Trendlines in Forex Trading

Post on: 6 Октябрь, 2015 No Comment

7.1. What are Trendlines?

Trendlines are straight lines that connect each successive rising bottom to show an uptrend or each consecutive declining top to indicate a downtrend. There should be 2 price points for the trendline to be drawn. The longer the trendline and the more points it connects the stronger it can support/resist the prices on subsequent tests — because more market participants are aware of it. The steeper the trendline — the more bullish or bearish the market sentiment.

Ideal up trendline

Ideal down trendline

The up-trend trenline visible on the 1-day EUR/USD chart (from 29.09.05 to 07.09.2007) provided support to the prices

Note. All forex charting packages allow to draw the trendlines. Some of them (e.g. Intellichart ) can also automatically create trendlines for you.

Most major currencies, like EUR/USD and NZD/USD which are shown below, are characterized by frequent, sustained and well-defined trends. Trendlines can be a very effective tool which you can use to follow and profit from these currency price movements.

7.2. How to Draw a Trendline?

To draw an up trendline simply connect 2 or more ascending lows. To draw a down trendline do the same with two or more descending highs. Extend the trendline to the right to see where the future support (for an up trendline) or resistance (for a down trendline) levels should be. When drawing a trendline try to connect as many price extremes as possible -peaks of the upper shadows for downtrends and the bottoms of the lower shadows for uptrends. It is also possible for a trendline to pass through candles’ shadows or the edges of their real bodies as long as it connects the maximum number of bottoms in uptrends or tops in downtrends. A trendline which connects a maximum number of points will have greatest predictive power for the future price action because it most accurately reflects the underlying market sentiment. Whenever the sentiment changes the new trendline will have to be drawn or the older one redrawn.

Example of Drawing the Down Trendline

Click to Enlarge.

Quote: Andrews used a trendline that he named the Multi-Pivot line. This is a trendline which runs through more than two pivots. This trendline does not have to run through the exact high or low of each pivot; it only needs to be close to each pivot. Andrews believed that the greater number of pivots through which a trendline runs, the more important the trendline is for finding future support and resistance levels and pivots., Patrick Mikula in his book The Best Trendline Methods of Alan Andrews and Five New Trendline Techniques .

7.3. Using Trendlines in Forex Trading.

There is usually more than one trend showing itself in the price action (e.g. a longer-term uptrend being corrected by a shorter-term downtrend). This often results in seemingly meaningless price picture which can be quickly clarified by drawing a few trendlines. Simply draw all the trendlines you can on 3 charts of different time-frame: 1) on a daily chart, using historical data of 1-3 years (for long-term trends); 2) on a 1-hour chart using historical data of 1-3 months (for medium-term trends); 3) on a 15-minute chart, using historical price data of 1-3 weeks (for the short-term trends). You will be amazed how often the prices will respect and obediently manoeuvre through the network of trendlines that you have drawn. At times you can feel almost sorry for the price which is constantly getting hit by the various boundaries it encounters. No wonder, when it finally feels that it can move feely it easily gets too excited about the future. The following example demonstrates this principle in action:

Click to Enlarge.

Note: It is a good idea to determine which charts to draw the trendlines on and discipline yourself to check and update these charts continuously. You can specify which charts to review in your daily checklist .

Note: Most bank reports on forex (e.g. KBC’s weekly technical report) use trendlines of varying length in their technical analysis.

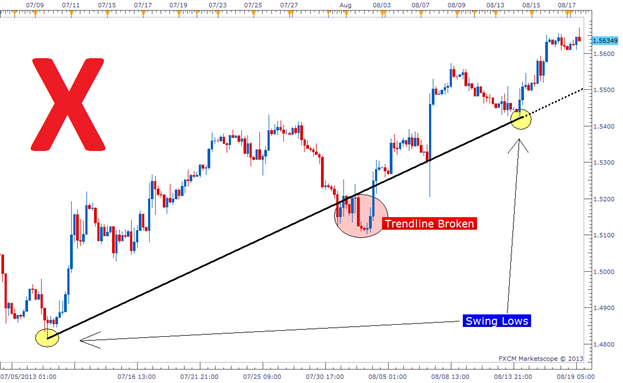

Trendlines will reverse their roles if broken - in accordance with the principle that the support and resistance levels will assume opposite roles once violated. An up trendline will often act as resistance to the future price rallies after it is decisively broken. Likewise, a violated down trendline will usually provide support to subsequent price dips. You can take advantage of this rule by extending all of your trendlines (broken or not) as far to the right of your charts as possible, as is shown below.

Click to Enlarge.

Trading strategy using the trendlines is pretty straightforward. Buy on dips toward the up trendline and sell when the prices bounce off the down trendline. You can also add to your position on each successful test. The idea is to stay with the trend (be it a short-term, a medium-term or a long-term trend) and the trendlines help you to do exactly this. As you look for entry levels, it pays to think more in terms of zones around your trendline than the exact price touches — since many investors will have slightly different trendline positions and, therefore, might not act simultaneously when the price approaches it. For this reason you should try not to use overly tight stop-losses when trading trendlines. When the trendline is decisively broken, you exit all your trade (s) -as is demonstrated in the example below. This exit strategy is similar to closing all your positions at the break of the baseline which confirms the completion of one whole impulse wave .

Click to Enlarge.

Note. Candlestick patterns can help you to quickly determine if the test was successful when the prices test a trendline.

You can also draw a price channel line, parallel to the original trendline so that it passes through the maximum number of price extremes opposite to it (tops of rallies for up trendlines/bottoms of declines for down trendlines) — and take some of your profits when the prices touch this line. The following pictures illustrates this stategy.

Click to Enlarge.

Click to Enlarge.

Alternatively, you can book your profits when the currency prices hit some prominent support/resistance area — like a longer-term trendline, round number level or a fibonacci retracement level of the longer-term trend.