The REIT Way To Become A Disciplined Dividend Investor

Post on: 6 Октябрь, 2015 No Comment

Wikipedia defines discipline as systematic instruction intended to train a person, sometimes literally called a disciple, in a craft, trade or other activity, or to follow a particular code of conduct or order. As a husband and father to five kids, I find myself constantly struggling to not only discipline my children but also to be an example of good habits.

It seems that discipline is in its simplest the assertion of willpower that is more correlated to the use of self control and I often find myself aligning my habits — both good and bad — with daily tasks that are triggered by creating value. For example, many of you know that I write daily articles and that discipline is rooted in my desire to be a successful businessman. Clearly there is no considerable profit in writing web-based articles, yet my motivation is aimed more at building a core of expertise in commercial real estate.

As the legendary Benjamin Graham once said, the most durable form of education is self education and I have become somewhat of a disciple of Graham’s words by motivating myself to research and write on topics that are aligned with my DNA — commercial real estate. Harry S. Truman once said:

In reading the lives of great men, I found that the first victory they won was over themselves self-discipline with all of them came first.

To give you a little background, I used to develop commercial real estate and although I witnessed success, I also witnessed failure. If I were to tell you about all of my failures in life you would likely not ever invest in real estate again. However, my biggest motivator today — to be a disciplined writer — is also by biggest reward — to be a coach and instructor.

You see, I have a passion for real estate and the victory I get for helping one investor is far more rewarding than making a few million dollars building a shopping center. Better yet, I don’t take on any risk and that helps me sleep well at night. However, whether success is defined by the number of rent checks I own or the number of putts I take on the golf course, there is a common thread that is formed around habits. In 1940, Albert Gray summed up this inspiring message (as he addressed the 1940 NALU at an annual convention in Philadelphia):

The common denominator of success — the secret of success of every man who has ever been successful — lies in the fact that he formed the habit of doing things that failures don’t like to do.

Why REITs?

So how did I evolve from a real estate developer into a REIT writer? It’s simple. I spent 25 years of my life building a sizable net worth in real estate. I owned shopping centers, warehouses, free-standing properties, duplexes, and even a few franchises. Unfortunately, I was unable to create liquidity and diversification fast enough and I saw most of my nest egg vanish into thin air.

Unlike a REIT, my portfolio was controlled by one individual (not me) and because I had most of my eggs in one basket my retirement was hit hard. So after the Great Recession, I had a choice: Stay in real estate or stay out.

As I contemplated my next move I thought to myself, why not start over like everyone else. Except this time, make sure I learn from my past mistakes. I strategized, commercial real estate has been hammered everywhere so why not get in now when prices are at the lowest level in decades. It seemed logical since the three things that caused me the greatest pain in life — transparency, liquidity, and diversification — were all sitting there before me in screaming flashing lights: REAL ESTATE INVESTMENT TRUSTS .

What an easy transition; having a 25 year background in real estate and property valuation gave me a tremendous competitive advantage. Also, my desire to protect principal at ALL COSTS became my mantra penciled across my forehead.

Yet, as I tried to justify my new career in writing, there was something missing. I mean, writing is certainly a passion for me and I enjoy putting words on paper; however, I wanted something more. I’m motivated from my failures in life and that is certainly part of the newfound success, however, I have a much deeper habit forming objective and it’s something that I can’t keep thinking about

The Power of Dividends

As I mentioned, I have enjoyed past success and one of the most rewarding things in life is witnessing the rewards of determination. I have watched my oldest daughter working hard for 12 years of schooling and obtaining a full scholarship to the University of North Carolina. I have watched my mother raise two children by herself and become a gifted real estate salesperson. I have watched Donald Trump evolve from a well known Manhattan area developer into an iconic worldwide brand of luxury.

Determination is habit forming and even the world’s most famous investment professionals, including Ben Graham and Warren Buffett. have made mistakes; however, they often do not repeat them. Instead they stubbornly adhere to their investment approach and apply strict discipline over a long period of time, resulting in superior results.

