Forex Pivot Point Trading Strategy

Post on: 21 Октябрь, 2015 No Comment

The ever popular Forex platform supplies an abundance of tools that investors can utilize when trading in the foreign exchange markets. Signals, indicators, managed accounts and other types of software like Forex robots all play an important role when trading with the Forex platform. Another popular tool that many investors will utilize is called a Forex pivot point trading strategy. Traders use pivot points to predict future trading and when to sell or buy their shares. Pivot points can be found with any trading market by looking at graphs and charts. The importance of these pivot points will allow the trader to make decisions on whether or not to sell their shares. These pivot points can be programmed with certain Forex software that alerts the trader with signals or indicators.

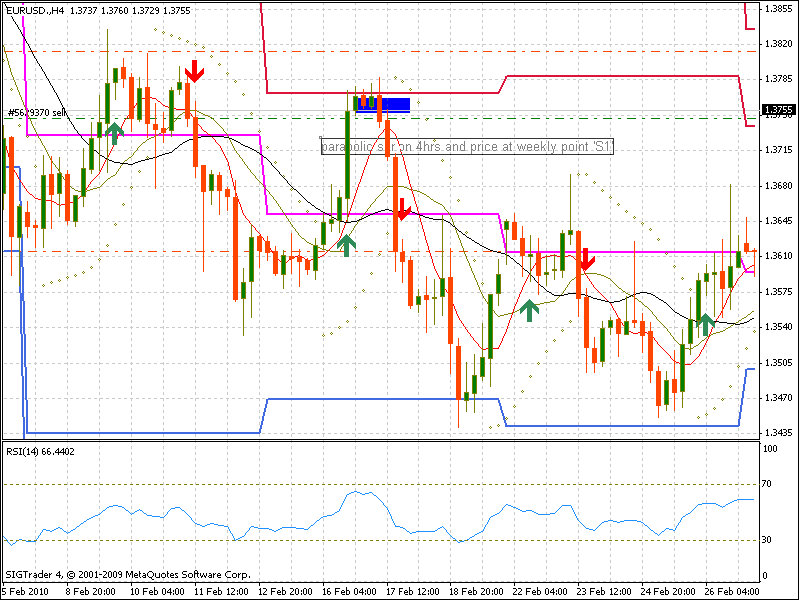

The foundation of making a profit with any market simply relies on buying low and selling high. These pivot points can change throughout the day, either jumping up or dropping down. However, with foreign exchange trading, these pivot points need to be acted on in a matter of seconds in order to turn a profit. A pivot point trading strategy is extremely important to investors who are known as range-bounders. New strategies can be developed by the trader when they combine their current indicators to work along side of a pivot trading strategy. The equation between these two might sound a bit complicated but the simple strategy of “buy low and sell high” are still in play here.

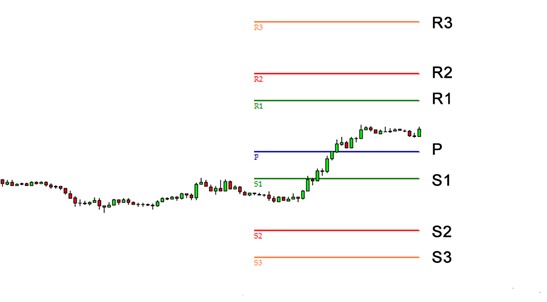

Pivot points reveal the high point and low point of the share during trading. They also provide what the price of the shares were closed at. Pivot points use this information to calculate future possible pivot points and outline the best buy and sell strategy for the investor. However, calculations done by using pivot points over a short period of time may result in higher risks. Pivot points are to be calculated over a period of time for the most accurate results. Knowing when to use pivot point strategies at that most opportunistic time is a powerful way the traders can make a killing.

For example, when Forex markets open, theypresent a high opportunity of growth because of how many users are first logging on and making adjustments. This time of opening is the most crucial time to take advantage of. Many Forex traders use this time to buy or sell shares depending on their pivot trading strategy that they have designed. There are two very popular pivot trading strategies to be aware of. One is called “sell short” and the other is called “candle stick.” Selling short involves selling before the price of the share drops in order to avoid losses. Pivot points are used to accurately identify these predictions and graphs show these forming before they actually drop. Making these predictions and being able to act on them with in seconds is crucial to a trader’s success. Without pivot point strategies, indicators and signals, the trader would be all over the map trying to make a profit.

Pivot point strategies have been used for years by traders who are involved with Forex and other markets as well. Pivot points have shown to be more powerful within the Forex market than they are in traditional markets. Formulationg your own pivot point strategy may take some time. However, advice can be given by firms that work with traders who are interested in learning how the Forex system works. Talk to experienced Forex users and kick around some ideas. What you may learn from an experienced Forex trader may surprise. Pivot point strategies are something that all Forex traders should use.