The Truth Behind Hidden Fees in 401k Plans (Part 1)

Post on: 30 Август, 2015 No Comment

More than 78 million baby boomers start surging their way into retirement beginning 2008; the first generation of Americans to retire with 401(k)s. These are employer sponsored plans that allow workers to invest money without Uncle Sam taxing it until its withdrawn. But something has been draining cash out from these plans. Since the creation of the 401k plan in the early 80s, all that extra money saved should have been compounding, racking up these retirement plans and making Americans rich. But instead, the average 401(k) balance for boomers nearing retirement is only $60,000. Thats not much more than the median household income in the US for 1 year. There are a lot of reasons why 401(k)s are coming up short, like the stock markets steep decline from its all time high in October 2007. A less obvious reason, infact a hidden reason are all of the fees that can take a big chunk out of your investment returns.

Video Review

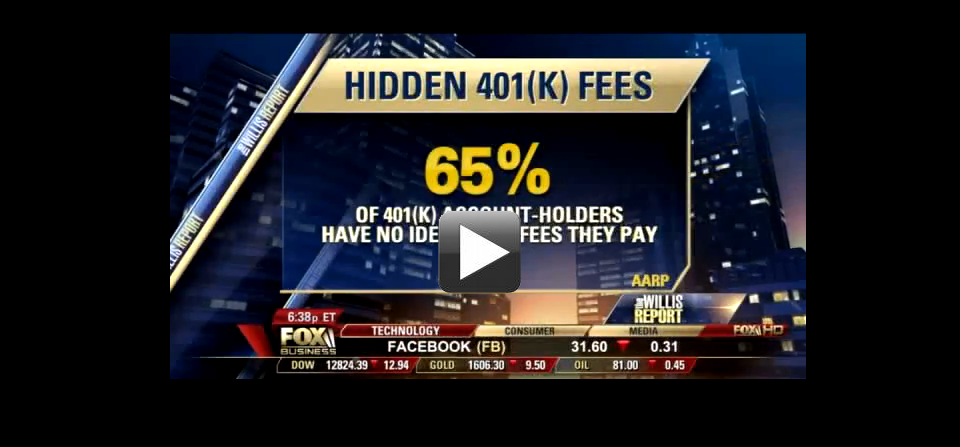

Commentator (Mike Schneider from Bloomberg TV): A survey done by AARP in 2007 showed 8 out of 10 respondents with 401(k)s didnt know the cost of their plans. Thats because many of the fees, all of them legal, are buried in the fine print of obscured documents or are so confusing that they might as well be written in a foreign language. Examples of confusing fees are:

12B-1 Fees

Shelf Space

Surrender Charges

Finder fees

Revenue Sharing

Wrap fees

Soft Dollars

Commentator (Mike Schneider from Bloomberg TV): Its a complicated puzzle, but the US Department of Labor counts there are atleast 17 fees that can be charged to your 401k plan. Right now you will be lucky to find even one of them by name in your account statement. What you dont know can hurt you. After 40 years of 401k investing, you can say goodbye to 1/2 of your potential nest egg. We want to show you how to find these hidden fees, whos charging them and how its being done without you knowing it.

Commentator (Mike Schneider from Bloomberg TV) in Seattle Washington: Gerald Schneider of Washington fits the profile of a typical 401k investor; its not because he is a baby boomer, Jerry is 62, and not because Gerry likes dogs. Also not because Gerry lives in a log cabin, but what makes Gerry same as other 50 million 401k investors is that he just saw his 401k balance take a serious tumble. From the beginning of January 1st, 2008 to March 31st, 2008, Gerry lost $44,108.32; those were investment losses Gerry knew about, its what he didnt know that got him worried. After his loss, Jerry now has about $390,000 in his 401k. According to an independent audit account, Gerry would have tens of thousands of more dollars were it not for hidden 401k fees.

Commentator (Mike Schneider from Bloomberg TV) in Portland, Oregon: Gerry called his bosses in Elcon Professional Building @ Elcon Associates Inc. and demanded to know where all the extra fees were coming from. They said, what kind of crap is this? Gerry said well its gotta be coming from somewhere, lets find out what it is! So I had Matt find out. Matt Hutchinson is a national retirement planning expert who in 2007 testified to Congress about hidden fees. When we buy bread, we know $1 will buy $1 worth of bread. But when it comes to 401k plans, a sticker price is advertised at 50 cents, yet the actual cost may be closer to $3. Hutchinson does occasional audits for the US Department of Labor; the Federal Agency that regulates retirement plans. So Bloomberg News asked him to review Gerry Schneiders account. In February 2007, Gerry received this memo from Elcon informing him that the company running Elcons plan, John Hancock Financial Services, charged annual fees of 0.10% of the amount in his portfolio, totalling $404.23 Thats not what Matt Hutchinson found!

Matt Hutchinson (Independent Fiduciary): Gerry it appears based on our findings that youre paying approximately, 3000% more than what you believed you were paying. Kinh Pahm, Vice President of Elcon Associates and the companys 401k trustee says he didnt mean to mislead anyone. He says he was only repeating what John Hancock was telling him.

Kinh Pahm (401k Trustee of Elcon Associates): I feel they are not being very straightforward, lets put it this way.

Commentator (Mike Schneider from Bloomberg TV): John Hancock declined to appear on camera for this program. So did officials from Fidelity Investments, Nationwide and so did the other insurance & financial planning companies that charge workers tens of billions a year to manage their retirement plans. To put this all in perspective, Gerrys 3.6% is more than what a lot of people should be paying.

Ted Benna (Original Inventor of 401k Plans in 1980s): For most 401ks, the annual cost of the services provided plus a fair profit margin should not exceed 1% of your total investments, if you are participating in a big plan. Plans that have assets of $10 million and up, you know, thats a good benchmark. If you go to a small employer, you probably should rachet it up to 1.5% Overtime, fees amounting to just 2% can devalue your retirement plan in half!

Burton G. Malkiel (PH.D. at Princeton University, Author of Best Seller A Random Walk Down Wall Street and a Scholar who has spent decades analyzing the impact of fees on Investments): Can you imaging somebody saying to you, let me invest your money for you and when youre ready to retire, Ill take half your money away from you. If somebody ever said that, youd say youre crazy! Im not going to let you do that!

Edward Siedle (Benchmark Financial Services & Former Attorney at SECs Investment Managing Division): In many of the plans that I have audited, the total fees people are paying come out to 3% 5%! There are some 401ks that I call lethal, because they will kill you, they will absolutely kill your retirement nest egg!