The Ivy Portfolio

Post on: 20 Октябрь, 2015 No Comment

ETFs

ETF Asset Allocation Model Trading With The Moving Average

I’ve been reading about a very interesting investing strategy; have you heard of the Ivy Portfolio? This strategy comes from a book with the same name written by Mebane Faber and Eric Richardson. They studied how the most prestigious American Universities such as Harvard and Yale manage their pension plans. Here’s how the Ivy Portfolio works ;

What is the Ivy Portfolio?

The Ivy portfolio mixes a strategic ETF asset allocation model traded according to the moving average of each ETF. The investment strategy is relatively easy to put in place as you must take into consideration only 2 factors:

#1 A tactical ETF asset allocation mix

#2 Trading according to the moving average of each ETF.

Therefore, once you have made enough research to get a good ETF asset allocation mix, your Ivy Portfolio will surf along on a very simple and easy to understand trading strategy: you buy when the ETF crosses the moving average in a uptrend and you sell when the same ETF crosses the moving average in a downtrend .

What is the goal of the Ivy Portfolio?

If you simply make an ETF list and buy them using a classic buy and hold technique; you will enjoy the rides up and suffer the market crashes. If you rebalance your portfolio to respect your asset allocation mix, you will eventually make money but you will also be tempted to sell your ETFs during bad times and wondering when to get back in during a bull market. However, by building an Ivy Portfolio; you are making your life much easier:

#1 The Ivy portfolio makes trading decision s fairly easy

Trades are not triggered by fundamental analysis, trader’s perceptions or investor’s emotions. Trades in the Ivy portfolio are triggered by the moving average. Therefore, it is just a matter of setting up an alarm that will tell you when one of your ETFs crosses the moving average. Automatically, you buy or sell the ETF according to your model.

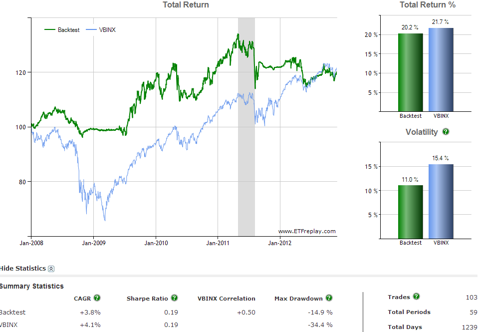

#2 The Ivy portfolio avoid s most of the crashes

As I have previously discussed, the biggest (in theory) advantage of trading with the moving average is that you avoid the biggest part of any stock market crash. Therefore, as soon as the ETF dropped enough to break the trend, you get rid of it and stay in cash until it goes back up high enough to break the trend again. This will prevent your portfolio from suffering severe losses.

#3 The Ivy portfolio capture s most of the gains

Here again, this statement is based on the moving average theory. Instead of wondering if the recession is really over or if we are heading towards a double dip recession, you simply follow the moving average. Therefore, when the current trend hike is strong enough to break the trend, you have your answer. This allows you to get in on board without waiting on the sidelines too often.

#4 The Ivy portfolio is a cheap way to build a solid asset allocation

Through trading ETFs, the Ivy portfolio is the best solution for an investor who doesn’t want to lose his money in management and trading fees. Since you are following strong trends, you are not encouraged to trade often. I’ve seen an example of an Ivy portfolio that sat cash for 600 days with its international ETF since the markets were bad during that time.

The Ivy portfolio is not perfect

I see a major problem behind the Ivy portfolio theory; the investor behind the asset allocation mix! The problem is that you have to follow each ETF and its moving average to make sure you don’t miss a trade. This could take some time or will require one to invest in a trading system providing alerts within those parameters.

There is also another thing that bugs me with the Ivy portfolio; how to select the correct ETF asset allocation model? I’ll try to answer this question in another post ![]()

***************************************************