The easy way to invest in the Stock Market index trackers

Post on: 16 Март, 2015 No Comment

Jasmine Birtles

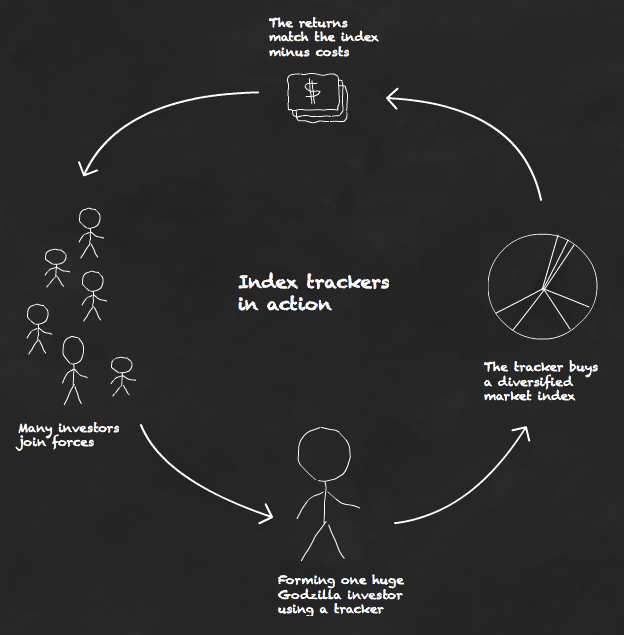

This is the easy, cheap and non-frightening way to invest in the stock marketand it works! Index-tracking funds (also known as trackers) are a no-fuss way of putting your money into the stock market (for the long-term remember) and making decent money over time. Heres what they are and how you can start investing today.

What are index-tracking funds?

Tracker funds track a particular stock market index (i.e. defined group of companies such as the largest 100) by investing some of your money in every single company in that index. This means that as the index goes up or down (depending on how the shares of each of the companies in the index do each day), your investment goes up and down with it.

There are various indices in Britain and around the world that are ‘tracked’ by tracker funds. For example, the FTSE 100 (the index you keep hearing about in the news) is made up of the 100 biggest companies that have shares available to buy and sell on the London Stock Exchange (LSE) that’s where those shares are ‘listed’.

When a company gets listed on a stock market it means that at least part of it has been sold to the public (i.e. you, me or anyone else who wants to buy those shares) rather than being privately owned.

In other words, lots of people can own a little bit of each company by buying one or more bits/‘shares’ of it. Once a company is listed it can only become a ‘private’ company again if it buys back all of the shares or if another company or group of people does so and thereby ‘de-lists’ the company – this is what Richard Branson did with his company, Virgin.

If you are considering investing in a tracker fund or two, another index you should be familiar with is the FTSE All-Share, which represents the vast majority of companies that are listed on the London Stock Exchange (over 700 of them).

There’s also nothing to stop you investing in a fund that tracks one of the many other indices, such as AIM (Alternative listings for smaller companies in the UK), the Dow Jones or the Nasdaq in America, the Nikkei in Japan, the Hang Seng in Hong Kong or the DAX in Germany in fact I suggest that in time you should spread your money across different countries and sectors but to start with, stick to British funds where you know where you are and you have easier access to information about them.

Get LOADS of FREE investment guides here to help you learn to invest in the stock market for profit

The different types of indices to track

There are three main British indices that you can choose to ‘track’. The FTSE 100 and the FTSE All-Share tend to perform pretty similarly, but the third, the FTSE 250, goes up and down a little more because it’s made up of middle-sized companies, for which the prices can be a bit more volatile.

The FTSE 100 This measures the largest 100 companies in the UK by value. One current example is BP, which is UK-based, but operates internationally.

The top 100 companies represent about 80% of the value of the whole of the London-based market (the FTSE All-Share), so you can get a pretty good idea of what the stock market as a whole is doing from how these top 100 companies are performing. This is why they report on the FTSE 100 in the news – if the FTSE 100 is up a few points then the overall feeling is positive – companies are generally perceived to be doing well.

The FTSE 250 The next 250 biggest companies in size are known as the FTSE 250 – in other words, the companies ranked 101 to 350 in the market. Companies in this index are generally known as the mid-caps, meaning that they have a capitalisation (what they would be worth if you sold them) that is somewhere in the middle between the FTSE 100 and all the other tiddly little companies that are listed.

Interestingly, many of the traditionally ‘British’ companies, like manufacturers and house-building companies, are often found in the FTSE 250. For that reason, investors often choose to track this index if they believe the next few years will be bright for the British economy. They’ll look for signals such as a falling unemployment rate, which means more people are holding down jobs and able to spend more on housing, travel and shopping.

The FTSE All-Share This measures how the major part of the companies (around 700 of them) listed on the London Stock Exchange is doing. This includes each one that sells shares to the public, from the very big household names like BT to the tiddlers, such as estate agents. Although it includes all of the publicly listed companies in the country it moves up and down in a similar way to the FTSE 100 because the first hundred companies in the index account for the vast majority of the wealth of the whole lot.