Commodity ETFs Tax Considerations

Post on: 25 Август, 2015 No Comment

Current Affairs News:

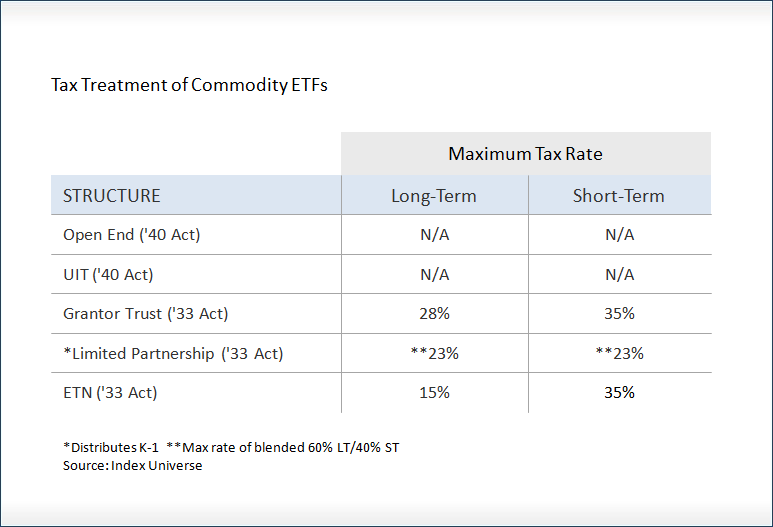

Exchange traded funds provide the average retail investor with the opportunity to easily access the commodities space. As the April 15 tax deadline approaches, investors should take the time to look over some tax consequences associated with commodity funds to minimize any potential pitfalls.

Commodity ETFs come in two basic categories funds that hold the physical commodity and those that track futures contracts, writes Janice Revell for CNNMoney. [ETFs and Taxes: What You Need to Know ]

When an individual invests in a physically-backed precious metals ETF, like the SPDR Gold Shares (NYSEArca: GLD ). the IRS treats you as if you were actually holding the bullion yourself, Michael Iachini, head of ETF research at Charles Schwab Investment Advisory, said in the article. [Long-Term Gains on Gold, Silver ETFs Taxed at Higher Rate ]

The IRS treats gold, silver and other precious metals as collectibles. Collectible metals are not taxed at the 15% maximum long-term capital gains rate, but instead, they are taxed at the ordinary income rate of up to 28%. If the precious metal ETF is held for less than a year, short-term rates can be up to 35%. [ETFs and Tax Efficiency ]

The IRS places a 60/40 split on futures-based ETFs, like the U.S. Oil Fund (NYSEArca: USO ). which are structured as limited partnerships. When sold, 60% of the profits is taxed at a maximum 15% long-term capital gains rate and 40% of the profits is taxed at short-term ordinary income rates. Additionally, unrealized gains on futures-based ETFs are marked-to-market annually contracts held within the funds are taxed at the market value regardless of maturity at the end of the year. [Three Things You Need to Know About ETF Tax Efficiency ]

Furthermore, futures-based ETF investors will receive a K-1 form from the fund provider that outlines gains from the shares, which you will have to pay taxes on.

Paul Justice, director of ETF research at Morningstar, notes that investors can hold these types of commodity ETFs in an IRA instead. While you would still owe standard tax on IRA withdrawals upon retirement, buying and selling commodity ETFs within an IRA does not trigger tax consequences.

For more tax information on ETFs, visit our taxes category .

Max Chen contributed to this article .

Full disclosure: Tom Lydons clients own GLD.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.