Improve Your Intraday Targets to Improve Your Trading

Post on: 16 Октябрь, 2015 No Comment

Article Summary. Forecasting profit targets intraday is very tough for a new trader to do. However, when you start with a very simple tool and recent price action extremes, you can have a very clear path to locating where you can plan to book profits on your trade.

There are a handful of aspects to managing your trade that sound more complicated than they really are. More than likely, you were told when getting started that you need to identify your entry, identify your stop and limit point and identify your trade size. One key way to identify the stop and limit point is to use the current market behavior.

Identifying the current market behavior has to do with volatility. When seeking volatility we can look for the average true range over a fixed amount of time i.e. 14 days to see what type of behavior the market is displaying. If the number of average pips traveled is higher over one currency pair than another, the higher ATR would indicate higher volatility in terms of pip movement.

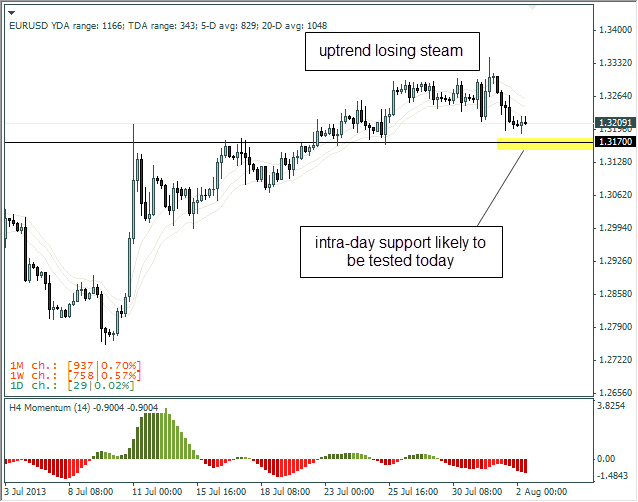

Learn Forex: ATR Pips Indicator Makes Finding This Important Number a Breeze

Presented by FXCMs Marketscope Charts

The preferred tool for todays lesson is the ATR Pips indicator. This can be freely downloaded from the FXCM App Store and applied to your chart. However, if you prefer, you can easily calculate ATR yourself by adding up the total pip ranges over a fixed number of days and dividing by your sample size.

Average True Range in Pips to Identify Your Stop

Identifying an entry can be enhanced with many indicators. but the goal is to find a high probability spot for the trade to continue. The purpose of a stop is to make sure that you dont give up too much of your account equity in finding a profitable trade. Also, a stop is a key way to make sure that youre not risking more of your account capital than youre looking to make on any certain trade.

When using the ATR to set a stop for a short term trade, you can simply cut the ATR in half. Because were using 100% of the daily ATR as a profit target, using 50% will be a stop with a good risk to reward ratio. The minimum risk to reward ratio that were often willing to accept is 1: 1 so that we never risk more pips than were looking to profit on the trade.

Learn Forex: Using Half of the Daily ATR Is a Strong Stop When Combined With a Good Entry

Presented by FXCMs Marketscope Charts

Average True Range in Pips to Identify Your Limit

The ATR builds a realistic profit target into our trading. Realistic targets are necessary because it puts you in the right mindset. That mindset is that, I will take what the market gives me regularly and consistently without giving up too much of my capital.

Learn Forex: 100% of the Daily ATR Can Be Your Trade Limit

Presented by FXCMs Marketscope Charts

Once the ATR is displayed, then you can take 100% of the ATR from your entry and make that your limit. As we mentioned above, your stop will be half the daily ATR or 50%. This will ensure that you have a strong risk: reward ratio built into your trading.

Closing Thoughts

The purpose of utilizing ATR for identifying targets is to keep you grounded as a trader. It is very easy to expect your new buy trade to go to the moon, but that may have you holding on until it turns into a loss. ATR will get you in and out of trades based on what the market is giving you with a strong risk to reward ratio.

Happy Trading!

—Written by Tyler Yell, Trading Instructor

To contact Tyler, email tyell@fxcm.com.

To be added to Tylers e-mail distribution list, please click here.

Unsure which indicators match up with your skill set?

Take our Forex Trader IQ Course to receive a custom learning path for how to trade FX.