What is the Modern Portfolio Theory

Post on: 30 Август, 2015 No Comment

Assumptions

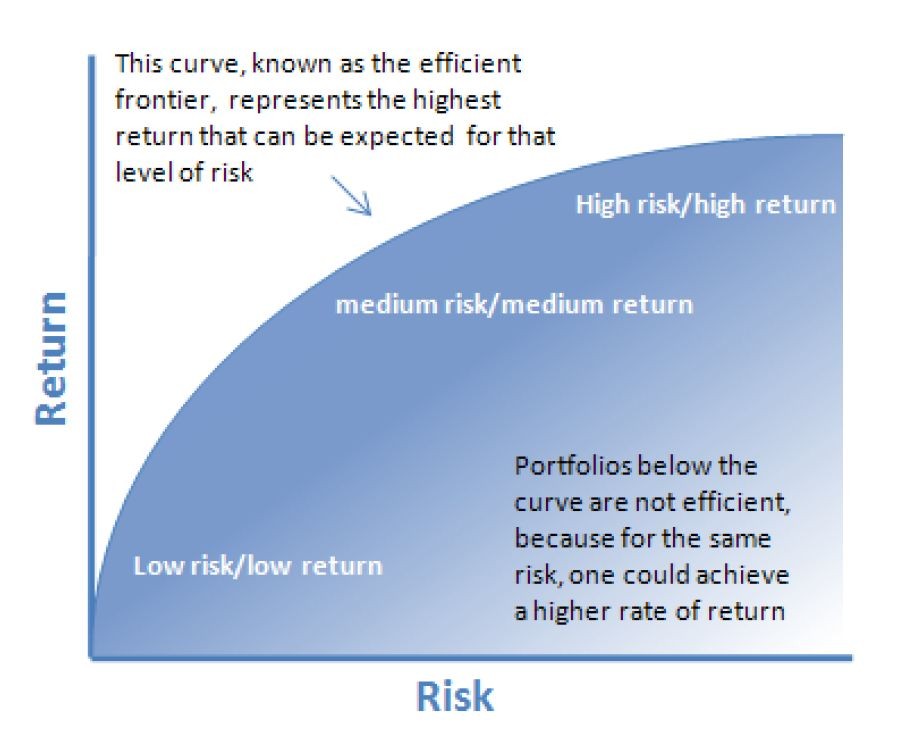

Modern portfolio theory assumes that investors want investments that offer the highest potential gain for the least amount of risk. MPT does not attempt to beat the market by analyzing and trading individual investments. Modern portfolio theory argues that investments are already fairly priced because of the high level of competition within financial markets. In general, assets cannot be described as overvalued or undervalued. MPT differs from fundamental analysis, where investors evaluate financial data from corporate annual reports to buy undervalued or cheap investments.

Portfolio Design

Online tools and financial planning software, such as Quicken, can help you design your portfolio according to MPT guidelines. These tools require you to complete questionnaires regarding your current income, expenses, assets, age and financial goals. Common financial goals include providing for education funding, retirement income, and your first-time home purchase. The software analyzes your information, and recommends a diversified portfolio that lists out stocks, bonds, and cash reserves as percentages. Mutual funds provide exposure to each distinct asset class. Morningstar is a good online resource to design portfolios and select mutual funds that manage risks while providing for potential growth.

Caution

Do not assume that your recommended portfolio will remain the same throughout your life cycle. For example, younger savers have more time to recover from potential losses, and are better served with higher exposure to the stock market. At the other extreme, heavier bond market exposure offers stable returns that are more suitable for retirees. Review your portfolio two times per year to account for any lifestyle changes, such as promotions, marriage and childbirth.

Criticisms

References

Resources

More Like This

Portfolio Theory

How to Make a Portfolio

How Much of My Portfolio Should Be in REIT?

You May Also Like

Harry Markowitz was the creator of modern portfolio theory. Published under the title Portfolio Selection in the 1952 Journal of Finance, Markowitz.

Modern Portfolio Theory (MPT) is a method meant to help you achieve the highest investment returns with the least amount of risk.

Successful investing is one of the fastest and most efficient ways of increasing your wealth. Unfortunately, since investing requires risk, it is.

Fair value of an asset is determined by using mathematical models in the finance theory. The fair value determined through these models.

Balanced portfolio theory, sometimes called modern portfolio theory, seeks to maximize returns while minimizing risk through the creation of portfolios that include.

Portfolio analysis is the process of looking at every investment held within a portfolio and evaluating how it affects the overall performance.