even suggests that North American shale could emerge from this experience stronger, because of its inherent resiliency. The same factors that should see shale output slow sooner than that from big conventional projects taking years to develop would allow it to ramp up faster, once the current global oil surplus has been consumed. Meanwhile, with larger projects delayed or canceled, conventional production would take longer to return to net growth above normal decline rates.

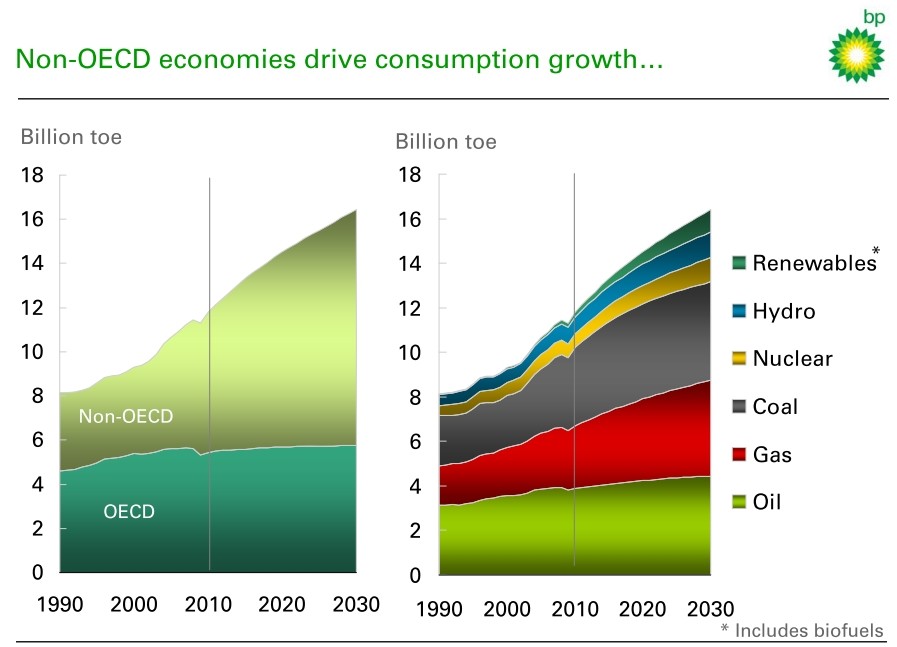

That could become the factor that dispels the current skepticism concerning shale oil opportunities outside North America, as apparently exemplified in BP’s latest long-term outlook. Companies looking for growth opportunities in a few years might regard developing the shale resources of China, Argentina and Russia —assuming sanctions on the latter end—as lower-cost, lower-risk investments than some deepwater or other big-ticket projects.

As for OPEC, its production growth through 2020 seems to come down to a single country. The report assesses the current situation in Iraq and concludes that despite the threat from the Islamic State and the country’s ongoing internal frictions, output should continue to grow by another million bbl/day or so. That strikes me as optimistic, particularly considering the proximity of ISIS forces to Kirkuk. which formerly accounted for around 10% of Iraqi production. Postwar development has focused on the big fields in southern Iraq. which have so far proved to be beyond the reach of ISIS, but a further deterioration of security in the Kurdish north could jeopardize future expansion plans.

The wild card on the supply side is Iran, which under international sanctions has seen its oil exports cut by roughly half. The Medium-Term Oil Market Report explicitly assumes that sanctions will continue. However, if current nuclear talks reached an agreement, sales could ramp up by a million bbl/day over the next year, if buyers could be found. That would alter the IEA’s supply/demand calculations substantially.

And that leads us to demand, which at this point is still a key uncertainty. I concur with the report’s general assessment that the world has changed since previous oil price drops and rebounds in ways that make a sharp rise in oil use less likely. US demand is up, but as I described in a recent post large groups of consumers around the world have seen little or no relief at the gas pump that might stimulate more consumption.

When I wrote about the IEA’s World Energy Outlook last December. I focused on its themes of stress and the potential for a false sense of security. In the short time since then the oil and gas industry has experienced a large dose of stress, but I’ve seen few signs of complacency on the part of consumers beyond a recovery in the US sales of SUVs and light trucks. That may change if low oil prices persist for a few years.

A different version of this posting was previously published on the website of Pacific Energy Development Corporation