Indeed there is no substitute for self-discipline and that also goes for the power of compounding. More specifically, REIT dividends are arguably the most important element of wealth creation. REITs offer above-average dividend yields due in large part to the minimum distribution requirement for companies structured as REITs. They also have a history of consistently raising their dividends, resulting from cash flow growth that can come organically from rising rents and occupancies, or externally from development and acquisitions.

Since 1994, dividend yields for U.S. REITs have averaged approximately 113 basis points more than the 10-year Treasury yield to compensate investors for REITs’ relatively greater risk. Today, they offer a yield premium of nearly 200 basis points relative to Treasury’s, providing a potentially attractive alternative for income-seeking investors.

The power of REIT dividends is rooted in the disciplinary concept that Harvard Professor Michael Jensen described in a research article (Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers ) that has been cited over 13,500 times. In the article, Jensen describes the free cash flow hypothesis whereby a company with too much free cash flow would result in internal insufficiency and waste of corporate resources, thus leading to agency costs as a burden of stockholder wealth. Now, keep in mind, REITs don’t have that problem since they are forced to pay out 90% of taxable income in the form of dividends. As Jensen explains:

Payouts to shareholders reduce the resources under managers’ control, thereby reducing managers’ power, and making it more likely they will incur the monitoring of the capital markets which occurs when the firm must obtain new capital. Financing projects internally avoids this monitoring and the possibility the funds will be unavailable or available only at high explicit prices.

Jensen’s free cash flow hypothesis states that when a company has generated an excessive surplus of free cash flow and there are not profitable investment opportunities available, management tends to abuse the free cash flow in hands, resulting in an increase in costs. As Jensen went on to say:

Managers with substantial free cash flow can increase dividends or repurchase stock and thereby pay out current cash that would otherwise be invested in low-return projects or wasted. This leaves managers with control over the use of future free cash flows, but they can promise to pay out future cash flows by announcing a permanent increase in the dividend. Such promises are weak because dividends can be reduced in the future. The fact that capital markets punish dividend cuts with large stock price reductions is consistent with the agency of free cash flow.

That’s what I call discipline. You can see now why REIT returns have been systematically better than non-REITs. But any company, REIT or not, has an improved chance of performing better, as the legendary Ben Graham explained in The Intelligent Investor :

Paying out a dividend does not guarantee great results, but it does improve the return of the typical stock by yanking at least some cash out of the manager’s hands before they squander it or squirrel it away.

We all know that we can all not be as wealthy as Donald Trump or Warren Buffett ; however, we can create amazing wealth and financial security through the power of compounding. Given the forced make-up of the dividend (REITs must payout 90% of taxable income), REITs are able to provide investors with extraordinarily attractive compounding attributes. As Marc Lichtenfeld explains in Get Rich with Dividends :

Compounding takes a while to get started, but once it does, it’s like a runway train going downhill, picking up momentum each year.

Reinvesting dividends can allow you to super-size your portfolio — something like owning shares in a free ATM machine. As Lichtenfeld explains:

If you’re an investor who doesn’t need the income right now and can put off instant gratification for long-term benefits, reinvesting your dividends can generate the kinds of returns you probably thought were possible.

It’s Time for Some Tactical Dividend Decisions

I believe now is a good time to take a more tactical REIT approach; based upon the premise that REIT prices are down but the economy is not (employment is up and REIT prices are down). I’m not advocating that investors should take a deep dive and begin to load up on REIT shares. In fact, I warn the market timers to be prepared for increasing volatility, and don’t expect REITs to go straight up to new highs like we saw prior earlier this year. Those days are over, at least for a while.

However, an income investor should take advantage of the market opportunity to increase dividend income. An intelligent dividend investor should recognize that now is a terrific time to put money to work and although REIT prices are down, fundamentals are strong and the economy is improving. Simply said, there is a window of opportunity to build a solid portfolio of income stocks that will pay off over time — and compound!

