Arnott The Urban Legend Behind Stocks More

Post on: 12 Сентябрь, 2015 No Comment

Research Affiliates’ Rob Arnott follows up the article ‘Bonds: Why Bother’ by answering audience questions from his recent webinar.

In a follow-up to his popular JoI article ‘Bonds: Why Bother?,’ Research Affiliates founder Rob Arnott partnered with the Journal of Indexes for a live webinar examining where investors should be looking for opportunity today .

As a bonus, Arnott has provided written responses to all the questions that were asked by the audience during the webinar. His answers follow below. (In some cases, for efficiency’s sake, multiple similar questions on a single topic have been condensed into a single question.)

Audience Question: Given the prospect of heavy or hyper-inflation, how do you find a reasonable return that can keep pace? Do you have any expectations on how this may play itself out in the coming few years?

Rob Arnott. TIPS provide protection against inflation; as bond yields soar in the face of inflation, TIPS yields can potentially go the other way, especially from a high initial real yield. Commodities can protect us from inflation shocks, though not inflation per se-futures prices already embed inflation expectations in the forward prices. Stocks enjoy inflation pass-through, albeit with a lag. Inflation shocks will be bad for stocks, but sustained inflation will eventually be passed through. If stocks are cheap (which is true only of deep value), they can do well even in the face of inflation.

Audience Question: Discuss your view of future interest rates in the coming years and their impact on bond class prices. Which type of bonds are the worst and best to hold in a rising rate environment?

Arnott: Inflation poses a real threat to bonds. It’s implausible that the monetary spigot will be reversed when the perceived deflation threat is eliminated, in time to avoid meaningful inflation. Bonds and stocks both offer very nearly the widest dispersion in valuations in history. So, the deep value side of both categories (junk/convertible bonds and deep value stocks) offer great prospects, barring a real Armageddon scenario. The safe-and-trendy end of both asset classes (Treasuries and quality growth) is richly priced; I find them utterly uninteresting.

Audience Question: How will corporate defaults in late 2009 and early 2010 affect the total returns on these investments? Are they still viable investments?

Arnott: Defaults will be huge. The key issue is not whether we’ll see defaults, but whether spreads are rich enough to compensate us for that risk, for the well-diversified investor. With junk bond and convertible bond spreads wider than they were in the Great Depression, we’d have to see worse than that scenario for the investor to forfeit the whole yield spreads.

Audience Question: It is common knowledge that the current fiscal stimulus is tremendously inflationary. What is the expected effect on residential real estate values?

Arnott: It’s not common knowledge. there are two views out there. But I agree with those who think it’ll be inflationary, perhaps massively so. Real estate will come back. But real estate is a classic lagging asset class. It can’t turn while inventories are rising. Inventories can’t turn while foreclosures are rising. Commercial real estate has only begun to tumble. This isn’t an asset class that has any hope of turning in 2009. Wait for 2010 or later.

Audience Question: How do you feel about the typical thought that small- and mid-cap stocks tend to lead out of recessions?

Arnott: They probably will again, though large deep-value companies are also likely to lead.

Audience Question: What do you think about the oil market? Are we running out of oil worldwide, and/or what do you expect the energy market to do over the next decade? Also, what do you think of the S&P Commodity Trends Index (that will go long or short different commodities)?

Arnott: Oil is a finite resource. It’ll run out. When oil was discovered, folks were fretting about the impending demise of the whale population, the source of whale oil. We’ll find alternatives. But not before the economics of finding that alternative become compelling. We have ample coal and natural gas (and don’t have to import them!). Nuclear, solar, wind and tides all become economically viable at various energy price levels. But we’ll see $25/gallon gas in 10-20 years. At that stage, the shift to alternatives will be in full swing, without any inept, politically opportunistic government intervention.

In commodities, also, we see exceptional dispersion in values. Some are at lows not seen in a decade; others (gold) are near their all-time highs. Playing these spreads should be profitable.

Audience Question: What about munis?

Arnott: Municipal defaults will soar in the coming years. Be very selective.

Audience Question: Perhaps TIPs are priced poorly because they reflect the government’s habit of miscalculating the CPI-the source of prospective principal upgrades. Please comment.

www.shadowstats.com/. The government does lie about the statistics. People see their homes, their jewelry, their collectables soar, and they think they’re making money. No. The purchasing power of the dollar is tumbling. If you own the same home, jewelry or collectables as before, you’re obviously no richer just because they command a higher notional price.

That said, TIPS are the cleanest way to hedge inflation risk. The true real yield is perhaps 2% lower than it seems. And, you’re taxed on the yield, on the inflation and on the hidden, unacknowledged inflation. But, viewed as insurance against reflation, this yield give-up is the price we pay for that insurance. Also, note that, if real yields on TIPS are lower than they seem, the same holds true for Treasuries and other assets.

Audience Question: What’s a reasonable equity risk premium?

Arnott: It varies over time. But the 5% that everyone seems to expect for stocks relative to bonds is no better than an urban legend. A 5% excess return was achieved while stock market valuation multiples were soaring, and at no other times.

Audience Question: Is asset class correlation a moving target? And what is an efficient way to measure current correlation?

Arnott: Correlations rise with inflation and fall with deflation. By the time you measure it, it’s too late to do you any good (witness last Sep/Oct!). It’s best to assume that it mean-reverts toward long-term historical averages. And because low correlations generally won’t hurt us but high correlations will, it’s best to assume that it can be higher than we might expect.

Audience Question: It seems you’re simply promoting a diversified approach to investing. How is this different than basic portfolio theory?

