Pe Ratio Market Valuation Advisor Perspectives 2015

Post on: 27 Сентябрь, 2015 No Comment

3A%2F%2Fwww.advisorperspectives.com%2F?w=250 /% Here is a new update of a popular market valuation method using the most recent Standard & Poor’s as reported earnings and earnings estimates and the index monthly

3A%2F%2Fwww.advisorperspectives.com%2F?w=250 /% The 2011 article P/E: Future On The Horizon by Advisor Perspectives contributor Ed Easterling provided an overview of Ed’s method for determining where the market is

3A%2F%2Fwww.multpl.com%2F?w=250 /% Price to earnings ratio, based on trailing twelve month “as reported” earnings. Current PE is estimated from latest reported earnings and current market price.

3A%2F%2Fmystocksinvesting.com%2F?w=250 /% Very very dangerous if you follow what the newspaper said. STI is a bucket of 30 blue chip stocks. STI PE is under 15 does not mean that individual stock is under value.

3A%2F%2Fwww.valuentum.com%2F?w=250 /% A version of this article first appeared on our website June 9, 2013. By: Brian Nelson, CFA. I was recently reading an article about the price-to-earnings (PE) ratio.

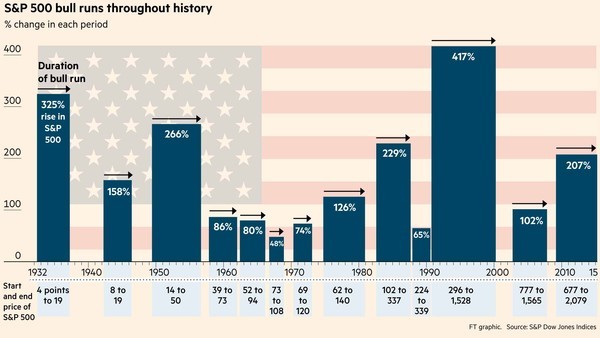

3A%2F%2Fwww.valuewalk.com%2F?w=250 /% Stock Market Pullback Perspective by LPL Financial. Highlights: We see the recent increase in volatility as normal within the context of an ongoing bull

3A%2F%2Fwww.fool.com%2F?w=250 /% The PEG ratio is one of the most popular valuation tools. It takes about eight seconds to calculate and is much easier than running a discounted cash flow

3A%2F%2Fwww.investopedia.com%2F?w=250 /% Analysts have argued for years about the merits of price/earnings (P/E) ratios. When P/Es are high, as they were in the late 1920s and 1990s, raging bulls would

3A%2F%2Fwww.blackrock.com%2F?w=250 /% As the equity bull market enters its seventh year, investors are rightly concerned about its longevity. While the recovery in the global economy has supported

3A%2F%2Fwww.wisdomtree.com%2F?w=250 /% 1-month LIBID rates: Good indication of the cost of borrowing U.S. dollars for one month’s time in European markets. 1-month rupee forwards: Agreements to either

3A%2F%2Fseekingalpha.com%2F?w=250 /% It is important for us all to recognize the future value the market a perspective on relative value both today and looking forward. This is an earnings-driven analysis, and we are comparing earnings growth both today and tomorrow to the PE ratio

3A%2F%2Fwww.fool.sg%2F?w=250 /% That’s a valuation which compares somewhat favourably with the Straits Times Index’s long-term average PE ratio (from 1993 a long-term investing perspective, it serves no utility whatsoever in telling us what the market will do over the short

3A%2F%2Fwww.fnarena.com%2F?w=250 /% In the end, while we can all theorise and speculate as much as we like, bottom line is the value and direction of what we own in the share market is determined by how much cash (dividends) and profits (PE ratios Viewed from this perspective, the

3A%2F%2Fwww.businessinsider.com%2F?w=250 /% Here is a new update of a popular market valuation method using the most recent Standard & Poor’s as reported earnings and earnings estimates and the index monthly averages of daily closes for the past month, which is 1,550.83. The ratios in parentheses

3A%2F%2Fwww.marketwatch.com%2F?w=250 /% Valuation is a crucial part of the discussion, which has drawn attention to one gauge that measures how heated the stock market is. It’s called the CAPE ratio (but also goes by Shiller P/E and like financial advisor Kay Conheady, who created the

3A%2F%2Fwww.valuewalk.com%2F?w=250 /% Advisor Perspectives welcomes upside is to assume a future valuation multiple that would put the stock market into bubble territory. The S&P 500 Index was recently trading at a cyclically adjusted price-to-earnings ratio, or “CAPE,” 1 of 27.3

3A%2F%2Fwww.investing.com%2F?w=250 /% The 2011 article P/E: Future On The Horizon by Advisor Perspectives contributor Crestmont Research data to my monthly market valuation updates. The first chart is the Crestmont equivalent of the Cyclical P/E10 ratio chart I’ve been sharing on a monthly

3A%2F%2Fmoney.usnews.com%2F?w=250 /% PE ratios research for market-data firm Advisor Perspectives and curator of an affiliated web site (dshort.com) that is a cornucopia of historical market data. [See 5 Factors That Drive Stock Prices.] Today, says Short, all three valuation methods

3A%2F%2Fwww.schaeffersresearch.com%2F?w=250 /% The following is a reprint of the market interest ratio (SOIR) for FEYE arriving at 0.97, in the 98th annual percentile. The takeaway from all this — in addition to the likelihood of further additional upside from FEYE, from our perspective — can

3A%2F%2Fwww.gurufocus.com%2F?w=250 /% Even though the Buffett style investing seems convenient for most people, a Graham style, deep value approach will lead to much higher returns with less risk — even for novice investors. What if I told you that there are, even at high market valuations