Can actively managed funds outperform the market

Post on: 5 Октябрь, 2015 No Comment

TRANSCRIPT

Liz Tammaro: Great. So we actually have a second live question here from Chris. So Chris says he understands that not all, or even most, actively managed funds can beat the marketwe talked about thatbut do we believe that a small percentage of particularly skilled managers could consistently beat the market or the market averages or indexes? And if that is true, if someone were able to have consistent outperformance, would it be worthwhile to research and find those managers versus using index funds? What do you think?

Scott Donaldson: Sure, I’ll try to take a stab at that. I mean, if you think about it, if you certainly know or you think or have a high level of confidence that you’re going to select a manager that can outperform the market, or you know with certainty they’re going to outperform the market, then you would actually choose to do that.

Liz Tammaro: Sure.

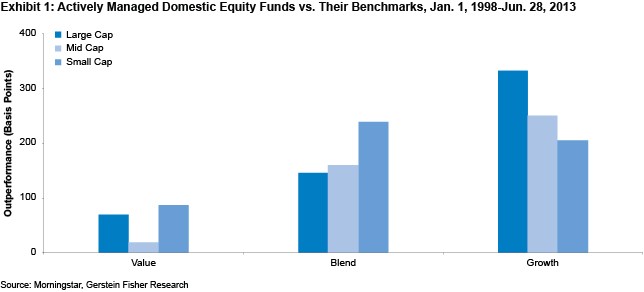

Scott Donaldson: The difficulty of that is in a lot of the research we’ve seen is even though there have been active managers that have been successful and been able to outperform the market, over even whether it’s one, three, or even in some cases ten years or more, that outperformance is very, very difficult to maintain because of some of the differences in the portfolio holdings and the characteristics of the market. The characteristics of what are in favor change from time to time based on the economy and earnings outlooks and so forth.

So unless that manager believes in a style that is an outperforming style for a while, they usually just don’t all of a sudden change that philosophy as market conditions change. Some do, but many, many don’t. So there’s going to be a time when they’re probably going to outperform sometime in the future.

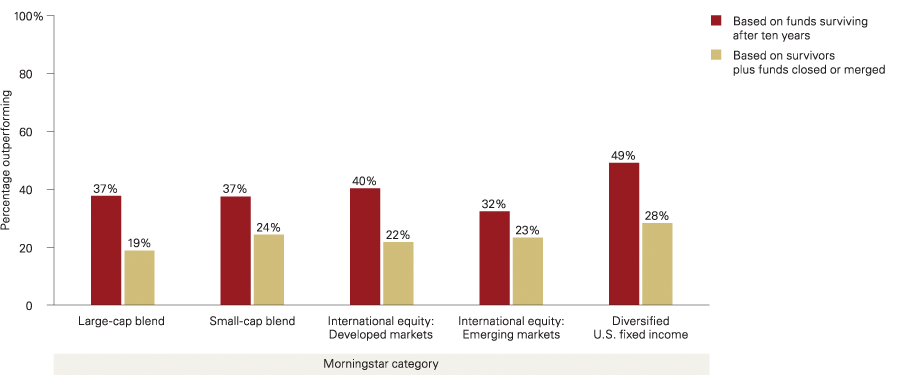

One of the pieces of data that we have seen if you’re going to select an active manager, it’s certainly having confidence in the team and their philosophy, and you believe in it, and how well have they done over how long, and so forth. But the other thing, similar to why indexing, is a very positive and good investment strategy is low costsor lower-cost relative to higher-cost fundsare one of the best predictors of future relative outperformance, or performance that we have seen in our research. Morningstar has done the research. There’s numerous studies out there that lower costs are one of the best predictors.

So if you’re going to go active, looking at lower-cost active relative to a higher-cost active counterpart is a very, very good starting point to do that.

Walter Lenhard: We should also mention that although Vanguard is a big believer in index products, we also believe in active management. So the markets aren’t perfectly efficient, and there should be the ability to capture some positive excess return. You just have to be very careful about the mean reversion. A lot of managers that have outperformed over the last three and five years don’t outperform over the next three- and five-year cycle.

Important information

For more information about Vanguard funds, visit vanguard.com, or call 877-662-7447, to obtain a prospectus. Investment objectives, risks, charges, expenses, and other important information about a fund are contained in the prospectus; read and consider it carefully before investing.

All investing is subject to risk, including possible loss of principal.

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

2014 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor.