Mutual Funds Index Funds The S P 500 Index Fund

Post on: 13 Октябрь, 2015 No Comment

The Truth About Mutual Funds

The S&P 500 Index Fund

Many investors know that the letters Warren Buffett, CEO of Berkshire Hathaway (NYSE: BRK.A and B). writes every year to Berkshire’s shareholders contain some of the most valuable investing lessons available anywhere. Fewer people know that The Bogle Perspectives. a collection of speeches delivered by John Bogle of the Vanguard Group, contain a distillation of facts, figures, and analysis on mutual funds and are the most comprehensive and useful education that a mutual fund investor can acquire. (The possible exception to that is the education contained in Mr. Bogle’s new book. which is a more expensive, but more detailed, compilation of these speeches.) Fools are certainly indebted to John Bogle, for — contrary to what you may have read on countless magazine covers — mutual fund investing is extremely simple: Buy an index fund.

(Psst. There’s a reason that all these magazines don’t tell you how simple mutual fund investing really is. Scientific marketing surveys and focus group testing have determined that magazines with covers that read Index Funds: Still The Best Choice. every single month really wouldn’t sell as well as magazines that promise Our BRAND NEW 10 Best Mutual Funds To Buy RIGHT NOW! Sad, but true.)

In 1975, John Bogle presented an idea to the board of directors of the newly formed Vanguard Group — create an extremely low-cost mutual fund that would not attempt to beat the returns of the stock market as measured by Standard & Poor’s 500 index; instead, it would attempt to mirror the index as closely as it could by buying each of the index’s 500 stocks in amounts equal to the weightings within the index itself.

In his presentation to the Vanguard board, Bogle presented the historical data then available to him. In his account of The First Index Fund, Bogle writes:

I projected the costs of managing an index fund to be 0.3% per year in operating expenses and 0.2% per year in transaction costs. Since fund annual costs at that time appeared to be about 2.0%, I concluded that an index fund should reasonably be expected to provide an annual return of +1.5% above a managed fund.

In the intervening years Bogle has proven to be even more correct about indexing than he had predicted he might be. Since then, the gap between the performance of the market and the performance of actively managed mutual funds taken as a whole has actually been significantly wider than the 1.5% theorized by Bogle in 1976. During the 1990s, the total shortfall between actively managed mutual funds and the market as measured by the S&P 500 has so far been a whopping 3.4% per year.

The differential between actively managed funds and passively managed index funds is very easily explicable. The difference does not come from the actively managed mutual funds being run by buffoons. Not at all. The stocks that mutual fund managers pick end up being more or less average performing stocks. Bogle analyzes the differential as being determined by four factors: costs, turnover, sector, and cash reserves.

During the 1990s, the S&P 500 has provided an annualized return of 17.3%, compared with just 13.9% for the average diversified mutual fund. This 3.4% is explained first by understanding the fact that during the 1990s the S&P 500 (essentially an index of the 500 largest companies in America) has produced returns that are better than the rest of the market. One must first look at an index of the whole stock market, the Wilshire 5000 Index. The return for the Wilshire 5000 has been 16.3% during the 1990s, so you should count 1.0 percentage points as a large-cap effect, bringing the gap between managed funds and the Wilshire 5000 down to 2.4%.

The expense ratio of the average fund, that is the average amount of expenses that a fund charges its shareholders every year, was about 1.3% during the period. (Over the last couple of years expense ratios have been rising further and currently stand at 1.5%.) By comparison, the Vanguard S&P 500 expense ratio is 0.19%.

Many funds also buy and sell their holdings at a rapid pace. Currently this turnover occurs at an average rate of 85% per year. This means that at the end of every year the average mutual fund only owns 15% of the same shares with which it started the year. The transaction costs involved in buying and selling so many shares every year result in an additional 0.7% of return disappearing every year.

Additionally, fund managers, believing that they can time the market, hold an average of about 8% of their portfolios in cash reserves. This practice has been a very expensive penalty during the bull market of the 1990s. This holding of cash reserves essentially explains the rest of the differential between mutual funds and the market.

Did you get all that? We sure hope so. We’ll return and explain all of these concepts in further detail in Part 7 and 8, but if you are invested in any mutual fund and are not currently aware of how expense ratios, turnover, market sector, and cash reserves apply to your fund, you are investing blind.

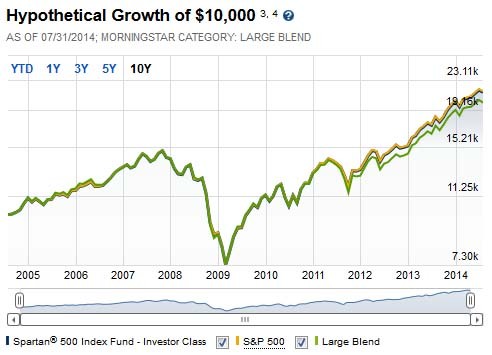

S&P index funds have garnered a lot of attention over the last couple of years for good reason. The Vanguard S&P 500 fund has outperformed over 90% of all domestic equity mutual funds over the past three and five years (and a much higher number if you include bond and international equity funds). But S&P index funds certainly aren’t the only index funds — and in fact may not even be the best.