Elliott Wave Theory in Forex Trading to Follow Trends

Post on: 10 Октябрь, 2015 No Comment

The forex market with the huge amount of liquidity and the stupendous average daily turnover attracts many to reap its several thousand booties. But oftentimes what happens is an average trader like us fails to interpret the trend effectively. This is where the technical tools come to your rescue.

The wave patterns, the graphs they all tell a story if understood carefully and interpreted rightly. One such common tool is the Elliot Wave. So how do you trade the forex market using the Elliott Wave Theory? But to understand it becomes important to understand what exactly do we mean by Elliott Wave.

Understanding Elliott Wave Theory

Its basis is derived from the theory that a 5-wave pattern is observed in most financial market trends. The wave patterns are generally expected to follow a set trend; you would have three trends on the upside i.e. waves numbered 1, 3 and 5.

These three are then separated by two waves pointing downward which are waves numbered 2 and 4. Another key element of this theory is for every five waves that move up, you will have five trending down. The order in this is again the same as the individual wave patterns. That is 1,3 and 5 on the upside and 2 and 4 pointing downwards.

Elliott Wave Pattern

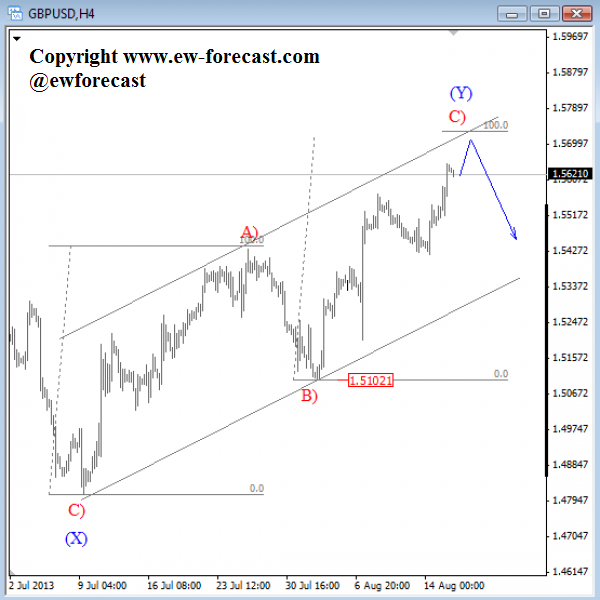

There is another interesting aspect in these wave formations. It is known as counter-trend waves. During this the waves 2 and 4, the currency pair for which this is being charted might see retracements in parts of the wave, and you might actually see smaller upmoves in these wave patterns.

However, the reader must remember; reality is hardly ever textbook perfect. More often than not the wave pattern is hardly this smooth and neat and neither does it follow such a distinctive pattern. So what happens is the same set of waves might be subject to completely different interpretations by different people.

As a forex trader, therefore, your focus needs to be astutely on how you can trade the forex market using this rather than how to generate these.

History Of Elliott Wave Theory

Ralph Nelson Elliott who devised this wave theory was a professional accountant and also referred to as a mad genius. Back in the early 20th century, he analyzed stock market data dating back to nearly 75 years and came to the conclusion that despite the apparent chaos observed in general stock market functioning, still the pattern could be seen on all markets. In short, he understood the order in disorder in stock market trading. However, he continued gathering evidence till he was 66 years old and then eventually shared his findings with the rest of the world. It was all published in a book called ‘The Wave Principle.’

In this book, he deduced that generally market cycles are repetitive provoked by investor emotions brought about by external sources like TV coverage and expert analysis on TV channels. The dominant social psychology at the time when a certain market pattern is unfolding is crucial too. The collective psychology, according to Elliott always resulted in the same repetitive fashion. The waves in these patterns were the upward and downward moves.

Thus on the ways you can use it to reach the desired end, Elliott believed since market cycles tend to repeat, if the patterns that are repeating are identified correctly, you can predict future price moves based of their past performance. Perhaps this is one of the major catalysts that pull so many traders to follow the Elliott Chart. It arms them with ammunition to identify reversals and easily look for tops and bottoms just by following the previous highs and bottoms.

Understanding Fractals

However, before we delve any deeper into the various facets of interpreting the Elliott Waves, we need to be well versed with certain key elements that form an indispensable part of these unique wave patterns.

One of the basic ones is ‘fractals’. So what exactly are these fractals? These are the structures that can be divided into separate parts, and each of these would have similarity with the whole wave pattern. Almost like a set within a set. Mathematically this would be known as a ‘self-similarity’.

Some real life examples of fractals that will enable you to understand the pattern better include sea shell, snow flake, cloud and the like. These fractals are the key links in both the formation as well as the identification of patterns in an Elliott Wave. These not only make interpretation easier but also create the necessary bridge to move from point a to b. Just like the snow flake though small in size is of immense significance in the larger case, so is the case with Fractals in the ultimate deductions of Elliott Wave Theory.

A Step By Step Plan To Interpret Elliott Wave Theory

Just like with any other money market strategy, interpretation on the basis of the Elliott Wave Theory needs to follow a precise plan with a pre-set objective as well as target on the entire investment in the specific currency pair you might be betting on or betting against. So here is a step by step plan to master the Elliott Waves and optimize their benefits in your daily trading action.

How To Generate The Elliott Waves

The method that you might employ to generate these waves is extremely subjective. Different traders might be reaching the same end using different routes. It could be based on your analysis, or you could use some software that enables wave charting.

