What is the Difference Between Passive Investing and Index Funds

Post on: 30 Август, 2015 No Comment

How do I take on more risk as a passive investor?

John Lamb/ Photographer’s Choice RF/ Getty Images

The terms passive investing and index investing are often intertwined. They are not exactly the same. The confusion around the terms was expressed by one of my readers who sent a few of the best questions I have ever received. She wanted to understand what passive index investing was, and how you take more risk or less risk as a passive investor. Her questions and my answers are below.

Question 1: One concept I struggle with is index funds. Is the argument one of passive vs. active, or is it an argument of index vs. other types of mutual funds? Or perhaps I am just misunderstanding the definition of passive investing. Are index funds the only form of passive investing? If so, then to me that would mean the argument FOR index funds is an argument of passive vs. active management.

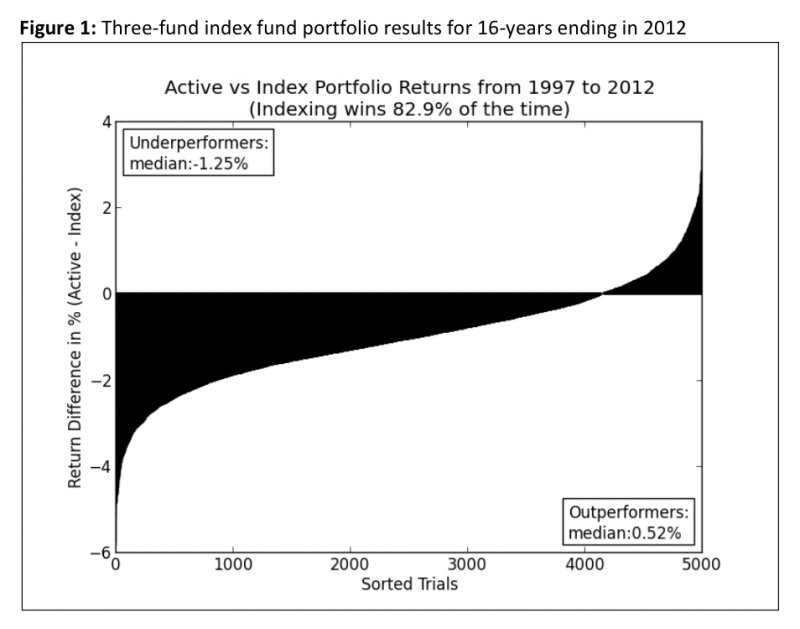

Answer: Index funds are not the only form of passive investing, but they are the most common form. An index fund defines the stocks (or bonds) it owns by owning the same stocks as those that are included in a known and measured index, such as the S&P 500 or the Russell 2000.

A passively managed fund that is not an index fund will have a set of criteria for defining the types of stocks it owns; it will then own all the stocks that meet those criteria without any attempt to pick the “winners” out of that group. Dimensional Funds is a mutual fund company that is passive, but their funds are not index funds. In conclusion, you are correct. The argument for index funds is an argument for passive investing over active investing. All index funds are passive, but not all passively managed funds are index funds.

- Learn more:

Question 2: When people say you should take on more risk while you are young because you have more time to recoup, are they referring to your asset allocation mix? Or are they referring to both your asset allocation mix and the mix of subclasses within the classes? If the latter, does that mean that you should put your money in things such as penny stocks (I’m taking it to the extreme here).

Answer: When financial advisors and the media talk about taking on more risk, we are almost always referring to your asset allocation mix. meaning your mix of stocks to bonds to cash.

Over short periods of time, stocks (measured by the stock market indices) can go up a lot or down a lot. When you look at the time period from 1973 – 2009 as an example, in a single year, stocks could go up as much as 60-90% or down as much as 40-50%. Over that same time period if you measure all the 20 year time frames, during stocks best 20 year time period you achieved returns in the 14-18% a year range, and over the worst 20 years your returns were in the 6-7% range. The reason investment articles tell you to take more risk when you are younger is because you have at least 20 years to let your money work for you.

- See historical market returns in this series of graphs: Historical Market Returns

Question 3: Combining the two thoughts — if you should invest in index funds but also take on more risk while young, how is that accomplished? Is it possible to invest only in index funds and expose yourself to more risk, which is what they say you should do while you’re young? I guess my question is, does that mean that, as an example, a 2 year old should have 100% of their money invested in stocks, and that 100% of that investment in stocks should be put in index funds?

Answer: Assuming you want to be a passive investor, and you agree that picking individual stocks in an attempt to beat the market is not a worthwhile endeavor (something I wholeheartedly agree with), then yes, a 2 year old would have 100% of their money in stock index funds or passively managed funds.

Here is an example of how a passive investor might allocate a 100% stock portfolio across various index funds:

- 30% S&P 500 Index fund

- 10% Mid cap index fund

- 10% Russell 2000 or small cap index fund

- 20% Large cap international index fund

- 10% Emerging markets index fund

- 10% International small cap index fund

- 10% Real estate index fund

You can find funds that fit each category above in the best index funds list.

As you get older, you would reduce the percentage to the stock index funds and increase your percentage allocation to bond index funds.