The differences between index funds and managed mutual funds

Post on: 29 Август, 2015 No Comment

posted in Finance. Investing

Security-market indices use index values to compute total risk and return for an aggregate market or its components over a specified period of time and use the computed return as a benchmark to evaluate the performance of individual portfolios. Indices are used to develop an index portfolio. However, given the market conditions and the difficulties managers face in outperforming specified market indices on a risk-adjusted basis over time, the need for an alternative option is obvious.

Index funds invest in portfolios that emulate the performance of benchmark market portfolios by replicating the movements of an index of a specific financial market. Index funds are passively managed, that means that the fund manager makes specific portfolio decisions, which project the performance of a specific index.

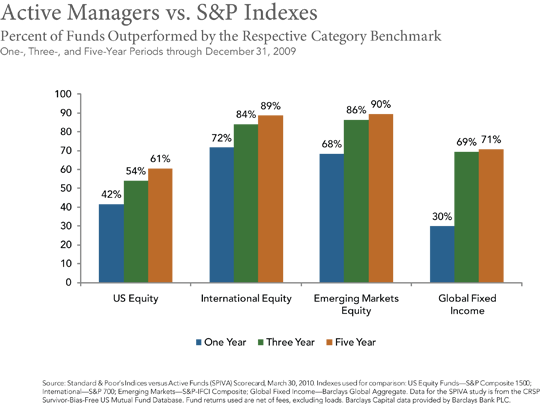

Managed mutual funds invest in a pool of funds, which belong to different individuals in a portfolio of investments such as stocks and bonds. Managed mutual funds are actively managed, that means that the fund manager analyzes current conditions and trends in order to decide the asset allocation in the fund. The aim is to outperform a relevant index by picking the right stocks in the right proportion.

The differences between index funds and managed funds are numerous.

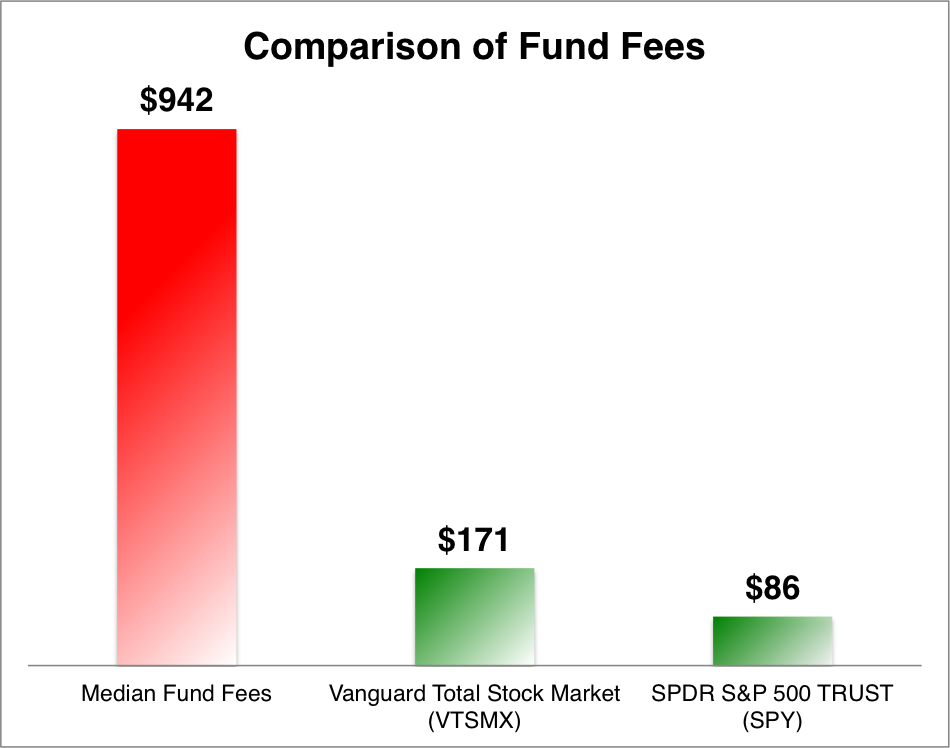

Index funds have the advantage of lower fees and taxes. Due to the fact that the composition of an index does not change frequently, the fund manager makes fewer trades than an active manager, who has to follow the track of the index constantly and anticipate the changes in its composition. Consequently, index funds have low trading fees and taxes than actively managed funds.

Index funds do not incur expenses related to the selection of stocks. Typically, index funds use sampling and mirroring models in order to decide when to buy, hold or sell individual stocks and be into agreement with the target index. On the contrary, investment in active funds typically involves paying for expensive management teams that will perform the adequate research and analysis to identify the stocks that fit the fund’s objective. Yet, passive management is not always effective, because by nature, sampling and mirroring models are not 100% accurate and this is why tracking errors occur.

Index funds offer to investors a high level of diversification at a relative low cost. Investing directly in stocks with a similar portfolio allocation would generate considerably higher cost. Moreover, index funds are always fully invested to the specified index. This means that the portfolio return is higher during market upturns and lower when markets decline. Instead, in active managed funds, the portfolio return is subject to the type of securities and the cash holding generated by the fund managers’ evaluation of the market. Therefore, portfolio allocation might or might not be rewarding in market upturns, but it is less costly during a market decline.

About the Author:

thehistoryculturevenue.blogspot.com/