Why Pay A Premium For Municipal Bonds

Post on: 31 Июль, 2015 No Comment

By Columbia Management Municipal Investment Team

What are premium, par and discount bonds?

- Premium bonds carry a coupon rate that is higher than current market interest rates and have a market value above 100 cents on the dollar.

- Par bonds carry a coupon rate equal to current market interest rates and trade at or near 100 cents on the dollar.

- Discount bonds carry a coupon rate that is lower than current market interest rates and trade below 100 cents on the dollar.

Why paying a premium often makes sense:

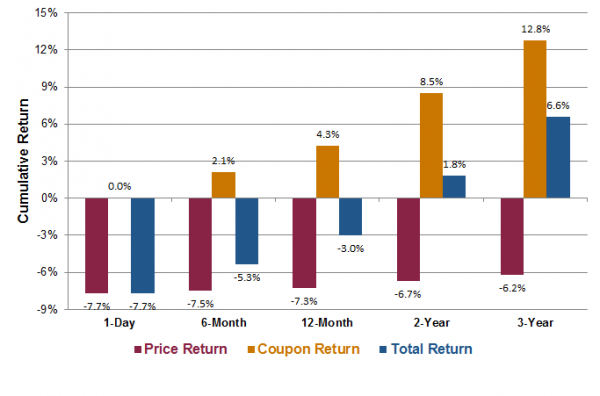

- Although paying a premium for a bond at the time of the purchase may seem counter-intuitive, premium bonds can be advantageous due to the high coupon rates and lower durations they provide relative to discount bonds.

- Higher coupons. The premium cost of the bond is eventually recouped through the higher coupon payments received over the life of the bond.

- Lower duration. A premium bond has a lower duration due to its higher cash-flows, making it more defensive and less price sensitive to changes in interest rates. During times of rising rates, a lower duration bond typically out-performs by retaining more of its value than a higher duration bond.

- Rising interest rates. If interest rates rise, a premium bonds greater cash flows can be reinvested at higher interest rates.

- De minimis tax penalty. A potential tax penalty is created if a bonds price falls below the de minimus threshold (which the IRS defines as a 0.25% discount per year from the original purchase price). While this tax penalty does not apply to the current bond holder, it carries over to the next purchaser of the bond and, therefore, further reduces the current price (value) of the bond. A higher coupon bond protects against this event by providing a price cushion, as the price of a premium bond is, by definition, farther away from the market discount price.

$100,000 par value bonds purchased for the same 10-year maturity at a 2.5% yield with 5%, 4%, 3% and 2% coupons:

Due to investor demand, new issue municipal bonds primarily come to market as premium bonds, with above market fixed rate coupons. As shown below, 5% coupon bonds continue to dominate issuance. Premium bonds with 5% or higher coupons represent nearly half of issuance in 2014, while 4% or higher coupons represent 85% of issuance. Therefore, current coupon bonds, at todays market yield levels, simply do not exist in any meaningful quantity.

Disclosure: None

Income from tax-exempt municipal bonds or municipal bond funds may be subject to state and local taxes, and a portion of income may be subject to the federal and/or state alternative minimum tax for certain investors. Federal income tax rules will apply to any capital gains.

There are risks associated with an investment in bond investments, including the impact of interest rates, credit, and inflation. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities.

Duration is a measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years.

The views expressed in this material are the views of the author through the date of publication and are subject to change without notice at any time based upon market and other factors. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. This information may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those discussed. There is no guarantee that investment objectives will be achieved or that any particular investment will be profitable. Past performance does not guarantee future results. This information is not intended to provide investment advice and does not account for individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Please see our social media guidelines .