Retail Investo Active Versus Passive Investing Which Outperforms Investor Education

Post on: 31 Июль, 2015 No Comment

Does Passive Outperform?

It is common to hear the claim that passive indexing outperforms active management, except for short run flukes. If the claim is correct, then all the time, effort, training and worrying that go into active stock selection is all a fool’s errand. This page by J.Norstad is a very good summary of all the arguments PRO passive investing.

But there are a lot of problems with doing a proper analysis of this issue, and academics have provided little guidance. Following are arguments AGAINST the claim, or issues that have prevented any valid conclusion. All Norstad’s points are addressed. Notice that proving the assertion wrong does NOT prove that active investors outperform passive. It means only that it is POSSIBLE for active investors to outperform.

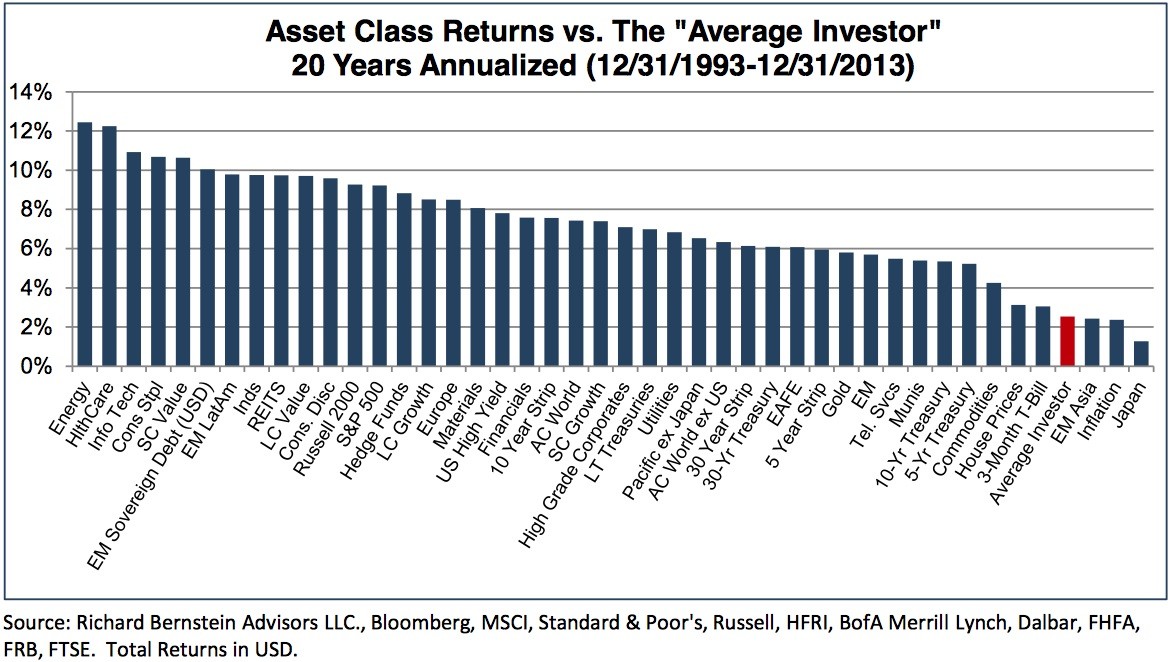

1) Theoretical vs Actual Returns : The rate of return claimed by the indexers is an index’s theoretical total return (as made actionable with an ETF). But investors’ realized returns are very different.

- Investors contribute additional savings at market peaks, and withdraw cash at inopportune times, meaning their returns are weighted differently through of the year.

- They try to keep the faith during market crashes, but succumb to fears and exit after sharp sell-offs. Because ETF’s are much easier to buy and sell than mutual funds (through the day and at a price you specify) owners may trade away profits — more so than owners of active mutual funds — especially if the MF has a deferred sales charge.

- They know they should not, but cannot resist the urge to market time with sector indexes they think will outperform (also with small cap and value indexes). When indexers do this they call it ’tilting’. When active investors do it they call it ‘market-timing’.

- They rebalance between asset classes during the year.

- They dollar-cost-average their way into positions. Both actions increase costs.

- They delay reinvesting dividends received. Or they spend the dividend. Or they reinvest it in another index ETF.

- The funds they own may have tracking errors against their benchmark index caused by the fund’s MER and also by the fund’s costs of operations that are not included in the MER. Promises to hedge currency exposure is very poorly executed by many ETFs, not because of costs but because of how the process is executed.

- There is also the cost of advice. For many active mutual funds the cost of advise in included in the trailer-fees paid out of the MER. These reduce their calculated returns. When an indexer pays for advice that cost is ignored in calculations of his rate of return. (Note that management fees should be factored OUT of any comparison of strategy returns. They are a function of a financial product, not a strategy.)

Returns from active management have no theoretical counterpart — although many will have quant models and trading rules. They are always real-life, in-practice returns realized in specified accounts. So, for any fair comparison between strategies the theoretical index returns cannot be used. The actual return of investors labeling themselves ‘passive’ has to be used.

Academics are starting to measure the returns of indexers. A 2012 paper (The Dark Side of ETFs ) compares the change in returns from one period to the next, between those retail investors who bought their first ETF vs. those who did not. They found that for those portfolios including both indexes and individual stocks, the active portion out-performed benchmark equity indexes, while the passive portion under-performed. The index holdings were a drag on raw returns, Sharpe ratios and alpha. They found that the index’s diversification gains were offset by worse market timing.

2) Straw Man Arguments : After all their other arguments have been discredited, the indexers always change the subject to Indexing (passive) is the most appropriate strategy for retail investors. Since most retail investors do not have the time, interest or training to pick stocks, OF COURSE passive indexing is most appropriate. But that is not the issue being discussed. The issue is performance returns, not which strategy is appropriate for whom.

Another straw-man argument is Managers who outperform in certain types of markets, underperform the other types. Again no one disagrees because it makes no point. The active investor is free to retreat to passive investing in markets he knows his personality does not suite. It is very common for active investors to index during bull markets but change to stock-picking in recessions. It is the indexer who is constrained by ideology not the active manager.

3) The Total Equals the Sum of the Parts: This argument was famously presented by William Sharpe in this article. It argues that All portfolio returns that beat the market are offset by other portfolios with lower returns. because the market is the sum of its parts. There are two counter-arguments.

The first is that this is another straw-man argument. No one says ALL active investors outperform. Some do and some don’t. Yes, measured together they are only average, but your personal returns will not be the average.

The other counter-argument is that his analysis ignores cash. The most powerful (and easy) way to outperform the market is by retreating to cash during major market crashes. Avoiding a 10% drop allows for missing the tops of bull markets a few percentage points a year for a few years. If nothing else this reduces your portfolios risk, if not its return. The stocks sold to exit the market are bought by someone, and that someone is included in Sharpe’s set of investors. But the cash portfolio is not included in his math.

4) Which Math Calculation of Returns : Consider the chosen method of calculating rates of return. There are different methods for different points of view. You must use the correct method for each issue. Take a simple example.

$500 invested at the beginning of the year.

50% growth in the first six months resulting in a $750 portfolio. ($500 * 1.5)

20% loss in second half of year resulting in $600 portfolio at year end. ($750 * 0.8)