Why Would Someone Buy a TBill With a Zero Percent Yield

Post on: 31 Август, 2015 No Comment

BLOG FEED %img src=http://www.davemanuel.com/images/rss.gif>

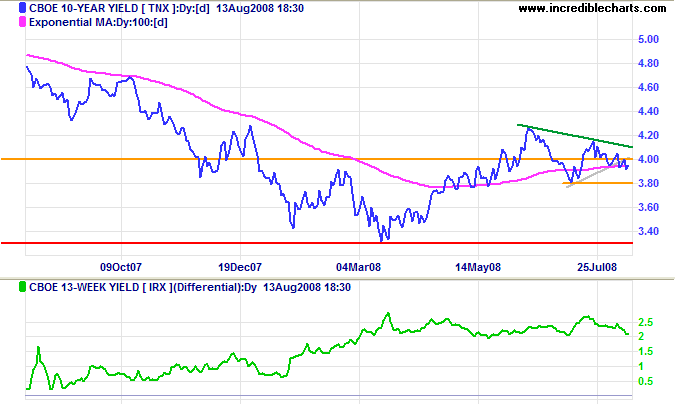

In case you missed it, earlier this week the annualized yields on three-month Treasury bills dropped to 0% (and actually hit -0.01%) before rising to 0.01%.

The last time that short-term Treasury yields dropped below 0% was in the late 1930s, according to the book, A History of Interest Rates by Sidney Homer and Richard Sylia.

T-bills do not pay interest — rather, an investor buys them at a discount to their par value, which will give them a return on their money by the time that the T-bill matures. T-bills are considered to be the safest possible investments in the world when it comes to preserving investor capital.

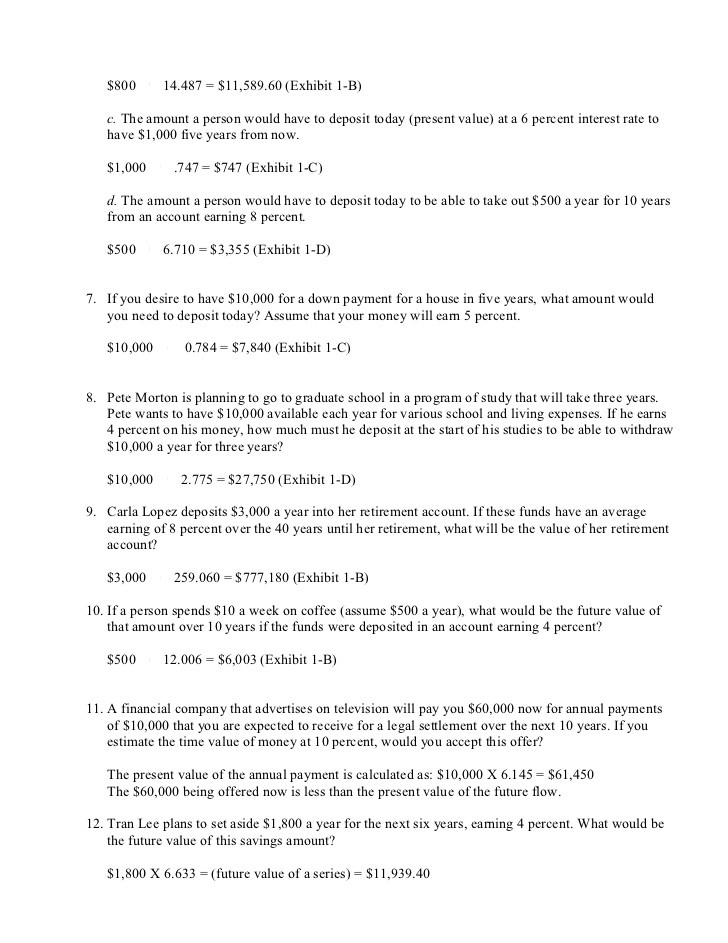

Earlier this week, $30 billion dollars worth of T-bills were sold to investors around the world. The t-bills were sold at a yield of 0.00% — meaning, investors will receive NO return on their money after one month. Even more incredibly — this debt offer was apparently four times oversubscribed, meaning that there was an insatiable demand worldwide for these T-bills.

So what gives? Why the incredible demand for these T-bills? And why would any investor voluntarily invest in something that would guarantee them no return after three months?

The answer: preservation of capital.

What is perceived to be the safest investment in the world right now?

Short-term US government paper.

Banks, brokers and other financial institutions are snapping up this debt to bolster their balance sheets before the end of the year.

Institutions, high net-worth individuals, sovereign wealth funds, pension funds and even foreign governments are also buyers of US debt.

The question is: if you had billions upon billions of dollars to invest and your number one priority was protecting your investment, where else would you invest the money? Keep in mind that it would have to be a highly liquid investment as well.

Are you going to invest in real estate? No. The stock market? No. Commodities? No. Debt of other countries? Maybe, but no other country on the planet has the insatiable demand for buyers of their debt like the United States. Currency? Too volatile.

You start crossing all of these potential investments off your list, and you can start to see the reason why investors are plunging billions upon billions of dollars into short-term US debt.

Again — investors don’t care right now about making money. They only care about preserving capital, which is why $30 billion dollars worth of T-bills sold this week at a 0.00% yield.

5 COMMENTS — What Say You?

Comment by greg on December 12, 2008 @ 2:38 am

Isn’t there going to be DE-flation right now? Would keeping holdings in cash be just as safe?

Comment by Mickey S. on December 12, 2008 @ 1:52 pm

Well if you had $10 billion dollars in cash — which currency would you keep it in?

Why would anyone with any brains

invest in a t-bill with negative

yield. When in Canada you can get

2.18% positive yield.

I would consider the euro to be

safer then the USD.

It makes no sense that the USD is the

safest curriency in the world.

Since it has been falling since 2001

and only going down in value over that period of time.

What people must also realize is that

the Japanese yen seems like a more stable currency in the world it does not movie like the USD or the CAD.

Just look at it. and it yields

a positive return on the money.

Comment by howard on December 21, 2008 @ 1:34 pm

I would keep $10 billion in Canadian dollars

at a rate of 2% your interest a year

would be $200 million dollars a year.

this is better then $0.00 a year

Comment by Steve on December 24, 2008 @ 12:48 am

Currency being too volatile does not logically lead to T-bills. By buying a T-bill you are putting yourself in a long position on the dollar, and thus still subjecting yourself to the volatility of currency.

It would seem to me that the reason to carry T-bills is that with the amount of money you have, there is a substantial cost to keeping it in physical cash. Also, you obviously don’t want it in a bank account because the FDIC cap is much lower than your totals avings.

Leave a Reply (No Registration Required)