Difference Between CFDs and Financial Spread Betting

Post on: 19 Октябрь, 2015 No Comment

Posted By Robert On Sunday, February 22nd, 2015 With 0 Comments

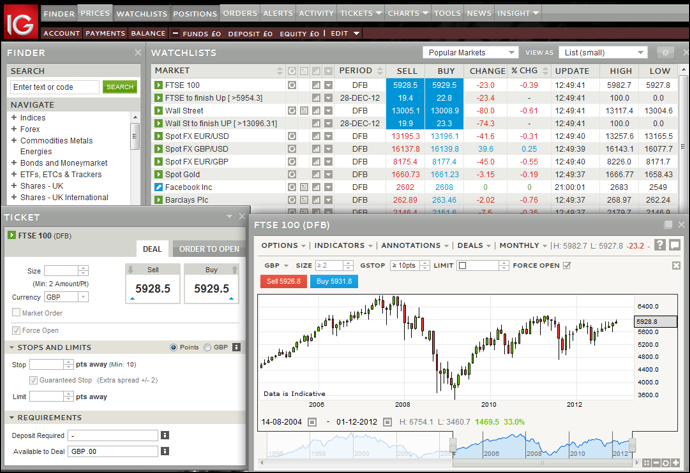

I received a question recently from a friend of mine asking me what was the difference between financial spread betting and CFD (Contracts For Difference ) trading. This is a good question and one I wondered about myself for quite a while when I first heard of CFDs. Over the last couple of years I went to a few sessions run by Davys and a few of the other firms who were trying to build up their CFD business. After going to these I realised that there is very little difference between trading CFDs and Financial Spread Betting. There are however a few subtle differences between the two which are worth being aware of, especially for those of you who are trying to make up your mind which route is best to go.

A Look At What They Have In Common

Ok, before I get onto the things that work differently between Financial Spread Betting and CFDs lets do a quick run through all the stuff that’s pretty much the same between the two:

- Both allow you the opportunity to go long or go short so you can take advantage of both rising and falling markets

- Both are free of stamp duty *

- Both are leveraged products which means a low initial outlay, you only need to put up a fraction of the total value of your trade, the IMR (Initial Margin Requirement) which can be as low as 2% on some markets, e.g Currencies.

- Following on from the previous point, because both are leveraged products, they are as a result both a high risk form of trading.

- With both all your trades are in the currency of your trading account, thus removing the risk of currency exposure, regardless of what market you trade.

- With both you never take ownership of the underlying instrument, so there are no share certificates issued and you have no voting rights at AGMs, etc

- With both you can trade a wide range of markets including equities, indices, currencies and commodities.

* Note: Tax Laws in Ireland may change.

With both spreadbets and CFDs you qualify for dividends on long positions on equities, well sort of…Although you are technically not the owner of the shares, if you hold a long position on the ex-dividend date your account / position will be credited with a payment that is the equivalent of the net dividend on the underlying shares. There is a potential downside here however to be aware of, if you hold a short spread trade or CFD position on the ex-dividend date, then your account will be debited by the amount of the gross dividend on the underlying shares.

There is a Capital Gains Tax Liability on CFD Profits

So from the above I think it is pretty clear that Financial Spread Betting and CFD Trading are very similar, basically the same kind of financial product dressed up with two different names. However, as mentioned above there are a couple of material differences between that two. The big one for me is that with CFDs there is a Capital Gains Tax Liability on any profits made from trading CFDs. Some see this as a drawback to getting into CFD trading over Financial Spread Betting but the proponents of CFDs will argue that there is a benefit here too, in that any losses incurred while trading CFDs can be offset against profits made in order to reduce your tax bill. That advantage sort of defeats the purpose since none of us get into trading to make a loss however losses are an inevitable part of trading so one has to take this in context.