Offshore Drilling in The Gulf of Mexico US and Pemex Activity

Post on: 16 Март, 2015 No Comment

February 3, 2015 by Anne Leonard

When the Obama administration announced its new five-year leasing plans for US waters on January 27, the inclusion of a portion of the Atlantic garnered most of the headlines. However, arguably the bigger news was the decision to make Gulf of Mexico lease sales region wide. After all, any leasing let alone drilling off the coasts of Virginia, North Carolina, South Carolina or Georgia is on an if-come-maybe basis, facing many interim hurdles that put it years in the future at best. On the other hand, beginning in 2017 the US Bureau of Ocean Energy Management (BOEM) will hold two Gulf of Mexico sales annually that will offer all open blocks in the Western and Central planning areas plus the blocks not under moratorium in the Eastern Gulf.

Pardon the pun, but this is a sea change. Since the first five-year plan was launched in 1980, Gulf of Mexico leases sales have been divided into Western Gulf and Central Gulf offerings, with a lease sale for the more heavily protected and therefore lightly explored Eastern Gulf thrown in every so often for good measure. With the exception of the year-and-a-half disruption brought about by the Macondo disaster in 2010, Central Gulf sales were generally held in the spring, followed by a Western Sale late in the summer.

More offshore drilling opportunities

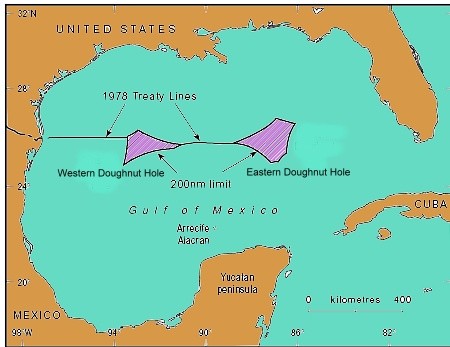

So what spurred the change? In a word, Mexico. The decision to offer all open blocks in one sale was made in light of energy reforms that are opening up licensing opportunities in Mexican waters. Acknowledging that resources no doubt straddle both sides of the US-Mexico Maritime boundary, the BOEM decided to offer more frequent opportunities to bid on open Outer Continental Shelf (OCS) blocks to facilitate cross-border exploration.

“This new approach will allow for BOEM to more effectively balance the sales while providing greater flexibility to industry to invest in the Gulf, particularly given the significant energy reforms recently adopted by the Mexican government,” said BOEM Director Abigail Ross Hopper.

Mexico is finally poised to act

The opening of Mexico after three quarters of a century is the single largest event on the international E&P horizon today, even in the face of collapsing crude oil prices. Ironically, Mexico closed and locked its doors at precisely the same time the first offshore oil well was completed. Drilled from a freestanding platform a mile and a half from the Louisiana coastline, as opposed to over-water drilling conducted earlier in the decade by barges in the Louisiana marshes, the Gulf of Mexico State Lease No. 1 began producing in March 1938, opening the Creole field.

Today the US Gulf of Mexico is one of the world’s premier oil and gas producing provinces, which of course has not escaped Mexico’s attention. It is no coincidence that the three light oil fields found to date in Mexico’s deep waters – Exploratus, Trion and Maximino – are clustered on the Perdido Foldbelt, within 50 miles south of Shell’s Perdido Development, which includes the Great White, Tobago and Trident fields. When Perdido began producing oil in 2010, it was hailed as a “technological tour de force” for being so far out (200 miles south of Houston) and so deep (in about 8,000 feet of water).

Mexico’s national oil company Pemex is looking for partners in these three fields in what is known as Round 0.5. These Lower Tertiary light oil fields are big prizes, with reserves estimated between 150-200 MMbo at Trion to as much as 500 MMbo at Exploratus. Up to 75% of Trion and Exploratus are said to be available, as well as operatorship of Exploratus. In addition, Pemex may farm out equity in Maximino. While reserves estimates have yet to be released for Maximino, Pemex has called it the “jewel in the crown.” Needless to say, Shell and its partners on the US side of the border – BP and Chevron – are all said to be interested.

In addition to the opportunity to farm into these three discoveries, the Mexican government will hold a bid round this year that will include deepwater blocks. Tom Liskey, DrillingInfo’s Northern Latin American Manager, said the call for bids for the deepwater tranche of blocks in the staggered Round 1 process is expected to launch in March 2015, with registration and data rooms opening in May 2015. Awards for the deepwater sector should begin in October 2015.

The US is not standing idle

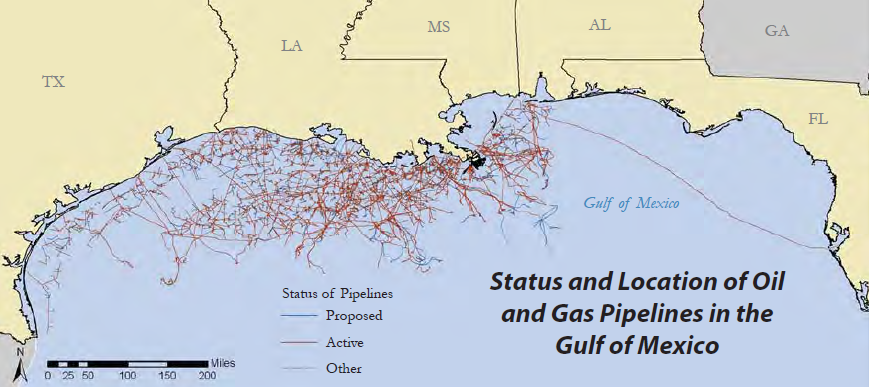

Meanwhile on the US side, another oil field far from shore in very deep water came onstream on January 15. Anadarko’s Lucius field, located about 240 miles south of the Louisiana coastline, is anchored by an 80,000 bo/d spar and producing via 100 miles of new oil pipeline and 230 miles of gas pipeline. Located in the Keathley Canyon area, Lucius is about 30 miles north of the Mexican boundary. Some 175 miles due east of Perdido, this portion of the Lower Tertiary Trend is very active and in 2013 Anadarko made another big discovery about 10 miles south of Lucius. That discovery, known as Phobos, is the first well drilled in the Sigsbee Escarpment. First oil at Lucius came only a month after Chevron began production at Jack/St. Malo to the east in the Walker Ridge area. In another recent development, Chevron, BP and ConocoPhillips on January 29 announced they will jointly develop several large oil discoveries – Gila, Guadalupe and Tiber – in the northwestern Keathley Canyon area.

All of this activity underlines the synergy that will be needed to exploit resources in Mexican waters. In addition to drilling and development on the US side, there are a number of seismic surveys currently underway that span both sides of the boundary, including two even further to the east in the undrilled Lund Protraction area.