Dynamic Trend Trading With Classic Pivot Points

Post on: 25 Ноябрь, 2015 No Comment

Article Summary: Pivot points are a price based indicator that help a trader find tipping points in the market. Naturally, when an up or downtrend is clear, the tipping points will lead to a new relative high or low. Identifying these points in the market is simple and precise and can provide you with a higher probability entry.

Leading vs. lagging indicators is a usually a heated debate. Lagging indicators like moving averages or oscillators help you confirm the trend and enter after its begun whereas leading indicators can help you see where price action could travel should the move continue or the range hold. Today, well show you how to use pivots to not only identify the trend but also to use pivots to spot entries and targets.

What Is A Pivot Point?

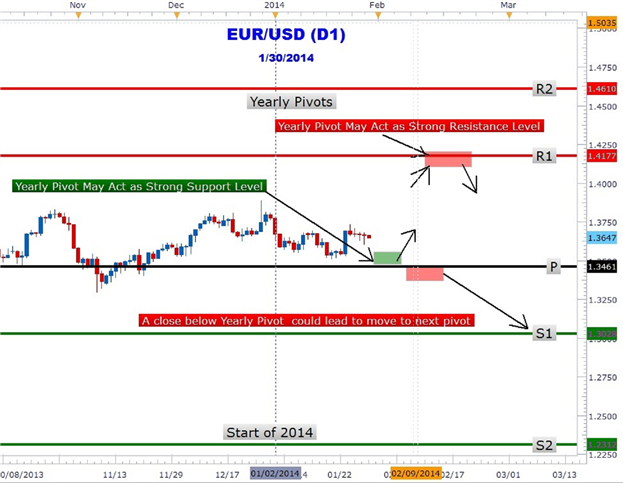

Pivots Points are a calculated tipping point coupled with likely levels of support or resistance based on the prior high, low, and close of a chosen period. This extremely powerful price-based level generator can help you see whether a move could peak or turn. They are sometimes referred to as Floor Pivots because historically many traders on the floor of an exchange would keep these numbers in front of them at all times to forecast significant price points on the days action.

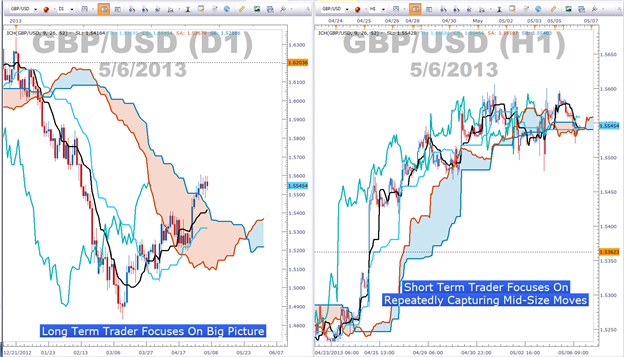

Learn Forex: Pivots in Action on GBPUSD Downtrend Targeting Daily Support

Presented by FXCMs Marketscope Charts

Learn Forex: Pivots in Action on USDCHF Uptrend Targeting Daily Resistance

Presented by FXCMs Marketscope Charts

Pivot points are drawn as the black line that a majority of the time shows you the bias for the days action. Support and resistance are displayed as red and green lines respectively. These are the levels you can focus on when using this tool.

Pivot Trading Strategy

When a trend has been identified, you can target the complementary levels for profit targets and the opposing levels as a stop. There are multiple methods for identifying the trend. If you want to stick with pivots as the sole indicator on your chart then rising pivot lines can show you an uptrend and the opposite for a downtrend.

In a downtrend, price can come up to or near the pivot and then bounce off and head towards the Support levels as a daily profit target. In the downtrend example above with 10 trading days of GBPUSD, price hit the support levels (targets in a downtrend) 7 days while only hitting resistance (stops in a downtrend) 2 days. This helps you see that price action near the pivot that begins to move back in the direction of the trend has a high propensity of hitting the target.

In an uptrend, price action favors the resistance levels almost in a magnetic fashion as price pushes higher. Support can be used as your stop for the day and if you decide to ride the trend out, you can move or trail your stop to the next days support level. USDCHF also shows a scenario where the stop was only hit 3 times out of a 10 day sample.

How To Add Pivots To Your Charts

The pivot point formula is simple. Pivot points take the high, low, & close which are seen as the most important prices to build the pivotal levels that we can trade from. Here is the formula for you:

P= (H+L+C)/3= pivot point

This is easier than it sounds because it will be a default indicator you can add.

Once the Pivot l evels are added you can look for price action to move to one of these levels respective of the trend. If youd like an easy way to generate trade ideas around pivots. DailyFX Plus offers a tool called the Technical Analyzer that builds trades based on the pivot or tipping point. True to form, limits and stops on your trade are based on support and resistance levels.

Happy Trading!

—Written by Tyler Yell, Trading Instructor

To contact Tyler, email tyell@fxcm.com.

To be added to Tylers e-mail distribution list, please click here.

If youd like to combine pivot points with price action signals you can t ake this free 20 minute Price Action — Candlesticks course presented by DailyFX Education. In the course, you will learn about the basics of price action and how to use the clues the market is providing to place trades.

Register HERE to start your FOREX learning now!

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.