Tax Loss Harvesting with ETFs 6 Ideas to Lower Client Liabilities

Post on: 31 Июль, 2015 No Comment

by Stoyan Bojinov on November 21, 2011 | Updated June 12, 2014

Innovation across the exchange-traded universe has brought forth a host of investment strategies to mainstream investors, allowing for access to previously difficult to reach corners of the global financial market. Aside from the well-known benefits of ETFs, like ease-of-use and transparency, the structure of these investment vehicles holds several, often times overlooked, tax benefits as well. Some declines in asset values might have a silver lining, as they present the opportunity for financial advisors and self-directed investors alike to exercise effective tax management and make prudent use of unrealized losses [see 25 Things Every Financial Advisor Should Know About ETFs ].

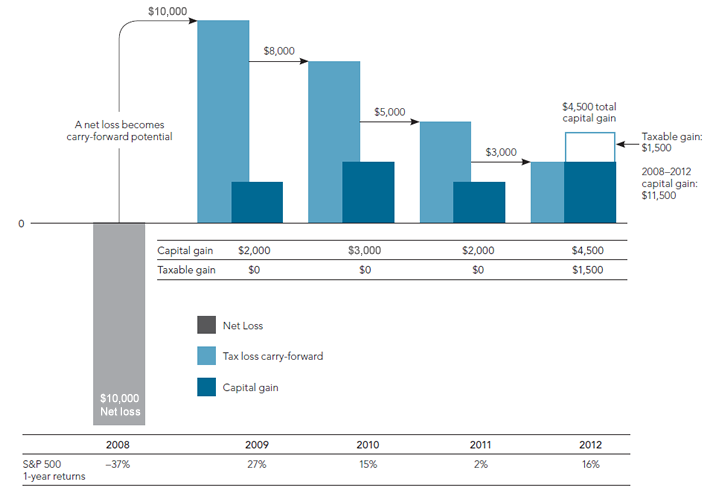

Market downturns provide the unique opportunity for investors to take advantage of losses to lower their tax liabilities. There are potential benefits of selling a losing security; investors can use the unrealized losses to offset realized gains in their portfolio, effectively reducing their tax liability. Second, investors can use the sale proceeds to reinvest in a similar position and maintain exposure as desired [see ETFs And Tax-Loss Harvesting ]. Its important that investors who wish to employ a tax-loss harvesting strategy be aware of the wash sale rule, which forbids the purchase of a substantially similar security within 30 days of a sale. If an investors sells a security intended as a long-term holding, then repurchases that same security, or one that is nearly identical within 30 days, the tax-loss benefit is lost [see Why ETF Really Stands For Efficient Tax Features ].

Tax-Loss Harvest Trade Ideas

ETFs allow for investors to work around the wash sale rule and take advantage of a tax-loss harvesting strategy given the extremely diverse product spectrum. Investors who have incurred an ugly loss on a stock position may wish to sell the security and use the proceeds to purchase a sector-specific ETF to maintain exposure to that corner of the market, while also realizing the tax-benefits associated with the incurred loss [see also Ten Commandments Of ETF Investing ]. Another option is for investors to sell mutual fund shares and incur a loss or avoid capital gain distributions, and purchase an ETF with a comparable investment objective. Finally, investors may also consider selling a losing ETF position and re-deploying the proceeds to another ETF with a similar, but not identical, investment strategy.

Tax-loss harvesting allows for investors to make the most out of their unrealized losses, while still maintaining the desired level and concentration of exposure to a particular corner of the market. ETFs make it easier for investors to swap positions as the end of the year approaches and realize tax-benefits while remaining fully invested. Investors should note that the IRS has not released a definitive opinion regarding what qualifies as a substantially identical security and its application to the wash sale rule and ETFs [see also Ten Myths About ETF Investing ].

Below we highlight several practical ETF Swap ideas that may be considered by investors looking to take full advantage of tax-loss harvesting:

iShares MSCI Emerging Index Fund (EEM ) / EG Shares Emerging Markets Low Volatility Dividend ETF (HILO ): Shareholders of the ultra-popular EEM probably werent too happy with the funds dismal 2011 performance given the rampant volatility that ripped through emerging markets. Investors may have considered selling their stake in EEM and re-deploying the proceeds to HILO, which offered comparable emerging markets exposure with a twist. HILO tracks a unique dividend yield weighted index that aims to deliver a higher level of current income along with lower volatility relative to traditional market cap weighted products in the space, such as EEM and VWO [see Five Equity ETFs With Low Betas For A Rocky Market ].

PowerShares WilderHill Clean Energy Portfolio (PBW ) / Van Eck Market Vectors Global Alternative Energy ETF (GEX ): PBW was down nearly 50% from January 2011 to November 2011, and investors who held onto this ETF may have wished to reap tax-benefits by reallocating capital to a comparable product instead. Investors could have considered GEX, which also offered exposure to companies in the alternative energy industry, except it featured a greater allocation to international holdings [see 25 Ways To Invest In Alternative Energy ].

iShares FTSE China 25 Index Fund (FXI ) / Guggenheim China All-Cap ETF (YAO ): FXI was down upwards of 10% from January 2011 to November 2011, and some investors may have chosen to cope with their unrealized losses by switching over to YAO. This Guggenheim alternative to the ultra-popular FXI, which features a shallow basket of 25 securities, offers investors access to a deeper, better diversified portfolio of Chinese equities. YAO also offers a broader sector representation of the Chinese economy; FXI is heavily tilted towards the financial sector, while YAO casts a much wider net.

Global X Uranium ETF (URA ) / iShares S&P Global Nuclear Energy Index Fund (NUCL ): URA incurred a serious loss of over 50% from January 2011 to November 2011, although shareholders may have an opportunity to take advantage of the funds disappointing performance. Investors may wish to employ a tax-loss harvesting strategy by taking losses on their URA position and using the proceeds to buy into NUCL. The Global X fund is focused on companies engaged in the uranium mining industry, while NUCL offers investors broader exposure to equities in the nuclear energy sector as a whole [see Nuclear Energy ETF Analysis ].

State Street Financial Select Sector (XLF ) / PowerShares S&P SmallCap Financials (PSCF ): Financial stocks all over the globe were hit hard in 2011 and shareholders of XLF may have wished to take advantage of any unrealized losses. Investors can have considered reallocating capital from XLF to a different fund targeting the same industry. PSCF may be an appealing alternative as it targets the small cap segment within the financial services corner of the U.S. economy.

iShares Latin America 40 Index Fund (ILF ) / First Trust Latin America AlphaDEX Fund (FLN ): Investors who wished to maintain their exposure to Latin American equity markets, but also wanted to take advantage of any unrealized losses in their ILF position, should have considered redeploying capital to FLN. This First Trust product is linked to a comparable equity benchmark that employs the AlphaDex weighting methodology [see our AlphaDEX ETFdb Portfolio ]. FLN screens and selects Latin American equities based on a number of fundamental factors, including sales-to-price ratio, cash flow-to-price, and return on assets.

Investors should consult a professional tax advisor before implementing any of the above mentioned tax-loss harvesting strategies.

Disclosure: No positions at time of writing.