In my monthly newsletter. The Intelligent REIT Investor. I plan to introduce a new portfolio (in December) aimed at only the perpetual dividend raisers. As Lichtenfeld explains:

Typically, a company with an established trend of increasing their dividends will raise them again next year and the year after that and the year after thatunless it becomes impossible to do so.

So in my newsletter I plan to introduce the only pure REIT Disciplined and Durable Dividend Portfolio (The 3D REIT Portfolio). The list of REITs will include a few Dividend Aristocrats (an S&P rating system whereby companies must have at least 20 years of paid and increased dividends), Dividend Champions (as defined by DRiP Resource Center as a company that has raised their dividends for at least 25 consecutive years), Dividend Contenders (as defined by Drip Resource Center as a company that has raised their dividends for 10-24 straight years), and REITs that maintained dividends (never cut).

As a disciple of dividend history, I recognize that past performance is no guarantee of future success; however, when it comes to the top dividend paying stocks, a company’s dividend history can give investors some hints about the future. By filtering out this select group of REITs, this new 3D portfolio will allow investors to access a diversified REIT portfolio and weighted using a Graham-based value concept.

Of course, dividends aren’t the only way to be disciplined. In other words, I would not recommend buying a stock simply because of the company’s long track record of paying out dividends. Investors should also be focused on the necessary margin of safety or what we say in real estate land, buying low and selling high.

Two REITs included in my 3D portfolio that appear to provide a buffer of protection against market fluctuations are Realty Income (NYSE:O ) and Digital Realty (NYSE:DLR ). Both REITs are growth stocks and based upon fundamentals, these two REITs appears to be trading at sound valuation levels. The entry points appear to be compelling opportunities for investors to capitalize on risk-adjusted prices that should enhance long-term profitability.

I am continuing to dollar cost average shares in Realty Income and Digital Realty. This concept of making equal purchases spread out over a longer period should prevent me from overpaying and help bring my investment to actual market levels. Yesterday Achilles Research posted an article on Realty Income explaining the rationale for the soundly valued shares.

I will be meeting with Digital Realty’s management team on Tuesday in San Francisco. I plan to write an article on the company later this week (I will also be attending REIT World ). Also, here is a recent article I wrote on the data sector REIT.

In closing, having a disciplined approach is critically important for all investors no matter what type of investment strategy they use. Dividend investors are no different and that’s why it’s important to educate yourself, develop a strategy, and stick to it. However, at the end of the day, REITs provide one of the best and lasting forms of dividend differentiation — a powerful model of repeatability that can enhance your investment portfolio by providing sustainable growth utilizing the power of compounding. In a few words, that’s how John B. Rockefeller explained his wealth and success:

Do you know the only thing that gives me pleasure? To see my dividends coming in.

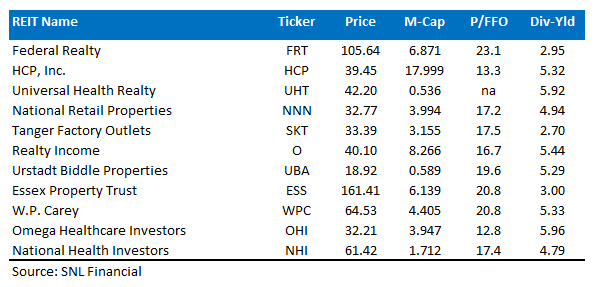

Here is the JV team (for my 3D REIT portfolio) — not as impressive as the Varsity team but also providing meaningful forms of dividend repeatability:

Check out my monthly newsletter. The Intelligent REIT Investor and my NEW 3D portfolio (coming in December).

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

Disclosure: I am long O. ARCP. VTR. HTA. DLR. UMH. STAG. ROIC. CBL. GPT. CSG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.