Forex Technical Analysis Analyzing Currency Markets with Charts

Post on: 30 Июнь, 2015 No Comment

Forex technical analysis is one of two ways to analyze the currency markets. It works by studying the movement of prices, while the other method, fundamental analysis. looks at external economic factors such as the strength of the national economy, political events and so forth.

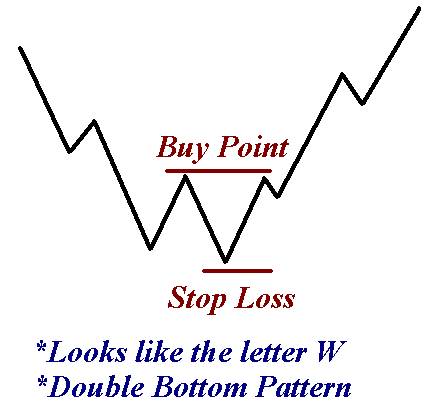

Studying price movement with forex technical analysis involves charts. The theory of it is that if you look at the historical records of how prices have moved in the past, you can identify tendencies and trends which will mean that you can predict how the prices will move in the future. Then, as soon as you spot an emerging pattern that fits your system, you have a trading opportunity .

There are three types of forex charts:

1. Line charts

Line charts simply plot each closing price and join them with a line. The rise and fall of the line shows the general movement of a currency pair. However, it does not show movements within the trading period. only the close.

2. Bar charts

A bar chart will show a series of vertical lines or bars. The top of the line represents the highest price during that time period. The bottom of the line represents the low. A short horizontal bar on the left indicates the opening price, and a short horizontal bar on the right indicates the closing price.

Since they show the open, high, low and close, bar charts are also sometimes called OHLC charts .

3. Candlestick charts

Forex candlestick charts show all of the same information as a bar chart, but presented in a different way. which most people find easier to read at a glance.

You have the same vertical line with the high at the top and the low at the bottom, but there is also a wide block in the middle showing the gap between the opening and closing price. The blocks will be filled white (for a rising price) and black (for a falling price) or — more often these days — they are coloured. Colours can vary, but a common combination is green or blue for rising and red for falling.

Most people prefer candlestick charts over bar charts because they are easier to interpret. It is much easier to see turning points in the market using candlestick charts. You can immediately see where the market reversed from an upward to a downward trend and vice versa.

When you see a trend forming, you can make money by trading in the same direction as the emerging trend. ‘The trend is your friend’, as currency traders say. For this reason, identifying the trend is the most important thing to learn in forex technical analysis. and using candlestick charts is probably the easiest way to do this.

You might also like to read our page on Forex Fundamental Analysis .