What is an accredited investor Startup Company Lawyer

Post on: 16 Март, 2015 No Comment

April 3, 2009

Under the Securities Act of 1933, a company that offers or sells its securities must register the securities with the SEC or find an exemption from the registration requirements. In addition, the company must also comply with securities laws in each state where securities are offered.

The Act provides companies with a number of exemptions from federal registration requirements. For some of the exemptions, such as rules 505 and 506 of Regulation D, a company may sell its securities to what are known as accredited investors defined in rule 501 of Regulation D. Offerings to accredited investors are exempt from the registration requirements on the theory that accredited investors are sophisticated enough to protect their own interests.

The following types of individuals are accredited investors:

- a director, executive officer, or general partner of the company selling the securities;

- a natural person who has individual net worth, or joint net worth with the persons spouse, that exceeds $1 million at the time of the purchase; or

- a natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

Net worth includes the value of houses and automobiles. Thus, many homeowners are accredited investors due to the value of their houses. The $1 million net worth and $200,000 income standards were established in 1982 and have not increased with inflation.

The following types of entities are accredited investors:

- a bank, insurance company, registered investment company, business development company, or small business investment company;

- an employee benefit plan, within the meaning of the Employee Retirement Income Security Act, if a bank, insurance company, or registered investment adviser makes the investment decisions, or if the plan has total assets in excess of $5 million;

- a charitable organization, corporation, or partnership with assets exceeding $5 million;

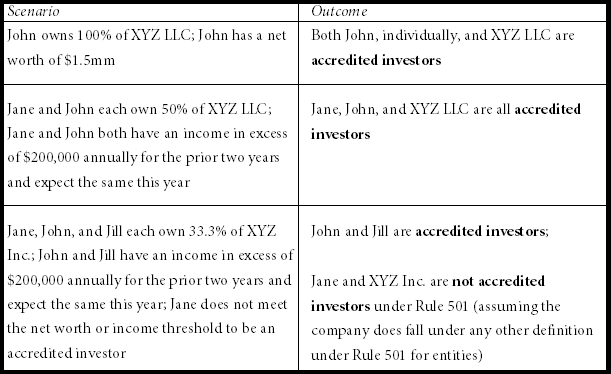

- a business in which all the equity owners are accredited investors; or

- a trust with assets in excess of $5 million, not formed to acquire the securities offered, whose purchases a sophisticated person makes.

SEC Proposes Amendments to the Net Worth Standard for Accredited Investor Status

On January 25, 2011, the Securities and Exchange Commission (SEC) voted to propose certain amendments to the net worth standard for determining accredited investor status under the rules promulgated by the Securities Act of 1933. These amendments reflect the requirements of Section 413(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). Although Section 413 was effective on July 21, 2010, upon enactment by operation of the Dodd-Frank Act, the SEC is still required to revise the Securities Act rules to reflect the new standard. In addition, the SEC is proposing technical amendments to Form D and a number of rules to conform them to the language of Section 413(a) and to correct cross-references to former Section 4(6) of the Securities Act, which was renumbered Section 4(5) by the Dodd-Frank Act. The proposed rules are available here .

New Net Worth Test

Under proposed Securities Act Rules 215 and 501, the value of a persons primary residence would be excluded for purposes of determining whether the person qualifies as an accredited investor on the basis of having a net worth in excess of $1 million. Previously, the net worth standards required a minimum net worth of more than $1,000,000, but permitted the primary residence to be included in calculating net worth.

The proposed amendments would define an accredited investor, among other things, as:

Any natural person whose individual net worth, or joint net worth with that persons spouse, at the time of purchase, exceeds $1,000,000, excluding the value of the primary residence of such natural person, calculated by subtracting from the estimated fair market value of the property the amount of debt secured by the property, up to the estimated fair market value of the property.

Neither the Securities Act nor the Securities Act rules define the term net worth, so the proposing release states that the purpose of adding the phrase introduced by the words calculated by is to clarify that net worth is calculated by excluding only the investors net equity in the primary residence. The SEC believes this approach is consistent with and advances the regulatory purposes of Section 413(a) because it reduces the net worth measure by the amount or value that the primary residence contributed to the investors net worth before enactment of Section 413(a). The SEC also notes that some of its existing rules are similar in approach to the proposed rules. For example, Rule 701 under Regulation R provides for the exclusion of the value of a persons primary residence in applying a net worth standard and also provides for the exclusion of associated liabilities, such as mortgages.

The proposed rules do not define primary residence, although they provide that issuers and investors should be able to use the commonly understood meaning of the term—the home where a person lives most of the time.

Effectiveness of the Proposed Rules

There is no transition period for the new accredited investor net worth standards, since these new standards were effective upon enactment of the Dodd-Frank Act. Under the current rules, a company or fund is not permitted to treat an investor as accredited if the investor subsequently loses that status, even if the investor has previously invested in the company or fund at a time when it satisfied the accredited investor standard. Investors must satisfy the applicable accredited investor income or net worth standard in effect at the time of every exempt sale of securities to the investor that is made in reliance upon the investors status as such. The proposed amendments would not change this situation. Nevertheless, the SEC is seeking comment on whether some transition and other rules might be appropriate to facilitate subsequent investments by an investor who previously qualified as accredited but was disqualified by the change effected by the Dodd-Frank Act.

Section 413(b) specifically authorizes the SEC to undertake a review of the definition of the term accredited investor as it applies to natural persons, and requires the SEC to undertake a review of the definition in its entirety every four years, beginning in 2014.

Effect of the New Net Worth Test

Among other things, the changes required by Section 413 of the Dodd-Frank Act impact the legal requirements governing unregistered offers and sales of securities, i.e. private placement exemptions from the registration requirements of the Securities Act relied on by companies in raising private capital from individuals. One of the requirements of certain private placement exemptions is for capital to be raised from accredited investors. By excluding the value of an investors primary residence in calculating net worth, indebtedness secured by the primary residence would be netted against the value of the primary residence up to the fair market value of the property. This may cause fewer individuals to qualify as accredited investors, thereby reducing available private capital.

Notwithstanding the foregoing, it is still possible for individuals to qualify as accredited investors on other grounds. For example, Rule 501 of the Securities Act provides that an accredited investor shall also mean any person who comes within, or who the issuer reasonably believes comes within, any of the following categories:

- any director, executive officer, or general partner of the issuer of the securities being sold, or

- any natural person who had an individual income in excess of $200,000 in each of the two most recent years or joint income with that persons spouse in excess of $300,000 in each of those years, and has a reasonable expectation of reaching the same income level in the current year.

As a result, while the net worth test promulgated pursuant to the requirements of the Dodd-Frank Act may be more restrictive, natural persons may still qualify as accredited investors under one of the other definitions provided in Rule 501.

What You Should Do Now

Because Section 413(a) became effective upon the enactment of the Dodd-Frank Act and it requires the exclusion of the value of a persons primary residence for purposes of determining whether such person qualifies as an accredited investor, all companies that have not already done so should revise their standard forms of accredited investor questionnaire and investor representations and warranties in their standard forms of financing documents to ensure that an individuals net worth is properly calculated.

Written by Yokum Filed Under General