How to Use Forex Volatility Stats

Post on: 30 Апрель, 2015 No Comment

On the Daily Forex Stats Page you will find forex volatility studies and correlation data. Forex volatility stats may seem daunting, but they are not. In fact, being aware of the average daily volatility can be very helpful. Not only can it aid in setting profit targets or entries (or eliminating some) but statistical strategies can be derived based off this information alone.

(To learn how to use correlation data, please see: How to Use Forex Correlation Stats )

Figure 1 shows shows some of the information available in regards to volatility on the Daily Forex Stats Page

Figure 1. Forex Volatility EURUSD focus, December 31, 2013

There are three main sections: a summary of average daily volatility in many currency pairs, and if you click on a currency you get additional charts (in this case the EURUSD) which show volatility by hour of day, and volatility by day of week.

How to use forex volatility stats:

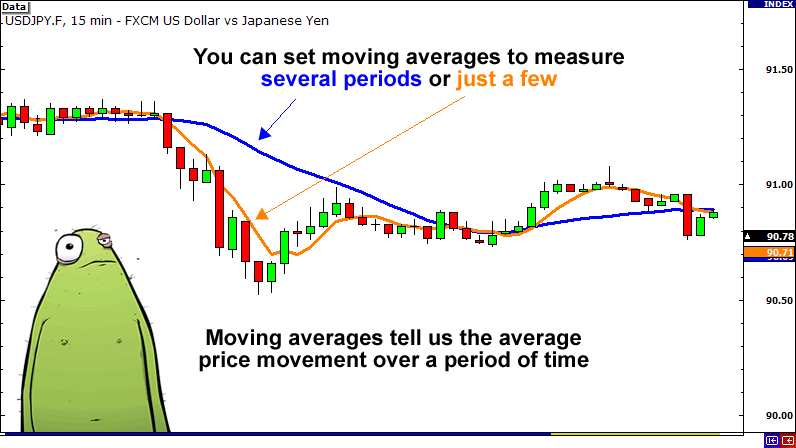

Changes in volatility can be used to confirm changes in direction, or point to an acceleration of the trend. Sharp moves to me are more important that a meandering price which has has little force behind it.

Volatility is often associated with a change in the direction. Trends are often complacent, reversals are not. Therefore, heightened volatility is usually seen during corrections within trends and in trend reversals.

During a trend volatility may be steady or decline. If the trend accelerates we see a rise in volatility. This can be a confirmation or a signal the market is nearing a turning point (potentially a blow off) but it depends of the maturity of trend. An example of a trend accelerating in a blow off fashion, which led to a big trend reversal, is the USD/CHF in August of 2011.

Changing the number of weeks that are averaged on the volatility study (Daily Forex Stats page) can greatly affect the data provided. If you are a short-term trader focus the average on 3 weeks or less. Longer-term traders can benefit from looking at volatility averaged over the longer term (default is 10 weeks) but also can benefit from taking a shorter-term average (2 to 5 weeks) to get a context of market movement.

Intra-day volatilitythe number of pips a currency pair moves in daycan provide a lot of information about where to place profit targets and stops. If you wish to exit a position today, the chances of the order filling well beyond the daily average range are slim (unless there is a significant news event occurring). Say the EURUSD already has a intra-day range of 100 pips today, and as the chart above shows the daily average range is 83.5 pips (subject to change). If you take a trade at the high or low of day and expect to make 30 pips on that trade, you may be disappointed as your target is even further outside the range that is typical for the pair. To hit your target the pair will need to move 130 pips, when it typically moves about 85.

That said, an average is an average. Any particular day can be more or less volatile than the average indicates. That is how an average is created. Intra-day volatility should be on a day traders radar, but it is not the only factor to consider.

Volatility can let you know when you should be trading when you shouldnt. Day traders are especially susceptible to the cost of paying the spread. and when volatility drops so does profit potential. This makes the spread more expensive in terms of the profit potential that can be attained by paying that spread. Therefore, short-term traders usually benefit by stepping to the side when volatility is very low.

Certain days of the week provide greater opportunity, and other days provide less opportunity. Certain hours of the day are more volatile than others. For more on this, see Understanding Forex Market Hours and Sessions and Their Impact .

While the market moves a certain number of pips in 24 hours, it will move less during the specific time of day you are trading. For instance, the EUR/USD may move 120 pips per day, but may only be moving on average 90 pips during the US session, or 87 pips during the European session. If the daily figure is used to day trade a single session the data being used is inaccurate. If day trading, be aware of the specific stats for the time of day you are trading. See Best Time of Day to Day Trade Forex for more details.

If your trades last more than week, the daily data on the Daily Forex Stats page may be overkill (you simply dont need that much data). Apply an Average True Range (ATR) indicator to your charts ( I use a 10 day time frame, 14 is standard), and this will likely provide you with all the volatility information you need.

If using an ATR, you can quickly change the time frame of your chart to weekly. The ATR reading will thus provide the average movement which is seen in the pair for a one week period. This is helpful for swing-traders in helping to establish a time frame of when profits or stops may be hit.

Volatility is always changing. Thus, it is important to keep up date figures and be aware of changes in volatility if strategies are sensitive to these changes.

Forex Volatility Summary

This is a brief and incomplete introduction to forex volatility. It is recommended that traders educate themselves further on volatility and acquaint themselves with statistics.

Refer to the Daily Forex Stats page to be aware of current volatility. You may find that being aware of volatility can help you control risk, find alternative trading strategies and alert you to potential dangers or opportunities.

Over 225 pages, forex basics to get you started, 20+ forex trading strategies, how to create your trading plan for success.