A Look At CFA Job Opportunities

Post on: 16 Март, 2015 No Comment

Is a Chartered Financial Analyst (CFA) designation worth the work required to obtain it and is it better than other professional commitments, such as a Master of Business Administration (MBA) or Certified Public Accountant (CPA)? To determine the value of the CFA designation, you must decide whether your chosen career path will require a position within a company or industry that values the CFA over other possible academic endeavors. Read on to get a better understanding of the careers that attract CFAs, and make sure these are positions you are interested in pursuing.

CFA Vs. MBA

The commitment to pursue the CFA cannot be understated. According to the CFA Institute. the following is the amount of time needed to obtain the CFA designation:

- Four years, on average, to complete the program

- Six months of preparation for each exam

- 250 hours minimum of study time (10-15 hours per week)

Unfortunately, some candidates might never achieve the designation, whether it is due to lack of academic skill, work or life responsibilities, or other factors. Compare this commitment to the MBA. After being accepted into an institution and following the course of study in an average of four semesters, most students receive a diploma. The CFA program is self–study; as such, there is certainly a lower likelihood of success. However, the decision to pursue either achievement should not be based on the length of time, difficulty, or certainty of completing them, but instead on where they provide the most value, personally or professionally.

The advent of MBA programs providing coursework to help candidates with the CFA is an indication that the MBA may not provide enough of the specialization necessary to prepare students for an investment career. MBA programs provide students with a broad-based business background, enabling graduates to follow a myriad of different career possibilities within a corporate environment or even in entrepreneurial ventures.

Before the advent of the CFA, the MBA was the de facto requirement for the investment industry; the specialized curriculum provided by the CFA has changed that. Now, most companies involved in making or managing investments insist on having the CFA for senior positions, and in some cases requiring that employees in senior position have both academic achievements. Due to the history between the CFA and MBA designations, it is understandable why certain people find that deciding between the CFA and MBA programs is difficult.

The same cannot be said when deciding between the CFA and other specialized business certifications, including the Certified Financial Planner (CFP) and CPA. Because the CPA, a specialization within the accounting industry, is so very different from the CFA, anyone who is challenged with making a decision between them is someone who really hasn’t decided what type of career they wish to pursue.

Where CFAs Work

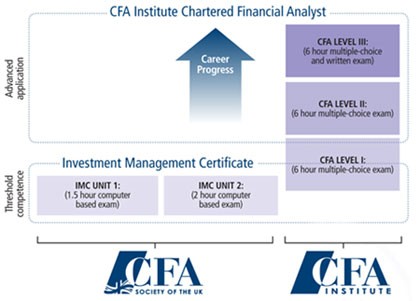

The following skills are valued by employers and can be identified by the CFA course of study. A student has to pass three exams before obtaining the CFA charter. Although all three exams focus on different aspects of the course, the main topics are indicated by the CFA Candidate Body of Knowledge (CBOK), as follows:

- Ethical and Professional Standards

- Quantitative Methods

- Economics

- Financial Reporting and Analysis

- Corporate Finance

- Equity Investments

- Fixed Income

- Derivatives

- Alternative Investments

- Portfolio Management and Wealth Planning

According to the CFA Institute, The CFA Institute membership in more than 100 countries can be seen as a microcosm of the global investment profession, with virtually every type of investment professional at every type of investment firm represented.