Observe Wave Formations Keenly

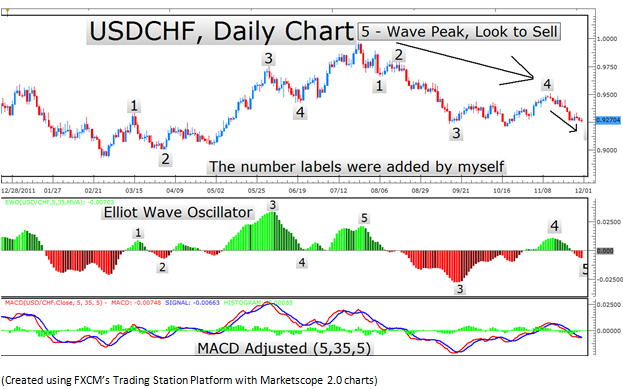

This next step is extremely crucial because most times in technical trading, timing is what seals the difference between right analysis and incorrect inferences. You need to keenly watch out for the formation of Wave 5. Needless to mention waiting goes hand in hand with extreme patience. You need to be watchful as well as patient. Now we must remind the viewer that this wave formation is not that common in the forex market. There are instances where it might occur just a few times in the entire year.

Trend Confirmation Is Important

As the topic suggests, confirmation of any trend is absolutely important for the pattern to bear fruit. Perhaps it is useful in this case to use other indicators or a collection of few indicators to confirm the trend.

For instance, if you think that the market is seeing a Long Setup and you need confirmation of that trend, the easiest option would be to use options like Three-day relative strength index (RSI) at the point which marks the change from the third wave to the fourth. For confirmation of the short setup trend, the reverse would have to be confirmed .

MACD indicator. specially Slow MACD can also help you distinguish the waves easier:

Determining The Stop-Loss

The main mantra for any trade is limiting losses and preserving profit. In this scheme of things, the stop loss plays a very important role. The profit and loss situation can vary deeply depending on the stop loss situation. It is ultimately that fine line that distinguishes a good trade from a bad one.

In case you are trading for a long position, take the three-day average range, subtract three times of it, and you get the initial stop loss to start your trade with. In the case of shorts, add three times instead of subtracting the figure to arrive at your basic stop loss point.

Now comes the next most important part where you move out of the planning zone and shift into the execution point. Let us assume that you want to enter a trade at next day’s opening price. After keying that in, you will also enter a stop loss and ensure that this is updated every day till you have open positions.

Booking Profits

Once you get good returns as a result of a good move, it would be seen as a wise choice to book some profit and then keep the balance position open with a trailing stop loss.

How to Execute an Exit Plan

Now let us analyze how to exit a trade using the Elliott Wave if a stop loss is hit. Lets understand one thing at the very behest, if supposing the stop loss order is hit; the entire trade has to be exited.

If the wave formation graduates to the highest one, i.e. the fifth wave, it is your cue to either exit your position or adjust the stop loss accordingly. In a case of long positions, a trailing stop loss level is a point that is arrived at by subtracting one times of the three-day average range from the lowest point seen the previous day.

Needless to mention, the opposite happens for a short trade. The trailing stop loss is arrived by adding instead of subtracting one times the three-day average range. However, if you see the wave count shifting to anything but the fifth one, exiting the trade at the earliest would be the best bet.

Advantages Of Using Elliott Wave Theory

The widespread appreciation and use of Elliott Wave stand testimony to the fact that it has its obvious advantages in analyzing the currency market movement and cues on how trade might pan out going forward.

First and foremost traders are able to identify a trend using these waves and this trend identification is not limited to any specific time limit. Trends can be identified over the course of any time frame and can eventually work towards helping to forecast future moves.

Based on the ability to forecast future moves solely on the basis of these past performances, forex traders are inspired to go for all available trade targets, even the ones that might appear somewhat hard to achieve at the initial level.

Most importantly an Elliott Wave doesn’t just gives you cues about important trading targets but also forewarns you about possible blips and slippery zones. You can be cautious well in advance and would not have to be subjected to avoidable traps and loss making trades whenever they can follow the trend and look for down moves.

It gives the forex trader a certain amount of independence by helping identify the trends and making past performance a parameter for future moves. Traders often learn from past mistakes and try and safeguard their current situation.

Disadvantage of Using Elliott Wave Theory

However, every coin has two sides and the same holds true for the Elliott Wave Theory.

One basic problem is interpretation can be highly subjective entirely based on a person’s interpretation of market movement and the resultant trend forecast. For the same pattern, there can be multiple conclusions, and my entire effort was directed at avoiding this type of situation.

Incorrect inferences can lead to identification of incorrect patterns and wrong future forecasts.

Thus, it further goes on to limit options for an individual who might be using these to draw inferences about distinct market moves.

Concluding

Thus, the Elliott Waves can become a tool of effective forex trade execution if understood properly and analyzed with care and concern. Precision and care are the buzz word in the context of handling this key technical tool for analyzing the various moods of the forex market and investing towards higher profit.

In the ample scope provided by the financial markets, currency trading occupies the largest position with undeniably the most liquid markets. The daily turnover is as high as 10 times the combined turnover of most equity markets world over. And in managing and tracking the movements of this behemoth of a market, Elliott wave is a force to reckon with. It might not be your crystal ball seeing into the future but it sure helps you to identify a distinctive trend, gives you ample time to weigh whether you want to stay with it or exit and also gives you idea about when the trend is likely to wrap up.

However, you need to understand the obvious limitations that every tool has and maximise its output with the limited means. Stretching any specific tool would fail to deliver the desired result, and the same holds true in this case. A trader’s convenience and willingness to execute a trade or bet on a specific currency still is the moot point that decides a trade. It is only in that kind of a situation that the Elliott Wave becomes more like a facilitator or an enabler to execute a well thought out forex strategy that will work at maximising the profit and limiting losses to as much extent as possible. There is no sure fit in the market but this is what can be the closest to that.

Don’t Miss Our New Articles!

Be the first who receives our most recent articles:

Learn more: