Currency Trading What are Currencies

Post on: 2 Октябрь, 2015 No Comment

You can opt-out at any time.

Currency markets (also known as forex markets) are the largest day trading markets (in terms of volume and amount of money), trading approximately $2 trillion per day. Currency markets are the markets where one currency is traded for another currency, such as trading the Euro for the US Dollar. The majority of currency trading is between central banks, commercial banks, and large companies, with the largest currency trader currently being Deutsche Bank in Europe, but the currency markets are also traded by individual day traders.

Currency markets are unique in that they are not traded at exchanges, but are traded directly between traders instead. There are several large currency trading centers, with London in Europe, New York in the US, and Tokyo in Japan, being the largest.

Popular Currency Markets

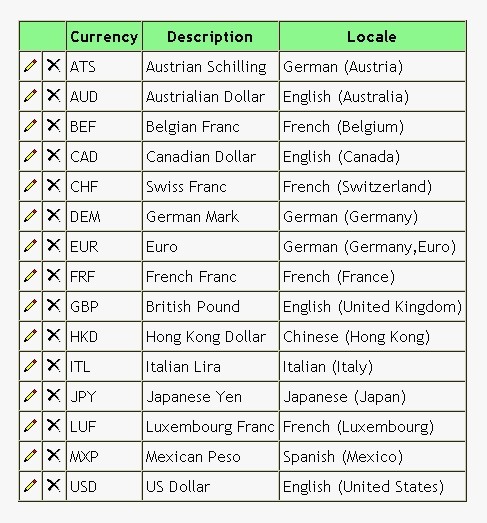

Some of the most popular currency markets are the following :

- EUR / USD — The Euro to US Dollar exchange rate

- GBP / USD — The British Pound to US Dollar exchange rate (also known as cable)

- USD / JPY — The US Dollar to Japanese Yen exchange rate

- CHF / USD — The Swiss Franc to US Dollar exchange rate

- EUR / GBP — The Euro to British Pound exchange rate

- AUD / USD — The Australian Dollar to US Dollar exchange rate

- CAD / USD — The Canadian Dollar to US Dollar exchange rate

- EUR / CHF — The Euro to Swiss Franc exchange rate

Exchange Rate Spreads

Most people are familiar with the difference (or spread) between the buying and selling exchange rates that they get when they exchange foreign currencies at a bank (e.g. when they go on holiday). For example, using the EUR / USD exchange rate, the difference would be several percentage points, which in real prices could be from 1.2500 to 1.2800, which in currency trading terms would be 300 pips (calculated as (1.2800 — 1.2500) / 0.0001). Day trading spreads are much lower, and would be more like a fraction of a percentage point, or 1.2500 to 1.2503, or only 3 pips (calculated as (1.2503 — 1.2500) / 0.0001). Some traders are attracted to the currency markets by the difference between the retail and trading spreads, but note that the currency futures markets have an even lower spread (usually the equivalent of 1 pip).

Currency Brokers

Day traders can access the currency markets via the same direct access brokerages that they use for other markets, but should be aware that their trades are not being processed by an exchange, but by a currency broker instead. These currency brokers are allowed to make their own markets, which means that traders using one currency broker will not necessarily see the same prices as those traders using a different currency broker. In addition, some of the more unscrupulous currency brokers actively trade against their traders, and will prevent their traders from getting the best possible price, while taking the extra profit for themselves. It is common for currency brokers to not charge commissions for currency trades, as they will take some of the spread as their commission instead.

Symbols and Tick Values

Trading Recommendation

While the currency markets can be day traded, they have some features that make them a less preferred day trading market. If you want to trade the currency markets purely for day trading purposes, then the futures markets offer enough markets based upon currencies, that you should trade the futures markets instead. If however, you want to trade currencies to actually hold the other currency (i.e. if you want to keep some money in Euros), then the currency markets are the markets to trade.