Taxes for the SelfEmployed A Primer

Post on: 16 Март, 2015 No Comment

Share

- Facebook Twitter Google Plus

Even people who are well-schooled about money can make basic mistakes when it comes to things like taxes. Take entrepreneurs, for example. When you own a business, you’re playing by your own set of rules – but when you’re doing your taxes, the rules are set forth under the Internal Revenue Code. Knowing the law makes elementary mistakes easier to avoid. Here are some general guidelines to maximizing your money, and staying on Uncle Sam’s good side.

Entrepreneur is another word for micromanager

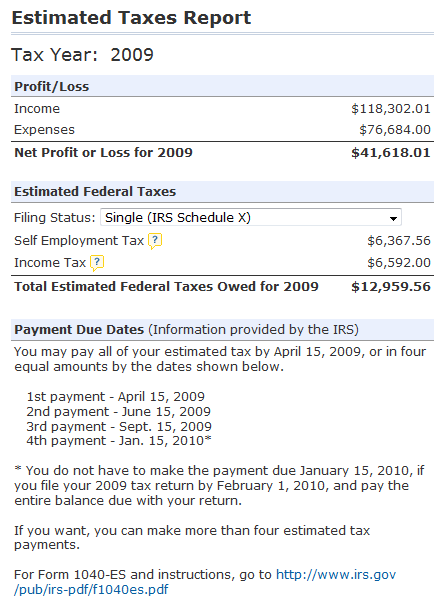

And that’s a good thing, because managing your own business requires you to stay on top of every little detail. But taxes are the one area where you should consider getting help from a professional tax advisor. New business owners often forget to make quarterly estimated Social Security, Medicare and federal and state tax payments, and when you’re doing your own returns you might not see or take advantage of all available deductions. Talk with a qualified tax advisor to figure out what you’ll need to pay each quarter and timing requirements, and how you may be able to save money through trade or business deductions. Don’t forget about collecting, allocating and paying for state and/or local sales tax.

Don’t mix business and pleasure

Many first-time business owners don’t separate business and personal expenses. At the end of the year, guess who has to sort through the mess? Your accountant, and that’ll hike your costs for tax preparation — often considerably. Consider setting up separate checking and credit card accounts for your business. You’ll thank yourself for it when tax time rolls around.

Just when you thought you’d escaped the corporate grind

Forming an S-Corporation may be a good idea. With an S-Corp, which is a pass-through entity for federal income tax purposes, you set up a regular payroll and make monthly payments to the IRS. Technically, you become an employee of the S-Corp and your salary is subject to payroll taxes – but your company profits, after payrolls and other expenses, are only subject to income tax, so depending on what you pay yourself you could save some money based on your particular situation.

In praise of the HR-10 (or Keogh) 401k or SEP or SIMPLE IRA If you’re looking to contribute more to your retirement, the good news is you’re not stuck with only a Traditional IRA. Look into an HR-10 (or Keogh) 401k or SEP or SIMPLE IRA – the annual contribution limits are generally much higher than with a traditional IRA.

This material is provided for general and educational purposes only; it is not intended to provide legal, tax or investment advice. All investments are subject to risk. We recommend that you consult an independent legal or financial advisor for specific advice about your individual situation.

The information herein is not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding tax penalties. Taxpayers should seek advice based on their own particular circumstances from an independent tax advisor

Neither Voya nor its affiliated companies provide tax or legal advice. Please consult with your tax and legal advisors regarding your individual situation.