Performance & risk management

Post on: 16 Март, 2015 No Comment

Mercuria has diversified its business to trading in a wide spectrum of commodity products including crude oil, refined oil products, petrochemicals, natural gas, LNG, power, coal, carbon emissions, freight, iron ore, base metals and soft commodities. The Group employs more than 1000 people and is privately owned by its founding shareholders and a group of senior employees. A key success factor is our extensive risk management culture.

Mercuria is one of the five largest energy traders in the world. In 2013, the Group had a record year selling 195 million metric tonnes of oil-equivalent — our global revenues amounted to USD112 billion.

Our financial performance shows a low correlation with the commodity cycle. Despite recent macro economic events and geopolitical turmoil, our business model continues to prove its ability to consistently capture profitable opportunities. Moreover, since inception in 2004, Mercuria has been profitable in every consecutive quarter.

Solid, unlevered asset portfolio

In addition to our sound equity base, Mercuria has an attractive portfolio of fixed assets ranging from upstream to essential business infrastructure. Storage and logistics assets enable Mercuria to create or enhance trading opportunities. A summary of material acquisitions and investments held by the Group can be found in the Assets Section of the website.

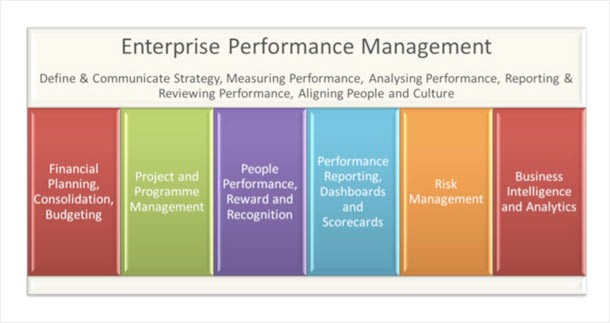

Risk management

Mercuria manages market, financial and operational risks associated with transporting commodities in significant volumes around the world.

We aim to perform in all aspects of the risk management spectrum. We continue to invest in our infrastructure through strategic Energy Trading & Risk Management (ETRM) systems. Our human capital is engrained with a corporate culture stressing the values of accountability, responsibility and communication at all levels of the organization.

Financial risk

Risk management functions are rigorously separated and independent from front office. Risks are reported to the highest level of the company management. We utilize a wide range of techniques and metrics at corporate, portfolio or trading level. Our robust control process covers the entire life cycle of risk from inception to settlement.

We believe that daily marking to Fair Market Value of all positions held in the company is vital to understanding and stating our risk.

Credit risk is assiduously managed by our Credit Department, providing a vital link between corporate risk management functions and the front office trading units. The department provides necessary checks and balances to facilitate new trading opportunities while also mitigating our ongoing counterparty, sector and country credit risks.

Use of Value at Risk

VaR is a widely used tool for monitoring risk in our industry. We use it to measure, manage and allocate risk across our business. Individual sub-limits are set and enforced by senior management. VaR is only one of a series of tools available, that typically include, position limits, market depth, concentration and liquidity considerations, as well as stress and worst case scenario metrics.

Operational Risk Management

We apply extraordinary attention to detail in ensuring the operational suitability of the vessels, barges, trailers and wagons that we use to transport commodities. Shipping, cargo management, loading and unloading is overseen by dedicated experts together with independent inspection companies. Products in storage and the storage assets themselves are continuously monitored.

We aim to consistently reach the highest standards with regard to our safety, health, environment and quality (SHEQ) activities, and maintain these standards wherever we operate.