Learn Forex Trading Chart Types Line Bar and CandleStick Charts

Post on: 11 Июнь, 2015 No Comment

%img src=bullet.gif>

Chart is a graphical description of forex price movements over a specific period of time. There are two important parameters in forex chart, the X axis represents time, and the y axis represents price.

Forex Charts usually consist of three types.

- Line Chart

- Bar Chart

- CandleStick Chart

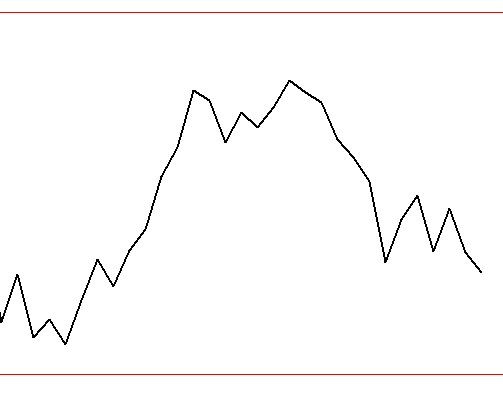

Line Chart

Line chart shows a series of data points which is connected together in a line. Commonly used data are closing prices as they are the most important feed to see in forex. Line chart is a basic type of chart used in forex and other financial studies.

GBP/USD 1 minute Line Chart

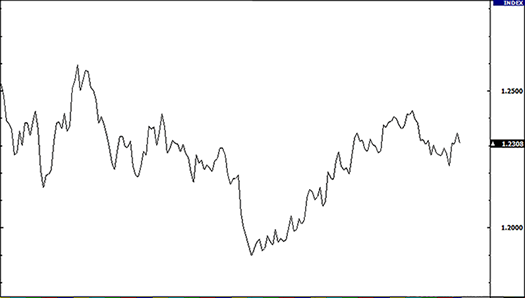

Bar charts provide more detailed information compared to Line chart. It shows not only closing price, but consists of opening price, highest price, and lowest price during a time period (timeframe). For example if you use 5 minutes chart, it means every price movements within 5 minutes period are represented by 1 single bar.

GBP/USD 1 minute Bar Chart

Open = Opening price of the period is indicated by horizontal line on the left side of the bar

High = Highest price of the period is indicated by the top of the vertical line

Low = Lowest price of the period is indicated by the bottom of the vertical line

Close = Closing price of the period is indicated by horizontal line on the right side of the bar

CandleStick Chart

Candlestick charts have the same characteristics of bar charts as they provide open, high, low, and close prices within one bar, but the main difference is the ease of interpretation purpose. We can easily interpret bullish and bearish pattern from the color of their bodies.

Candlesticks are used since the 17th century in Japan and have been improved in the 18th century by a well known Japanese rice trader from Sakata, Homma Munehisa, and now are widely used in forex trading due to the ability to display multiple data points instead of one.

Steve Nison’s 1991 book, Japanese Candlestick Charting Techniques, called back into traders’ memory this particular form of charting, which had already been picked up by Charles Dow around 1900. Today it is one of the most commonly used chart displaying methods with traders.

GBP/USD 1 minute CandleStick Chart

Candlesticks are usually composed of the body (white/green or black/red), an upper and a lower shadow (wick). The wick indicates the highest and lowest currency traded prices. Colors of the body correspond to bullish or bearish condition.

If the body is white (or green). it means opening price is lower than closing price (the price is moving uptrend/bullish). In the other hand, if the body is black (or red). it means opening price is higher than closing price (the price is moving downtrend/bearish).

Colored Candle Comparison