Forex Trading Strategies Simple Moving Average and MACD

Post on: 3 Май, 2015 No Comment

Forex Trading Strategies Simple Moving Average and MACD

Forex Trading Strategies: Simple Moving Average and MACD

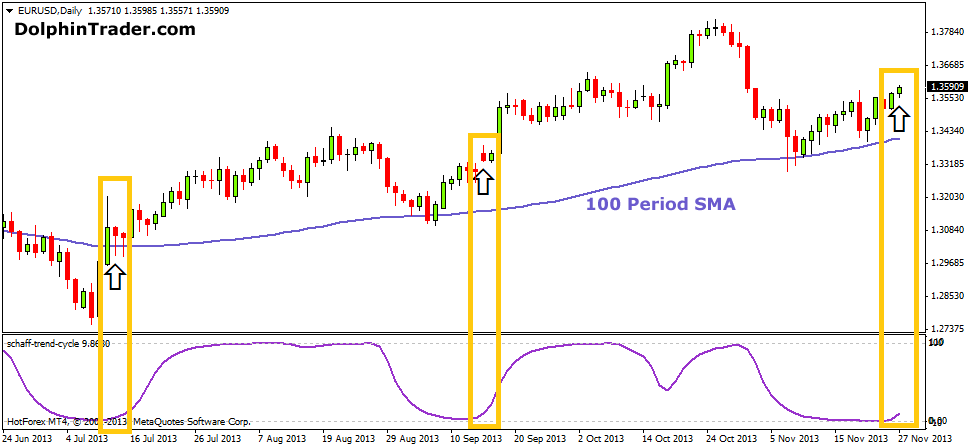

This tutorial will look at two of the simple charting methods that go with Forex trading. The first being the Simple Moving Average and the second being the moving average convergence divergence MACD. Firstly Simple moving averages take the last ex period of closes and convert them to a moving average. In the case of this AUD chart, what we can see is the simple moving average for 7 periods, 14 periods and 21 periods.

These simply moving averages are then loaded into the Bloomberg system and will take the last 7 periods. If for example if you are looking at a daily chart, it will take the last 7 trading day closes, the last 14 day trading day closes and the last 21 trading day closes to work out the trading signal. If looking at the 30min chart we would see the following:

What we are looking to do is cross a short moving average across a medium term moving average which then will cross the long term moving average

The theory being is that if I allow for a short term moving average to cross above or below the medium moving average then that gives me a buy or sell signal. If I allow the medium moving average to go above the long moving average, then this provides a confirmed buy or sell signal. If we look at a daily chart we will find an example of this at the following:

What this provides is a single that we should possibly start going long. As soon as we see the medium long term moving average cross through the long term moving average this shows a confirmation of the buy signal. When it comes to exiting the trade it can occur using the same method. However in this instance we want to see if the short term crosses down through the medium and will continue down through the long term moving average. This will determine if I take a short position or close out of the long trade.

Please note that there are a number of pitfalls to using this method for trading. Firstly, it can take time to get a signal which will mean you miss out on profitable trades .

Furthermore, if you go to early you may be what we call whipsawed. i.e you get in and out and in and out and this will essentially cost you substantial amounts of money. Finally, it takes time to get the hang of when something is pushing through and when something is not.

Moving Average Convergence Divergence (MACD)

As you can see by looking at the chart the MACD has given us a signal way before the Simple Moving Average. If we look at another part of the chart we will see that the same thing has occurred. However in this instance, what I want to do is then use some simple moving averages to confirm the signal. However, if I had sold the AUD here:

Then I would have been stopped out immediately as the market did not continue on lower. This is when you need to use a couple of technical signals as confirmation. This tutorial has looked at simple moving averages and how to set these up as well as Moving Average Convergence Divergence.