Apple s Profit v s Promise The Market Now

Post on: 13 Июнь, 2016 No Comment

Posted in Investing

Photographer: Adriano Machado/Bloomberg News

No matter how fast Tim Cook paddles, he cant match the ease with which Jeff Bezos floats down the Amazon.

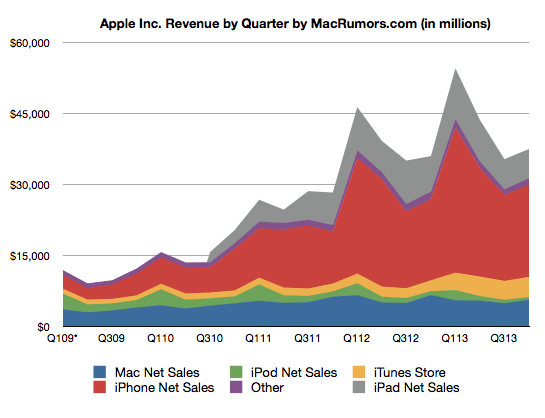

Apple Inc. today reported $13.1 billion in profit for the last quarter of 2012, putting it at over $40 billion for the year a number only one other company, Exxon Mobil Corp. has ever exceeded. Apple beat profit estimates, though (yes, this is the key part) growth slowed. So naturally Apple shares got clobbered.

You can debate whether investors who are selling are right to turn from Apple. Growth is indeed a question mark: the bigger the profit numbers get, the harder it is to raise them. To really make sense of the markets view of Apple, however, it helps to set Apple next to Amazon.com Inc.

On todays Bloomberg Billionaires list. Amazon founder Jeff Bezos comes in at no. 19, with a net worth of $25.3 billion. That fortune has skyrocketed as Amazon has gone to its current $267 share price and $121 billion market cap.

Comparing Bezoss fortune to Amazons earnings highlights how deeply puzzling that increase has been. Since 2003, the first year in which Amazon earned a profit, through the end of 2011, Amazon has reported a total of $5 billion in earnings. Amazon has not yet reported results for this year; it lost money in the last quarter, but is expected to turn a profit for the year.

Think of it this way: if Bezos had started the company himself, still owned all of it, and had taken out every penny in profit, his bank balance would be less than one-quarter of what his shares are worth. Or think of it another way: Apples profit for the last quarter alone is well over twice Amazons profit over its entire entire existence.

By conventional metrics, Amazons earning are so low that its almost senseless to talk about them. Amazons price/earings ratio? 505. Unable to explain this in any traditional way, commentators tend to descend into the mysticism of the far-off future, talking about Bezoss long term view. That long-term might parallel a human lifespan; Amazon has been a public company since 1997, and seems to be just entering adolescence.

Apple makes so much money that investors are leery of whether it can continue growing. In stark contrast, Amazon has made so little that, paradoxically, it continues to hold out the prospect of limitless growth. The magic of Steve Jobss recent years of Apple presentations was that you could rely on Apple to introduce perfectly, gloriously finished products. Bezos has done the opposite: whether its cloud computing services or the Kindle, Bezos keeps giving investors works in progress.

Amazon was part of the first cadre of companies to go public before turning a profit. That marked a dramatic break with the past history of the stock market. Since the late 90s, it has made less and less sense to talk about the intrinsic value of a company to predict the movement of its shares. No chief executive has understood that transformation better than Bezos or benefited from it more.

* Correction: An earlier version of this post said that Amazon had earned $5.4 billion.