A Look At Different Exit Strategies For Forex

Post on: 1 Апрель, 2015 No Comment

In The forex ma rket, figuring out when to close a trade is just as crucial as ascertaining when to open one. Closing a position is performed for a variety of reasons: to cut losses, decrease exposure, and most of all to take profits.

Coming up with an exit strategy

To formulate an exit strategy, there are some things you must take into account. Namely, how long you would like to be in a particular trade and how much risk you are willing to take. Some traders close their positions at the end of each day, while there are also those who maintain a position open for days. Risk is a vital consideration when trading. To help you determine your exit points, ascertain how much you are ready to lose and fine-tune your stops to reflect this.

Various exit strategies

Take-profit and stop-loss orders

There are two fundamental approaches to exit a trade, either you accept a loss or make a profit. Stop-loss orders are designed to limit a trader’s loss for a particular trade. They do so by closing a position when the price of the currency slips below a specified level. A take-profit order on the contrary establishes the exit point higher than the entry price. This order lets you secure earnings and even if the price falls after the upward trend. For more information about partial close and how to develop an exit strategy when trading forex please visit here.

Trailing stops

If you wish to keep the position open a bit longer but don’t wish to look at the market every second, you can opt for trailing stops. The basic purpose of a trailing stop is to increase your profit lock when the market moves favorably. By using this, youre able to keep a certain percentage of profit every now and then aside from avoiding a loss.

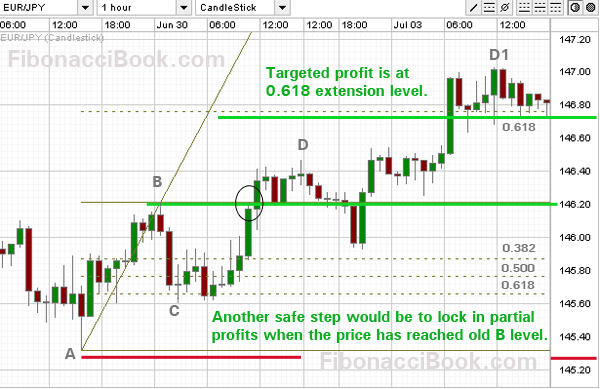

Partial close orders

In Forex, a single loss can reverse whatever gains you have realized from a certain trade. To avoid this situation, you can also partially close positions. By closing your position in a piecemeal manner as opposed to exiting it all at once, you guarantee that you obtain some profit even with unfavorable shifts in price down the road. You can find out more about MT4 Partial Close here.

The need for developing an exit strategy

Without an exit strategy in place, theres a high chance that youre going to take premature profit, or worse, run substantial losses. Placing automated stop and limit orders will help remove the emotions out of your trades, too.