Target Date Funds_1

Post on: 16 Март, 2015 No Comment

Three Reasons for “To” Not “Through”

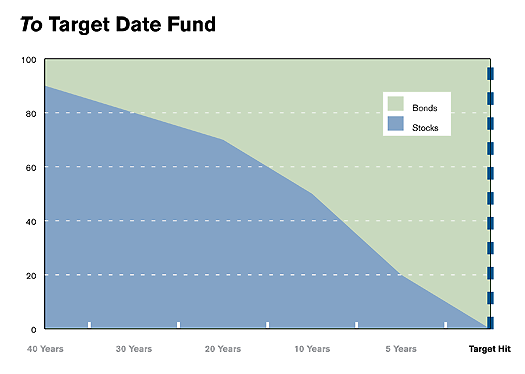

The question of “to versus through” comes up in nearly every target date fund conversation, whether it takes place in a plan sponsor committee meeting or on a personal finance blog. The phrase refers to the shape of the glidepath: A “to fund” glidepath reaches its final equity allocation at the target date, while “through funds” continue to reduce risk after the target date.

But what does “to versus through” really tell us? A review of the target date universe shows a wide range of risk levels at the target date for both fund types, undercutting the suggestion that it’s useful shorthand for risk. Rather, “to versus through” should be seen as differing philosophies about how to invest assets once participants no longer receive a paycheck.

BlackRock has always been a firm proponent of the “to fund” glidepath. We recently published new research that explores the financial economics supporting the “to fund” approach. We believe, however, that a persuasive common-sense case can also be made that begins by considering why a target date glidepath needs to evolve at all.

Reason 1: The glidepath is driven by the transfer of future wages into savings

Imagine your “investment portfolio” on the first day of your career. In all likelihood you imagine it as either nonexistent or, at best, consisting of a small amount of savings. In fact, your portfolio has a large allocation to human capital, which is the financial economics term describing the current value of your future anticipated wages.

Throughout your career, you transfer human capital into financial capital by getting paid. From a series of paychecks, you not only meet daily living expenses but also set aside a growing accumulation of financial capital for future expenses. By the end of your working life, your portfolio has been reversed: Your human capital allocation is gone, replaced by whatever financial capital you managed to save.

The value of your future wages may seem intangible, but for retirement asset allocation purposes human capital has real characteristics. Similar to a bond human capital provides an income stream. Early in our careers, when we have a larger portion of bond-like human capital and a smaller amount of financial capital we can take more risk by investing heavily in equities as we seek growth exposure. But as financial capital increases and human capital decreases, the glidepath eventually begins to reduce the equity level until it reaches the final, risk-adjusted allocation.

The final allocation may vary from provider to provider or plan sponsor to plan sponsor. But the key point remains: The glidepath is driven by human capital. Once human capital is gone, we believe there is no reason to continue reducing risk.

Reason 2: Retirement risk may be at its height the day we retire

Many people consider retirement as the finish line. But in reality, the day we retire may be the riskiest day of our financial lives. On that day, we have our longest retirement spending liability to fund. And we can no longer rely on wages to offset market losses or poor spending decisions. If that is the case, what is the argument for a glidepath continuing to reduce risk throughout retirement?

A glidepath that reduces equities beyond the target date can also undermine the potential benefit of diversification. For example, if a newly retired participant endures a bear market, a “through fund” glidepath that reduces equities may leave the participant poorly positioned for a potential rebound.

Reason 3: We believe the glidepath should anchor the day retirement starts – whenever that happens to be

One of the arguments offered by proponents of “through funds” is that people are working longer. That does not, however, change the fundamental driver of the glidepath. We believe the target date should not be driven by an arbitrary birthdate; it should be driven by the year retirement is set to start. So an individual who will be 65 in 2025 but plans on working until 70 should consider choosing a 2030 target date vintage.

Another argument occasionally offered by “through fund” proponents is that people are living longer in retirement. Longevity can be addressed by the level of growth assets in the final portfolio or by an income-aware strategy. It is difficult to understand how reducing equity levels throughout retirement addresses longevity.

Putting “To Versus Through” to Rest

The goal of a target date fund is to provide a consistent risk-adjusted portfolio that takes a participant through their career and retirement. There may be good reasons for differing on appropriate risk exposure, asset mix, and other issues at retirement. But once human capital is exhausted, and retirement risk is properly understood, the case for the “to fund” approach is clear.