Using a currency strength meter with your Forex Trading System

Post on: 7 Октябрь, 2015 No Comment

If you are not using a currency strength meter, then you are missing out on a potential trade saving device.

For 2 years Ive had several currency meters, some purchased and some programmed by my friend, but I never really took any notice of them. I had a Forex Trading System that worked and was quite happy with the results. A few months ago I started noticing a performance deterioration and I attributed it to my own state of mind, and not seeing things clearly. However, one of my colleagues pointed out that he had refined the systems we were using and always consulted the currency strength meter before he entered a trade.

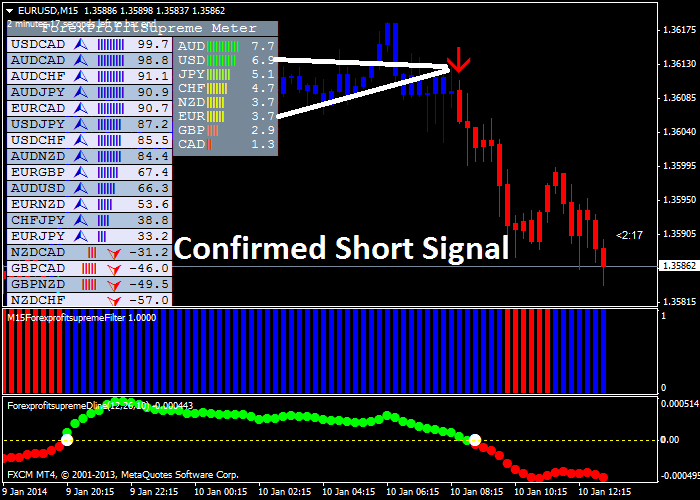

I thought about it and managed to dig up some of the meters I had buried in the outer reaches of my hard drive and started using them. The idea is simple, currency strength is calculated for a basket of currencies and values assigned based on the movements of a currency against all others. So if for example the USD is strong against the GBP but neutral or weak against the Euro. a short Eur/Gbp may be the ticket, if it fits your Forex Trading system parameters. Better still, if your system or method shows a potential trade, you can consult the meter and find out if you have a better probability. I added this to my arsenal of tools and have avoided several trades that although fitted my system criteria were not support by the currency strength. I dont use the meter itself as a trade finder, I use it confirm or deny a potential trade I am looking at.

As you know my trading method involves using pivot points, basically, buying support and selling resistance or, using the break and retrace to enter in the trend direction. (The video and post of this method is Click ). Since Ive started looking at the relative strength of the currency I have improved the results of this method by approximately 25%, a good saving and well worth the effort.

The other method I use is Forex rebellion which is an EA (expert adviser in MT4), and once again am using the meter to avoid low probability trades.

[adsenseyu2]

There are several packages out there with prices ranging from $199 to over $500. However mataf.net (an incredible Forex resource site) offers what they call a currency index which looks like this:

As you can see each currency is plotted in a different color and you can easily see which is strong and which is weak. You can also change the timeframes to suit your own method, so for example the GBP may be weak on the 4 hour charts, but strong on the 5 minutes charts. This gives you additional ammunition for both entering a longer term swing or position trade and also for taking with trend trends based on retrcemens. The mataf.net currency index is free, like most of the tools on the site and you can see it here ==> Click Mate

There is another one which works directly within MT4 and costs $199, you can check it here ==> Click

I make no specific recommendation as I use my own propriety meter but I suppose that having it updating in real time in MT4 can be a good advantage, Just check them out and see what suits you best.

Thats my quick post for today, I am still working on creating a PDF of all my methods and systems but with all recent market volatility and other commitments havent had the time yet. It will come in the meantime most of my methods are scattered around this blog and you can find them if you like