What Is Reviewed In A Home Appraisal

Post on: 1 Сентябрь, 2015 No Comment

When you go to buy a house, unless youre throwing down all cash on the deal, youll need to get a home appraisal. The lender requires this because they want to know that youre not borrowing a million bucks for a $50 home because in the event their own due diligence on you is faulty (and you default), they can at least take the home and sell it for the value of the loan. If the appraisal comes back lower than the selling price, then the lender is a little wary of extending you credit because now you have no collateral to back it up. (This explanation only applies to the appraisal of an existing home, I dont have experience with a new home)

One thing to remember is that the Home Appraisal is entirely separate from the Home Inspection. The inspection is designed to find the faults in the home that need to be addressed whereas the appraisal is merely designed to reach a value for the home. An inspection is far more rigorous in terms of going over the house with a microscope (if you get a good and capable inspector).

What You Get

Considering you usually dont get to pick the appraiser (the lender will), youre probably more interested in what you get for the money youre about to spend (its part of the ubiquitous closing costs). Youll get a report that lists out the following:

- The characteristics of your house and the land it sits on.

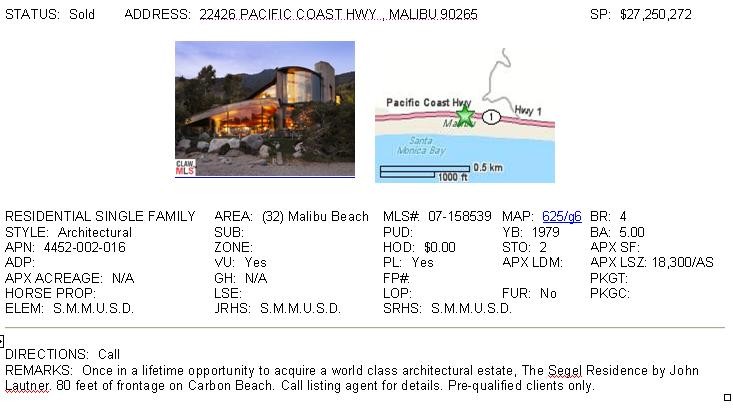

- Three comparable (comps) properties that are similar enough to your own property.

- Information about the real estate market in your general geographic area.

- Any positive or negative factors these are the unique characteristics that differentiate you from your neighbors, your comps, etc. An example of this would be if you had a back deck but none of the comparables do, if you have significant structure issues, stuff like that.

- Miscellaneous data The appraisal has a lot of information that you otherwise didnt think mattered or were quantifiable.

- Photos The appraiser may append photos of the front, read, and street view of your home as well as photos of the comparable properties.

For example, this is what my home appraiser said under Factors that affect the marketability of the properties in the neighborhood: The area is in good proximity of employment, shopping, schools, churches & recreation facilities. Public transportation, police & fire protection are readily available. Utilities are readily available and deemed adequate. Employment stability appears good. Properties in the neighborhood are generally well maintained; appearance & appeal to marketability are deemed as good. No detrimental conditions affect marketability were observed. So you see, there is a bit of subjectivity.

How Do They Determine Value?

Heres is where they get to play a little with numbers. They come up with a value by either taking the average price of three comparables sold in the last few months and then adjusting for the positive or negative factors. So you see, since many of the factors a bit subjective (how valuable is that deck?) so the appraiser usually can get you an appraisal that is at least the purchase price of the home.