The Beauty Of High Yielding Stocks In Retirement

Post on: 28 Октябрь, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

We’ve all been taught to add more fixed income-securities as we approach retirement. The argument is that stocks are too risky when the time frame for the investment is short, but bonds may actually be the riskier securities unless you are content to hold until maturity. Otherwise, since rates have nowhere to go but up, your bonds will be worth less in a higher yielding environment.

On the other hand, is there anyone who doesn’t love quarterly stock dividends? Today’s payouts look enormous in comparison with what you can get from bond yields. What’s more, dividend checks generally indicate that a company is taking in more cash than it needs.

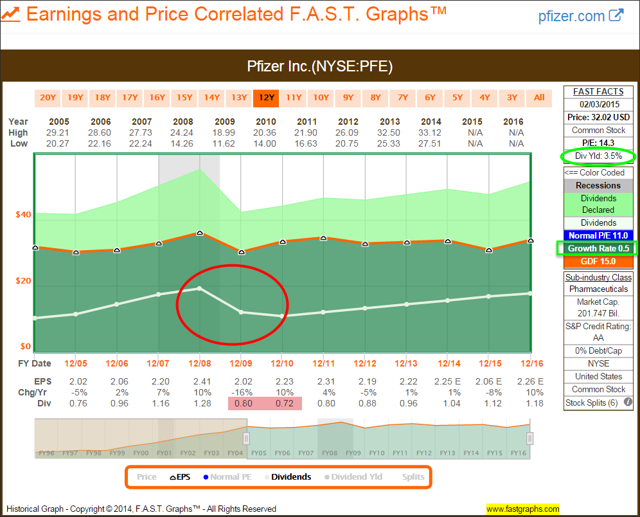

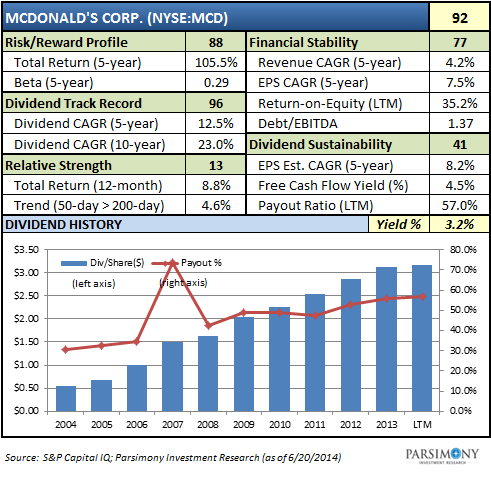

If you own good companies during good times (which is most of the time), stock dividends can grow, and increasing dividends generally lead to higher trading prices. Even more important: During periodic recessions, well-run companies keep paying those dividends, which makes it easier to control your emotions during those bear markets.

Then there’s the tax treatment. Interest from bank CDs or corporate bonds or Ginnie Maes are taxed as ordinary income. For many investors, those rates are 25%, 28%, 33%, 35%, and 39.6%.

Qualified dividends (which include most payouts to investors) get a break, as they’re now taxed the same as long-term capital gains. Most investors owe the IRS only 15% on those dividends. The only ones who pay the premium rate of 20% are those with taxable income of well over $400,000, and that 20% rate is still a bargain, compared with their ordinary tax rates.

The lower tax rates on dividends and long-term gains are now a “permanent” part of our tax law, meaning there’s no sunset date. These rates have been available to non-corporate taxpayers since 2003 and, with no indication Congress wants to crack the tax code any time soon, probably will be around for years to come.

A 0% tax rate on your dividends

Some investors can pocket dividends or sell appreciated stocks and owe 0% in tax, keeping all the money they get. You might think this applies only to low-income people who probably won’t own stocks. But that’s not entirely true: In retirement, a married couple might have $80,000 or $90,000 or more in gross income this year and still owe 0% tax on their dividend income

The 2014 tax tables show that the 15% tax rate for single filers goes up to $36,900 of taxable income and $73,800 for married couples filing joint returns. Keep in mind that those numbers are for taxable income, the number you report at the end of your tax return, after subtracting deductions and personal exemptions and non-taxable Social Security benefits and other tax breaks from your gross income..

Seniors without significant amounts of earned income in retirement could easily qualify for the 15% marginal rate – and a 0% rate on dividends and capital gains.

Suppose you are in your late 60s filing a joint tax return with your spouse, with very little earned income except for your Social Security benefits, which you supplement by tapping into savings. Since retirement, you’ve reported about $50,000 of taxable income each year.

In that case, you could add more than $20,000 of stock dividends to your taxable income this year, and owe 0% in tax. That would be the case in the years to follow, assuming no change in the tax law and no significant increase in your taxable income from other sources. If you are reluctant to own individual stocks, you could invest in a fund (open-end mutual fund, closed-end fund, ETF) that owns dividend payers. Qualified dividends passed through to shareholders get the same favorable tax treatment.

At current yields, you might need a $1 million portfolio to get $20,000 in dividends per year, at a 2% payout rate. With higher yielding stocks, you could get that $20,000 from a smaller portfolio.

As is always the case with equities, losers can be sold to generate capital losses, which can provide tax benefits. Winners can be retained and eventually sold at favorable tax rates—perhaps even zero percent.

There are situations where the 0% tax rate might apply to dividend income even for high-income taxpayers. Say you are helping to support your widowed parent or needy older brother: You might give your relative cash and suggest that he or she buy dividend-paying stocks or funds.

Those equities could provide your relative with tax-free dividends as well as growth potential. In 2014, you can give up to $14,000 ($24,000 as a couple) to as many people as you want without incurring a gift tax. If you want to give a more sizable gift, without incurring a gift tax you can dip into your estate tax exemption, which is now a generous $5.34 million per person. (Anyone considering sizable gifts should consult with a tax attorney.)