CURRENCY CORNER Using Pivot Points in Forex Trading

Post on: 10 Ноябрь, 2015 No Comment

By: Staff at FXTM

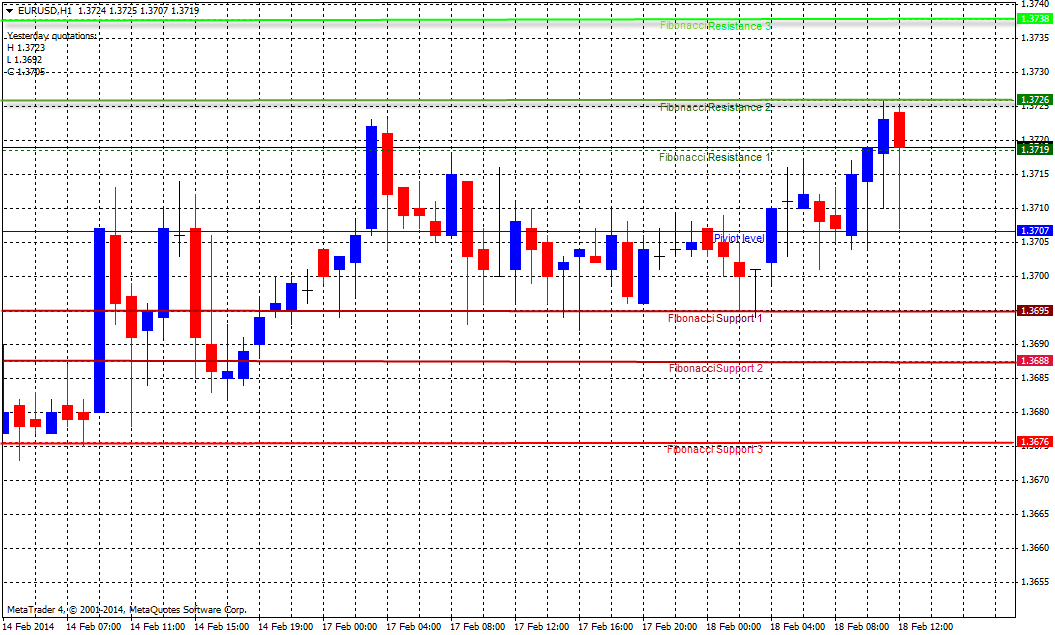

Traders have long relied on pivot points to help them enter and exit the forex markets at decent price levels and they are widely watched by many professional traders around the world, writes the staff at FXTM .

Pivots are calculated using the previous days high, low, open and close numbers which means that they adapt quickly each day to the markets different characteristics.

However, it is also possible to ignore the pivot levels themselves completely and just use the one main pivot as the main predictor of whether to go long or short. In this way, the pivot can act to gauge sentiment and confirm the direction in which to trade.

Market Opens Above the Pivot

When a market opens above the pivot, it is a clear signal that the market is bullish and that short-term traders should position themselves to go long the currency. Often, when the market opens above the pivot, it will stay up for the whole day and then end the day near its highs.

Indeed, if the currency does return to its pivot before resuming its upward trend, it will likely do so within the first hour or two of trading.

In general then, when a currency is trading above its pivot, traders should trade long.

Market Opens Below the Pivot

Likewise, when a currency opens below its pivot, it is a strongly bearish signal and traders should position themselves short for the most part. It is true that a currency may often return to touch its pivot at some point, usually in the first couple of hours. In this case, traders should wait until the market has come back off its pivot and is in no danger of following through it.

Market Crashes Through the Pivot

As mentioned, since the pivot is such an important level in daily markets, a currency may often touch this level once, twice, or even three times throughout one trading session. On the whole, this can be good a thing as it gives a trader an extra opportunity to make a trade.

However, the price will often crash through the pivot, and when it does so, it is usually wise for a trader to reverse course. If he or she is short and the market moves up through the pivot, the best thing to do is to close position and then look to go long.

This is particularly true if the market crashes through the pivot with strong conviction. This can often occur during a news release or from some other kind of fundamental news flow.

Support and Resistance Points

In some instances, support and resistance points can act as great take-profit levels, however, when using the pivot as a sentiment indicator, it is also possible to use the first support or first resistance mark to either enter positions or add to additional positions. In this way, you can attempt to take advantage of a really strong trend by building up the position as it moves through the important levels.