Arnott: There’s nothing new under the sun. Questions: How many people follow a truly diversified approach? How many think of their stocks as ownership of an enterprise (à la Graham & Dodd), rather than as some assemblage of portfolio characteristics? In the 15 th century, Jacob Fugger (Fugger the rich) put his money in shares, in loans (bonds), in property and in commodities. And he’d rebalance when the mix drifted away from one-fourth each. The shares and the real estate did well when the economy was strong; the loans and commodities did well when it was weak; the commodities and real estate did well when the government was debasing the currency; and the stocks and bonds did well when the government and the currency were sound. Old ideas have a lot of power, and keep getting rediscovered.

Audience Question: How has a simple allocation strategy that overweights the worst previous 5 years’ asset classes and underweights the best ones done? I assume better than equal weighting all the asset classes.

Arnott: It’s a powerful idea that few investors have the stomach to pursue. It means selling the best-loved assets and buying the most-loathed assets. It’s the essence of successful global tactical asset allocation.

Audience Question: Do you recommend purchasing individual bonds, or can the opportunities be realized through bond index fund or mutual fund options?

Arnott: I personally strongly prefer funds, as long as fees are reasonable. I don’t have time to study individual bonds, and most retail investors won’t have the requisite expertise. It’s a cheap way to get diversification and (hopefully) someone reasonably smart picking the individual assets.

Audience Question: On a go-forward basis, what are some of the main factors that suggest an asset class is over- or underpriced?

Arnott: The simplest is to compare its yield (or in the case of bonds, the spread relative to Treasuries) with the long-term history. If the yield or spread is near historical lows, you’re picking up nickels in front of a steamroller (as many investors learned too late after the skinny yields and spreads of 2006-07). If the yield or spread is near historical highs, there may be larger risks than before, but at least you’re getting paid for them.

Audience Question: When do you anticipate Fundamentally Weighted bond ETFs coming to market?

Arnott: I’m not at liberty to comment. Infer what you like from this fact!

Audience Question: Just like alpha has a cost, is the cost of Fundamental Indexing in investment-grade bonds not worth the benefit? It seems that the benefit is smallest in that category. Is that because it is a more efficient market relative to emerging markets?

Arnott: Fundamental Index ® strategies are at their best in any markets where the gap between price and the (invisible) eventual fair value is largest. It’s far larger in high-yield bonds and emerging markets debt.

Audience Question: Isn’t one of the risks of Fundamental Weighting in indexes that these measures such as price-to-sales are not forward-looking, but backward-looking? Do we really believe GM will generate as much sales in the next 10 years as it has in the last 10 years?

Arnott: Of course. But future expectations are already in the price. The point of Fundamental Index strategies is to take price out of the weighting decision, so that we don’t own more of an asset just because it’s expensive.

The fundamental weight is perhaps best seen as a sensible anchor for rebalancing, for contra-trading against the market’s constantly shifting expectations, fads, bubbles and crashes. It’s not the same thing as fair value weighting (which works really well, if only we could know the fair value! Look for my article in the upcoming summer JPM on the subject).

Cap weighting mirrors the composition of the stock market, with all its excesses and errors. Fundamental Indexing mirrors the composition of the economy, by weighting companies on their recent financial footprint in that economy, and so contra-trades against the excesses and errors of the market. It’s not that it doesn’t have errors. it’s that the errors are not the same ones that are in the price, so they have some chance of cancelling, rather than dragging us into overweighting the overvalued and underweighting the undervalued.

Audience Question: Many financials now have negative earnings and even negative book value. Do you treat them as value or growth?

Arnott: They’re value. Deep value. Price relative to historical smoothed sales, profits, dividends and book values are all very low. For a good reason! But, again, RAFI ® makes its money by contra-trading against market excesses.

Audience Question: What is the real stock price index?

Arnott: S&P 500 Index level / CPI level

Audience Question: [Are the statistics in the presentation measuring] nominal stock index returns AFTER inflation? Inflation for THAT period? No reinvestment? Stocks don’t include dividends at all? Please state or clarify assumptions.

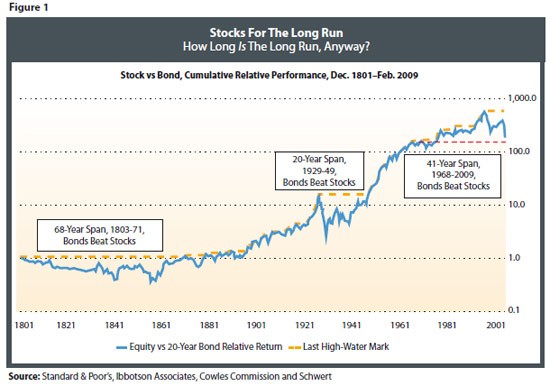

Arnott: Stocks have three components to return: dividends, inflation and real price growth. For the exhibits that compare stock and bond returns, we are looking at total return of both, and taking the ratio of the cumulative wealth of the stock market investor relative to the Treasury Bond investor. For the exhibits that focus on stock price returns, we’re focusing only on the last of these. So, we’re taking out inflation (which isn’t really a return on our investments!) and dividends.

I believe I mentioned a number of times that, during these protracted spans where real stock price levels were flat, investors were really only earning their dividends. with nothing from real growth. This is one reason that dividend yields matter so very much. A yield of 3% (today) is vastly more interesting than a yield of 1% (in 2000) and vastly less interesting than a yield of 6% (in mid-1982).

At a 3% yield for stocks and for 10-year Treasuries, I am not proposing that we should replace stocks for the long run with bonds for the long run! On the other hand, I do not see a 3% stock market yield as a screaming bargain, either. In my view, there are bargains galore, today, but not in growth stocks or in Treasury bonds.