Smart Beta ETF List New Trend in ETF Investing

Post on: 31 Март, 2015 No Comment

Smart Beta ETF strategies is one of the fastest growing trends in investment management. ETF providers has seen double digit growth in asset under management within the Smart Beta funds with $250 billion asset under management by 2013.

Traditional passive index funds tracks an index and the stock weights in the index are selected based their market capitalization. The higher the value of the company, the greater weight it would have in the index. By this nature, the performance of the index funds is biased towards larger stocks.

There is a number flaws in using market capitalization as proxy for portfolio weights.

- Large companies by law of large numbers usually grow slower than smaller companies.

- Market capitalization does not equal value. For example, NASDAQ index reached above 5000 in 2015. The last time it was above 5000 was during the technology bubble. An index selecting stocks based on investment fundamentals or return factors could avoid severe losses and buying overvalued stocks.

The Smart Beta ETF list created below are funds that are designed to be at the intersection of index tracking ETFs and actively managed funds. It has the best of both worlds matching the positive features of ETF investing such as low cost and transparency with degree of flexibility of strategic security selection seen in active management.

Active management in the context of smart beta does not necessarily mean there is a fund manager picking stocks within the smart beta fund. Rather the funds is created by a predetermined rules in deciding what kind of stocks goes into the index.

Investing through Smart Beta ETFs is still a passive strategy. However once the underlying index and security selection methodology is determined, the managers of ETF does not have discretion to deviate from the strategies.

Smart beta funds are separated into distinct strategies that includes securities in the fund on an equal basis, fundamental or volatility weighted methodologies. There are also dividend paying ETFs which has mix of indexing and smart beta strategies.

Market Smart Beta ETF

SPDR S&P 500 (SPY) is the largest market index ETF. It tracks the S&P 500 which is a market capitalization index fund. The weights of the 500 largest US listed stock is dependent on the size of the company. As a result, S&P5 500 is known to have a bias towards overvalued stocks. Note inverse market ETFs are not considered to be smart beta ETFs.

Guggenheim equal-weight ETF (RSP) is an equal weighted S&P 500 ETF. Equal weight means exactly as it sounds. It ignores the size of the company, rather every position in the fund is rebalanced to the same weight quarterly. For example every stock in the smart etf is weighted 0.25%. As long as a stock is included in the S&P 500, it will be included in RSP on an equal weighted basis.

Another smart beta approach of tracking S&P 500 is through weighing the exchange fund holdings by volatility. PowerShares S&P 500 Low Volatility (SPLV) is one such vehicle investor favour with this methodology.

Smart Beta S&P 500 ETF (SPY RSP and SPLV)

Chart above compares the 2 year return of the above smart beta ETF vs standard S&P 500 index tracker. It highlights RSP outperforming SPY and SPLV by almost 30% over the same time frame.

Passive indexing S&P 500 performed in the middle between RSP and SPLV. While SPLV can be considered the weakest performer. However returns are not everything in investing. It has the lowest volatility out all options tracking the S&P 500 which is acting exactly as it is designed by giving investor exposure to the S&P 500 with minimal volatility.

Smart Emerging Market Bond ETF

Our detailed research on Emerging Market Bond ETFs shows PowerShares Emerging Market Sovereign Bond ETF (PCY) has an interesting approach in investing in emerging market bonds vs other emerging market bond ETFs .

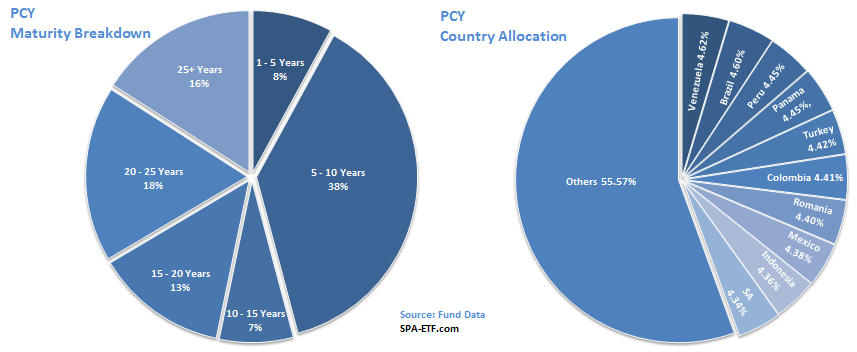

PCY tracks the DB Emerging Market USD Liquid Balanced Index PCY which manages emerging market bond portfolio through equal weighted exposure to countries in the fund.

The difference between the largest and the smallest position in PCY is only 0.50%. It can be considered a mean reversion play on emerging market performance as frequent quarterly rebalancing means selling the best performer and buying the under performing bond.

Diversified Emerging Market Bond ETF

Stock Buyback ETFs

PowerShares Buyback Achievers (PKW) is an fund that select stocks that is implementing a buyback program covering more than 5% of the outstanding shares. Creation of Buyback ETF is based on the research showing companies outperform its peers following announcement of buy backs even after 12 months.

- The fund invests in well known companies listed in the United States with average market capitalization of $50 billion.

- Not surprisingly ETF focusing on stock buying back large portion of its own stocks is biased towards companies with excess cash. ETF dividend yield is just a notch above 0.50%.

- Average ROE is above 20% and with P/E of 15 shows PKW still could have more room to run.

Invesco riding on the success PKW created an International Buyback ETF (IPKW) which invest in mostly non US companies buying back large portion of their stock. PKW provides international exposure for investors with an added layer of cushion of companies flush with cash. Investor should be aware of potential liquidity risks as IPKW only has less than $50 million asset under management.

Stock Buyback ETF breakdown

IPKW country exposure breakdown shows Japan and UK account for half of the fund with top 10 countries accounting for 90% of the fund.

The smart beta ETF list highlight some distinct strategies implemented by ETF providers. Investors appetite for smart beta as opposed to index tracking funds is expected to grow going forward.

Smart Beta Dividend Investing

There are a number of dividend focus exchange traded funds. First Trust Value Line Dividend Index Fund (FVD) is one such example. FVD equal weights stocks that has a dividend yield higher than S&P 500 index. The fund also rebalance on a monthly basis.

FlexShares Quality Dividend Index Fund (QDF) is another smart beta fund which uses proprietary model in improving selection of stocks that are included in the Northern Trust 1250 index. The primary factor it looks to improve on are the index beta and yield.